Xerox 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

terms of the underlying finance receivables it supports,

which eliminates certain significant refinancing, pricing

and duration risks associated with our financing. As part

of our continued objective to reduce our level of secured

debt, in November 2006, we delivered notice to GE, our

secured lender in the U.K., moving the final funding date

for that program from June 2010 to June 2007.

At December 31, 2006 and 2005, all of the lease

receivables and related secured debt are consolidated in

our financial statements because we are determined to be

the primary beneficiary of the arrangements and

frequently the counterparties have various types of

recourse to us. The lease receivables sold represent the

collateral for the related secured debt and are not

available for general corporate purposes until the related

debt is paid off. All of these arrangements are subject to

usual and customary conditions of default including

cross-defaults. In the remote circumstance that an event

of default occurs and remains uncured, in general, the

counterparty can cease providing funding for new lease

originations.

Information on restricted cash that is the result of

these third party secured funding arrangements is

included in Note 1 – “Restricted Cash and Investments”

to the Consolidated Financial Statements and disclosure

of the amounts for new funding and debt repayments are

included in the accompanying Consolidated Statement of

Cash Flows.

We also have arrangements in certain countries in

which third party financial institutions originate lease

contracts directly with our customers. In these

arrangements, we sell and transfer title to the equipment

to these financial institutions and generally have no

continuing ownership rights in the equipment subsequent

to its sale, as such the related receivable and debt are not

included in our Consolidated Financial Statements.

The following represents our total finance assets

associated with our lease or finance operations as of

December 31, 2006 and 2005, respectively:

2006 2005

Total Finance receivables, net(1) ...... $7,844 $7,849

Equipment on operating leases, net . . . 481 431

Total Finance Assets, net .......... $8,325 $8,280

(1) Includes (i) billed portion of finance receivables, net,

(ii) finance receivables, net and (iii) finance

receivables due after one year, net as included in the

Consolidated Balance Sheets as of December 31,

2006 and 2005.

Refer to Note 4 – Receivables, Net in the

Consolidated Financial Statements for further information

regarding our third party secured funding arrangements as

well as a comparison of finance receivables to our

financing-related debt as of December 31, 2006 and 2005.

As of December 31, 2006, approximately 31% of total

finance receivables were encumbered as compared to

44% at December 31, 2005.

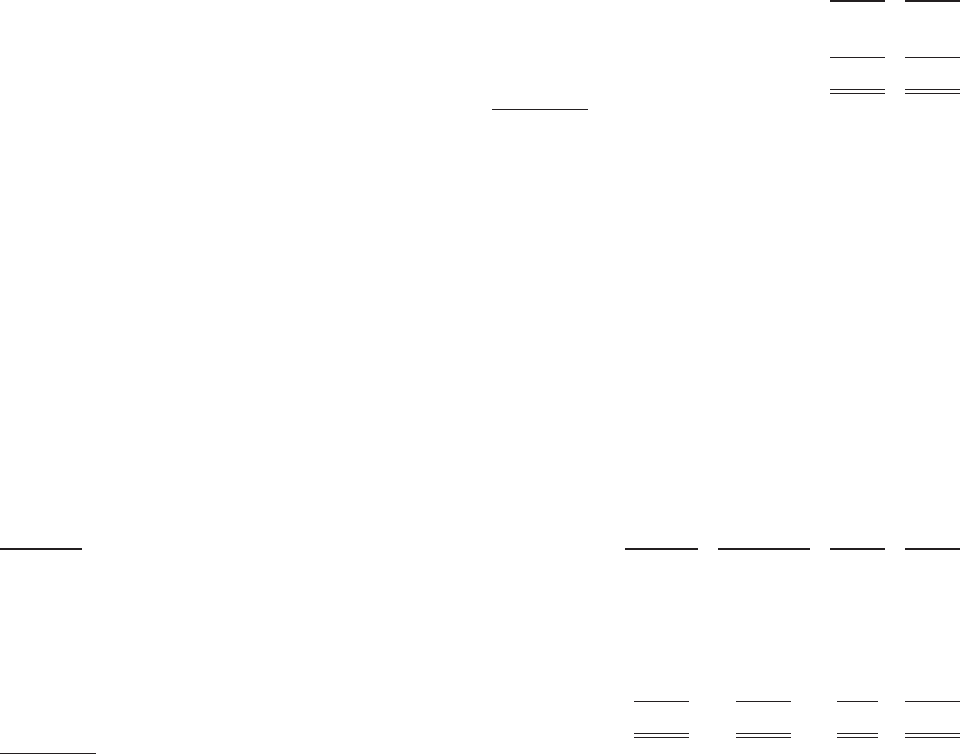

The following represents our aggregate debt maturity schedule as of December 31, 2006:

(in millions)

Unsecured

Debt

Debt Secured

by Finance

Receivables

Other

Secured

Debt

Total

Debt

2007 ........................................................ $ 295 $1,178 $ 12 $1,485(1)

2008 ........................................................ 9 722 5 736

2009 ........................................................ 1,055 109 5 1,169

2010 ........................................................ 687 44 2 733

2011 ........................................................ 800 6 — 806

Thereafter .................................................... 2,212 — 4 2,216

Total ....................................................... $5,058 $2,059 $ 28 $7,145

(1) Quarterly secured and unsecured total debt maturities for 2007 are $215 million, $421 million, $626 million and

$223 million for the first, second, third and fourth quarters, respectively.

44