Xerox 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

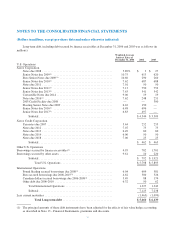

Note 10 – Supplementary Financial Information

The components of other current assets and other

current liabilities at December 31, 2006 and 2005 were as

follows (in millions):

2006 2005

Other current assets

Deferred taxes .................... $ 271 $ 290

Restricted cash ................... 236 270

Prepaid expenses ................. 119 133

Financial derivative instruments ..... 9 28

Other ........................... 299 311

Total Other current assets ..... $ 934 $1,032

Other current liabilities

Income taxes payable .............. $ 63 $ 84

Other taxes payable ............... 157 199

Interest payable ................... 128 102

Restructuring reserves ............. 291 212

Unearned income ................. 194 191

Financial derivative instruments ..... 17 12

Product warranties ................ 21 20

Liability to Xerox Capital LLC ...... — 98

Other ........................... 546 625

Total Other current

liabilities ................. $1,417 $1,543

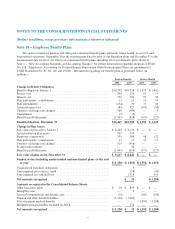

The components of other long-term assets and other

long-term liabilities at December 31, 2006 and 2005 were

as follows (in millions):

2006 2005

Other long-term assets

Prepaid pension costs .............. $ 19 $ 829

Net investment in discontinued

operations ..................... 295 420

Internal use software, net ........... 217 198

Restricted cash ................... 190 176

Debt issuance costs, net ............ 48 52

Other ........................... 282 246

Total Other long-term assets ... $1,051 $1,921

Other long-term liabilities

Deferred and other tax liabilities ..... $ 223 $ 771

Minorities’ interests in equity of

subsidiaries .................... 108 90

Financial derivative instruments ..... 42 45

Product warranties ................ 1 1

Other ........................... 447 388

Total Other long-term

liabilities ................. $ 821 $1,295

Net investment in discontinued operations: Our

net investment in discontinued operations primarily

consists of a performance-based instrument relating to the

1997 sale of The Resolution Group (“TRG”) of $325, as

well as remaining liabilities associated with our

discontinued operations of $32.

In connection with the 1997 sale of TRG, we

received a $462 performance-based instrument as partial

consideration. Cash distributions are paid on the

instrument, based on 72.5% of TRG’s available cash flow

as defined in the sale agreement. We received cash

distributions of $20 for each of the years ended

December 31, 2006 and 2005, respectively. The recovery

of this instrument is dependent upon the sufficiency of

TRG’s available cash flows. Such cash flows are

supported by TRG’s ultimate parent via a subscription

agreement whereby the parent has agreed to purchase

from TRG an established number of shares of this

instrument each year through 2017. Based on current cash

flow projections, we expect to fully recover the $325

remaining balance of this instrument.

In 2005, our net investment in discontinued

operations also included our net investment in Ridge

Reinsurance Limited which was liquidated in 2006 as part

of an agreement to transfer its remaining reinsurance

obligation together with related investments to another

insurance company. Refer to Note 21 – Divestitures and

Other Sales for further information.

Liability to Xerox Capital LLC: Liability was

settled in February 2006 as part of mandatory redemption

of preferred securities issued by Xerox Capital LLC. This

liability was settled for Cdn. $114 million ($100) and

Cdn. $24 million ($21) was remitted back to us upon

liquidation of Xerox Capital LLC.

75