Xerox 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

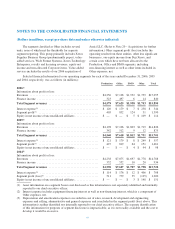

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

December 31, 2008, with early adoption permitted. Since

several of our international plans currently have a

September 30th measurement date, this standard will

require us to change, in 2008, that measurement date to

December 31st. At this time, we do not anticipate early

adoption of this requirement. FAS 158 is not effective for

our equity investment in Fuji Xerox until its annual

year-end of March 31, 2007. Upon Fuji Xerox’s adoption,

we will record our share of their after-tax charge to equity

which we currently estimate at $60. The adoption of this

standard is not expected to impact financial covenant

compliance included in our debt agreements.

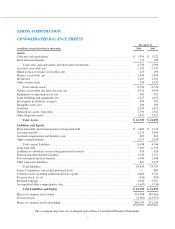

The following represents the effect of FAS 158 adoption within the Consolidated Balance Sheets as of

December 31, 2006:

Before Application

of FAS 158

Adjustments

Increase/(Decrease)

After Application

of FAS 158

Other current assets ................................... $ 923 $ 11 $ 934

Total current assets .................................... 8,743 11 8,754

Deferred tax assets, long-term ........................... 1,446 344 1,790

Other long-term assets ................................. 2,048 (997) 1,051

Total Assets ......................................... 22,351 (642) 21,709

Pension and other benefit liabilities ....................... 1,120 216 1,336

Post-retirement medical benefits ......................... 1,205 285 1,490

Other long-term liabilities .............................. 940 (119) 821

Total Liabilities ...................................... 14,247 382 14,629

Accumulated other comprehensive loss .................... (623) (1,024) (1,647)

Total Liabilities and Equity ............................. 22,351 (642) 21,709

In September 2006, the FASB issued SFAS No. 157,

“Fair Value Measurements” (“FAS 157”). FAS 157

defines fair value, establishes a market-based framework

or hierarchy for measuring fair value, and expands

disclosures about fair value measurements. FAS 157 is

applicable whenever another accounting pronouncement

requires or permits assets and liabilities to be measured at

fair value. FAS 157 does not expand or require any new

fair value measures, however the application of this

statement may change current practice. The requirements

of FAS 157 are effective for our fiscal year beginning

January 1, 2008. We are in the process of evaluating this

guidance and therefore have not yet determined the

impact that FAS 157 will have on our financial statements

upon adoption.

In July 2006, the FASB issued FASB Interpretation

No. 48, “Accounting for Uncertainty in Income Taxes –

an Interpretation of FASB Statement No. 109” (“FIN

48”). FIN 48 clarifies the accounting for uncertainty in

income taxes by prescribing a minimum recognition

threshold for a tax position taken or expected to be taken

in a tax return that is required to be met before being

recognized in the financial statements. FIN 48 also

provides guidance on derecognition, measurement,

classification, interest and penalties, accounting in interim

periods, disclosure and transition. The requirements of

FIN 48 are effective for our fiscal year beginning

January 1, 2007. At this stage, we do not believe the

adoption of FIN 48 will have a material effect on our

financial condition or results of operations. However, the

FASB has indicated that they expect to issue additional

FIN 48 implementation guidance regarding the ultimate

settlement of a tax audit, which may impact the timing of

certain liability adjustments. Accordingly, such guidance

may impact the amount we would record upon adoption

of this statement. We continue to evaluate the effects of

adopting this standard.

56