Xerox 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

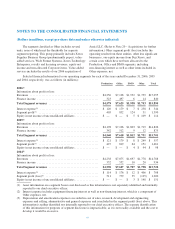

Note 5 – Inventories and Equipment on Operating Leases, Net

Inventories at December 31, 2006 and 2005 were as

follows (in millions):

2006 2005

Finished goods ................... $ 967 $ 956

Work-in-process .................. 67 99

Raw materials .................... 129 146

Total Inventories ................. $1,163 $1,201

Equipment on operating leases and similar

arrangements consists of our equipment rented to

customers and depreciated to estimated residual value at

the end of the lease term. The transfer of equipment from

our inventories to equipment subject to an operating lease

is presented in our Consolidated Statements of Cash

Flows in the operating activities section as a non-cash

adjustment. We recorded $69, $56 and $73 in inventory

write-down charges for the years ended December 31,

2006, 2005 and 2004, respectively. Equipment on

operating leases and the related accumulated depreciation

at December 31, 2006 and 2005 were as follows (in

millions):

2006 2005

Equipment on operating leases ....... $1,246 $1,262

Less: Accumulated depreciation ..... (765) (831)

Equipment on operating leases,

net ........................... $ 481 $ 431

Depreciable lives generally vary from three to four

years consistent with our planned and historical usage of

the equipment subject to operating leases. Depreciation

and obsolescence expense was $230, $205 and $210 for

the years ended December 31, 2006, 2005 and 2004,

respectively. Our equipment operating lease terms vary,

generally from 12 to 36 months. Scheduled minimum

future rental revenues on operating leases with original

terms of one year or longer are (in millions):

2007 2008 2009 2010 2011 Thereafter

$ 332 $ 205 $ 125 $ 58 $ 22 $ 2

Total contingent rentals on operating leases,

consisting principally of usage charges in excess of

minimum contracted amounts, for the years ended

December 31, 2006, 2005 and 2004 amounted to $112,

$136 and $137, respectively.

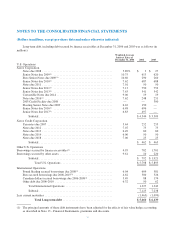

Note 6 – Land, Buildings and Equipment, Net

Land, buildings and equipment, net at December 31, 2006 and 2005 were as follows (in millions):

Estimated

Useful Lives

(Years) 2006 2005

Land ................................................................. $ 46 $ 51

Buildings and building equipment ......................................... 25to50 1,120 1,163

Leasehold improvements ................................................. Varies 338 326

Plant machinery ........................................................ 5to12 1,613 1,637

Office furniture and equipment ............................................ 3to15 949 967

Other ................................................................ 4to20 73 76

Construction in progress ................................................. 125 83

Subtotal .............................................................. 4,264 4,303

Less: Accumulated depreciation ........................................... (2,737) (2,676)

Land, buildings and equipment, net ...................................... $ 1,527 $ 1,627

69