Xerox 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Results of Operations and Financial

Condition

The following Management’s Discussion and

Analysis (“MD&A”) is intended to help the reader

understand the results of operations and financial

condition of Xerox Corporation. MD&A is provided as a

supplement to, and should be read in conjunction with,

our consolidated financial statements and the

accompanying notes.

Throughout this document, references to “we,”

“our,” the “Company” and “Xerox” refer to Xerox

Corporation and its subsidiaries. References to “Xerox

Corporation” refer to the stand-alone parent company and

do not include its subsidiaries.

Executive Overview

We are a technology and services enterprise and a

leader in the global document market, developing,

manufacturing, marketing, servicing and financing the

industry’s broadest portfolio of document equipment,

solutions and services. Our industry is undergoing a series

of transformations from older technology light lens

devices to digital systems, from black-and-white to color,

and from paper documents to an increased reliance on

electronic documents. We believe we are well positioned

as these transformations play to our strengths and

represent opportunities for future growth, since our

research and development investments have been focused

on digital and color offerings and our acquisitions have

focused on expanding our services and software

capabilities.

We operate in competitive markets and our

customers demand improved solutions, such as the ability

to print offset quality color documents on-demand;

improved product functionality, such as the ability to

print, copy, fax and scan from a single device; and lower

prices for the same functionality. Customers are also

increasingly demanding document services such as

consulting and assessments, managed services, imaging

and hosting, and document intensive business process

improvements.

We deliver advanced technology through focused

investment in research and development and offset lower

prices through continuous improvement of our cost base.

The majority of our revenue is recurring revenue

(supplies, service, paper, outsourcing and rentals), which

we collectively refer to as post sale revenue. Post sale

revenue is heavily dependent on the amount of equipment

installed at customer locations and the utilization of those

devices. As such, our critical success factors include

hardware installations, which stabilize and grow our

installed base of equipment at customer locations, page

volume growth and higher revenue per page. Connected

multifunction devices, new services and solutions are key

drivers to increase equipment usage. The transition to

color is the primary driver to improve revenue per page,

as color documents typically require significantly more

toner coverage per page than traditional black-and-white

printing.

Financial Overview

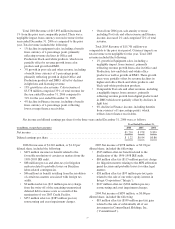

In 2006, we grew revenue, expanded earnings and

significantly improved our overall financial condition and

liquidity. Our continued investments in the growing areas

of digital production and office systems, particularly with

respect to color products, contributed to the majority of our

equipment sales being generated from products launched in

the last two years. Total revenue increased 1% over the

prior year, as growth in our post sale annuities more than

offset declines in equipment sales and finance income. Post

sale and other revenues increased 3% as compared to prior

year. Total color revenue was up 13% over the prior year

reflecting our investments in this market.

We maintained our focus on cost management

throughout 2006. While 2006 gross margins of 40.6% were

0.6-percentage points below 2005, we continued to more

than offset lower prices with productivity improvements.

Gross margins continued to be impacted by a change in

overall product mix reflecting a higher proportion of sales

of products with lower gross margins. We reduced selling,

administrative and general (“SAG”) expenses as

administrative and general expense efficiencies more than

offset increased bad debt expense. We continued to invest

in research and development, prioritizing our investments

to the faster growing areas of the market.

26