Xerox 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

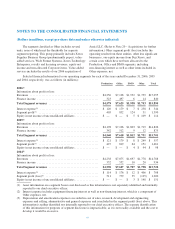

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Stock-based compensation expense for the three

years ended December 31, 2006 was as follows (in

millions):

2006 2005 2004

Stock-based compensation expense,

pre-tax ....................... $64 $40 $22

Stock-based compensation expense,

netoftax ..................... 39 25 13

FAS 123(R) requires that the cash flows from the tax

benefits resulting from tax deductions in excess of the

compensation cost recognized for stock-based awards

(excess tax benefits) be classified as financing cash flows.

Prior to the adoption of FAS 123(R), such excess tax

benefits were presented as operating cash flows.

Accordingly, $25 excess tax benefits has been classified as

a financing cash inflow for the year ended December 31,

2006 in the Consolidated Statements of Cash Flows. Such

excess tax benefits amounted to $12 and $23 for the years

ended December 31, 2005 and 2004, respectively and are

included in operating cash flows.

Prior to January 1, 2006, in accordance with APB

Opinion No. 25 “Accounting for Stock Issued to

Employees,” we did not recognize compensation expense

relating to employee stock options because the exercise

price was equal to the market price at the date of grant. If

we had elected to recognize compensation expense using

a fair value approach as required by FAS 123(R), and

therefore determined the compensation based on the value

as determined by the modified Black-Scholes option

pricing model, our pro forma income and earnings per

share would have been as follows:

(in millions, except per share data) 2005 2004

Net income – as reported .............................................................. $978 $859

Add: Stock-based employee compensation expense included in reported net income, net of tax ....... 25 13

Deduct: Total stock-based employee compensation expense determined under fair value based method

for all awards, net of tax ............................................................. (113) (82)

Net income – pro forma ............................................................... $890 $790

Basic EPS – as reported ............................................................... $0.96 $0.94

Basic EPS – pro forma ................................................................ 0.87 0.86

Diluted EPS – as reported .............................................................. $0.94 $0.86

Diluted EPS – pro forma .............................................................. 0.85 0.80

The weighted-average fair value of options granted

in 2004 was $8.38. The 2004 fair values were estimated

on the date of grant using the following weighted average

assumptions: risk-free interest rate of 3.2%; expected life

of 5.7 years; expected price volatility of 66.5%; and no

expected dividend yield.

Refer to Note 18 – Common Stock for additional

disclosures regarding our stock compensation programs.

Summary of Accounting Policies:

Revenue Recognition: We generate revenue

through the sale and rental of equipment, service and

supplies and income associated with the financing of our

equipment sales. Revenue is recognized when earned.

More specifically, revenue related to sales of our products

and services is recognized as follows:

Equipment: Revenues from the sale of equipment,

including those from sales-type leases, are recognized at

the time of sale or at the inception of the lease, as

appropriate. For equipment sales that require us to install

the product at the customer location, revenue is

recognized when the equipment has been delivered to and

installed at the customer location. Sales of customer

installable products are recognized upon shipment or

receipt by the customer according to the customer’s

shipping terms. Revenues from equipment under other

leases and similar arrangements are accounted for by the

operating lease method and are recognized as earned over

the lease term, which is generally on a straight-line basis.

Service: Service revenues are derived primarily from

maintenance contracts on our equipment sold to

customers and are recognized over the term of the

contracts. A substantial portion of our products are sold

with full service maintenance agreements for which the

58