Xerox 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

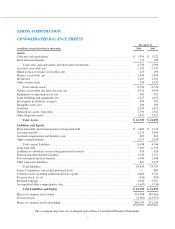

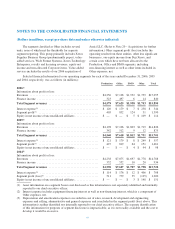

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Restricted Cash and Investments: Several of our

secured financing arrangements and derivative contracts,

as well as other material contracts, require us to post cash

collateral or maintain minimum cash balances in escrow.

These cash amounts are reported in our Consolidated

Balance Sheets, depending on when the cash will be

contractually released. At December 31, 2006 and 2005,

such restricted cash amounts were as follows (in millions):

December 31,

2006 2005

Escrow and cash collections related to

secured borrowing arrangements ...... $214 $254

Collateral related to risk management

arrangements ..................... 13 43

Other restricted cash ................. 199 149

Total ......................... $426 $446

Of these amounts, $236 and $270 were included in

Other current assets and $190 and $176 were included in

Other long-term assets, as of December 31, 2006 and

2005, respectively.

Provisions for Losses on Uncollectible

Receivables: The provisions for losses on uncollectible

trade and finance receivables are determined principally

on the basis of past collection experience applied to

ongoing evaluations of our receivables and evaluations of

the default risks of repayment. Allowances for doubtful

accounts on accounts receivable balances were $116 and

$136, as of December 31, 2006 and 2005, respectively.

Allowances for doubtful accounts on finance receivables

were $198 and $229 at December 31, 2006 and 2005,

respectively.

Inventories: Inventories are carried at the lower of

average cost or market. Inventories also include

equipment that is returned at the end of the lease term.

Returned equipment is recorded at the lower of

remaining net book value or salvage value. Salvage value

consists of the estimated market value (generally

determined based on replacement cost) of the salvageable

component parts, which are expected to be used in the

remanufacturing process. We regularly review inventory

quantities and record a provision for excess and/or

obsolete inventory based primarily on our estimated

forecast of product demand, production requirements and

servicing commitments. Several factors may influence

the realizability of our inventories, including our decision

to exit a product line, technological changes and new

product development. The provision for excess and/or

obsolete raw materials and equipment inventories is

based primarily on near term forecasts of product

demand and include consideration of new product

introductions as well as changes in remanufacturing

strategies. The provision for excess and/or obsolete

service parts inventory is based primarily on projected

servicing requirements over the life of the related

equipment populations.

Land, Buildings and Equipment and Equipment

on Operating Leases: Land, buildings and equipment

are recorded at cost. Buildings and equipment are

depreciated over their estimated useful lives. Leasehold

improvements are depreciated over the shorter of the

lease term or the estimated useful life. Equipment on

operating leases is depreciated to estimated residual value

over the lease term. Depreciation is computed using the

straight-line method. Significant improvements are

capitalized and maintenance and repairs are expensed.

Refer to Note 5 – Inventories and Equipment on

Operating Leases, Net and Note 6 – Land, Buildings and

Equipment, Net for further discussion.

Goodwill and Other Intangible Assets: Goodwill

is tested for impairment annually or more frequently if an

event or circumstance indicates that an impairment loss

may have been incurred. Application of the goodwill

impairment test requires judgment, including the

identification of reporting units, assignment of assets and

liabilities to reporting units, assignment of goodwill to

reporting units, and determination of the fair value of

each reporting unit. We estimate the fair value of each

reporting unit using a discounted cash flow methodology.

This requires us to use significant judgment including

estimation of future cash flows, which is dependent on

internal forecasts, estimation of the long-term rate of

growth for our business, the useful life over which cash

flows will occur, determination of our weighted average

cost of capital, and relevant market data.

Other intangible assets primarily consist of assets

obtained in connection with business acquisitions,

including installed customer base and distribution

network relationships, patents on existing technology and

trademarks. We apply an impairment evaluation

whenever events or changes in business circumstances

indicate that the carry value of our intangible assets may

61