Xerox 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total 2006 Revenue of $15,895 million increased

1% from the prior year comparable period. There was a

negligible impact from currency on total revenue for the

year ended December 31, 2006 as compared to the prior

year. Total revenue included the following:

• 1% decline in equipment sales, including a benefit

from currency of 1-percentage point, primarily

reflecting revenue declines in Office and

Production black-and-white products, which were

partially offset by revenue growth from color

products and growth in DMO.

• 3% growth in post sale and other revenue, including

a benefit from currency of 1-percentage point,

primarily reflecting growth in digital Office and

Production products and DMO, offset by declines

in light lens and licensing revenue.

• 13% growth in color revenue. Color revenue of

$5,578 million comprised 35% of total revenue for

the year ended December 31, 2006 compared to

31% for the year ended December 31, 2005.

• 4% decline in Finance income, including a benefit

from currency of 1-percentage point, reflecting

lower average finance receivables.

• Overall our 2006 post-sale annuity revenue,

including Post sale and other revenue and Finance

income, increased 2% and comprised 72% of total

revenue.

Total 2005 Revenue of $15,701 million was

comparable to the prior year period. Currency impacts on

total revenue were negligible for the year. Total 2005

revenue included the following:

• 1% growth in Equipment sales, including a

negligible impact from currency, primarily

reflecting revenue growth from color in Office and

Production, low-end black-and-white office

products as well as growth in DMO. These growth

areas were partially offset by revenue declines in

higher-end office black-and-white products, and

black-and-white production products.

• Comparable Post sale and other revenues, including

a negligible impact from currency, primarily

reflecting revenue growth from digital products and

in DMO which were partially offset by declines in

light lens.

• 6% decline in Finance income, including benefits

from currency of 1-percentage points, which

reflects lower finance receivables.

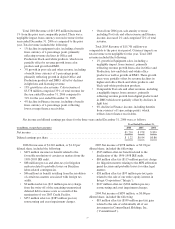

Net income and diluted earnings per share for the three years ended December 31, 2006 were as follows:

(in millions, except share amounts)

Year Ended December 31,

2006 2005 2004

Net income ............................................................. $1,210 $ 978 $ 859

Diluted earnings per share ................................................. $ 1.22 $0.94 $0.86

2006 Net income of $1,210 million, or $1.22 per

diluted share, included the following:

• $472 million income tax benefit related to the

favorable resolution of certain tax matters from the

1999-2003 IRS audit.

• $68 million (pre-tax and after-tax) for litigation

matters related to probable losses on Brazilian

labor-related contingencies.

• $46 million tax benefit resulting from the resolution

of certain tax matters associated with foreign tax

audits.

• $9 million after-tax ($13 million pre-tax) charge

from the write-off of the remaining unamortized

deferred debt issuance costs as a result of the

termination of our 2003 Credit Facility.

• $257 million after-tax ($385 million pre-tax)

restructuring and asset impairment charges.

2005 Net income of $978 million, or $0.94 per

diluted share, included the following:

• $343 million after-tax benefit related to the

finalization of the 1996-1998 IRS audit.

• $84 million after-tax ($115 million pre-tax) charge

for litigation matters relating to the MPI arbitration

panel decision and probable losses for other legal

matters.

• $58 million after-tax ($93 million pre-tax) gain

related to the sale of our entire equity interest in

Integic Corporation (“Integic”).

• $247 million after-tax ($366 million pre-tax)

restructuring and asset impairment charges.

2004 Net income of $859 million, or $0.86 per

diluted share, included the following:

• $83 million after-tax ($109 million pre-tax) gain

related to the sale of substantially all of our

investment in ContentGuard Holdings, Inc.

(“ContentGuard”).

28