Xerox 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 ppm products with an embedded controller. Products

include the Xerox iGen3®digital color production press,

Xerox Nuvera™, DocuTech®, DocuPrint®, Xerox 4110™

and DocuColor®families, as well as older technology

light-lens products. These products are sold

predominantly through direct sales channels in North

America and Europe to Fortune 1000, graphic arts,

government, education and other public sector customers.

The Office segment includes black-and-white products

that operate at speeds up to 90 ppm, and color devices up

to 40 ppm, as well as, 50 ppm color devices with an

embedded controller. Products include the suite of

CopyCentre®, WorkCentre®, and WorkCentre Pro digital

multifunction systems, DocuColor color multifunction

products, color laser, solid ink and monochrome laser

desktop printers, digital and light-lens copiers and

facsimile products. These products are sold through direct

and indirect sales channels in North America and Europe

to global, national, small and mid-size commercial

customers as well as government, education and other

public sector customers. The DMO segment includes our

operations in Latin America, Brazil, the Middle East,

India, Eurasia, Central and Eastern Europe and Africa.

This segment’s sales consist of office and production

products including a large proportion of office devices

and printers which operate at speeds of 11-40 ppm.

Management serves and evaluates these markets on an

aggregate geographic basis, rather than on a product

basis. The segment classified as Other includes several

units, none of which met the thresholds for separate

segment reporting. This group primarily includes Xerox

Supplies Business Group (predominantly paper), value-

added services, Wide Format Systems, Xerox Technology

Enterprises, royalty and licensing revenues, equity net

income and non-allocated Corporate items. Paper sales

were approximately 60% of Other segment revenues in

2006. Other segment profit includes the operating results

from these entities, other less significant businesses, our

equity income from Fuji Xerox, and certain costs that

have not been allocated to the Production, Office and

DMO segments, including non-financing interest as well

as other items included in Other expenses, net.

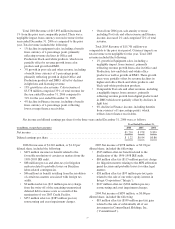

Revenue by segment for the years ended 2006, 2005 and 2004 were as follows:

(in millions) Production Office DMO Other Total

2006

Equipment sales ...................................... $1,343 $2,368 $ 605 $ 141 $ 4,457

Post sale and other revenue ............................. 2,913 4,760 1,327 1,598 10,598

Finance income ...................................... 323 497 6 14 840

Total Revenue ....................................... $4,579 $7,625 $1,938 $1,753 $15,895

2005

Equipment sales ...................................... $1,368 $2,436 $ 558 $ 157 $ 4,519

Post sale and other revenue ............................. 2,830 4,670 1,245 1,562 10,307

Finance income ...................................... 342 512 9 12 875

Total Revenue ....................................... $4,540 $7,618 $1,812 $1,731 $15,701

2004

Equipment sales ...................................... $1,358 $2,431 $ 503 $ 188 $ 4,480

Post sale and other revenue ............................. 2,880 4,644 1,194 1,590 10,308

Finance income ...................................... 352 552 10 20 934

Total Revenue ....................................... $4,590 $7,627 $1,707 $1,798 $15,722

Equipment Sales

Equipment sales reflect the results of our technology

investments and the associated product launches as

approximately two-thirds of 2006 equipment sales were

generated from products launched in the past 24 months.

2006 Equipment sales of $4,457 million declined 1%

from 2005 reflecting:

• Currency benefit of 1-percentage point.

• Growth in color products and DMO offset by

declines in high-end black-and-white Production

products.

33