Xerox 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and generate post sale and financing revenue.

Seventy-two percent of our 2006 total revenue was post

sale and financing revenue that includes equipment

maintenance and consumable supplies, among other

elements. We sell the majority of our equipment through

sales-type leases that we record as equipment sale

revenue. Equipment sales represented 28% of our 2006

total revenue.

We expect this large, recurring post sale revenue

stream to be approximately three times the equipment sale

revenue over the life of a lease. Thus, the number of

equipment installations is a key indicator of post sale and

financing revenue trends. The mix of color pages is

another significant indicator of post sale revenue trends

because color pages use more consumables per page than

black-and-white. In addition, market development,

particularly within the Eligible Offset market, is key to

increasing pages and we have leading tools and resources

to develop this large market opportunity.

Acquisitions

To further our business goals, we made two

acquisitions in 2006. We completed the purchase of

Amici LLC, (“Amici”), a provider of electronic-

discovery (“e-discovery”) services, primarily supporting

litigation and regulatory compliance. E-discovery is the

identification, filtering, production, and storage of

relevant data from paper or electronic documents, such as

e-mail, text files, memos, databases, presentations and

spreadsheets. Amici, now branded Xerox Litigation

Services, provides comprehensive litigation discovery

management services, including the conversion, hosting

and production of electronic and hard copy documents.

They also provide consulting and professional services to

assist attorneys in the discovery process.

We also purchased XMPie, Inc. (“XMPie”) to

further strengthen our position in the growing market for

personalized communications and cross-media marketing

campaigns involving digital printing, e-mail and

customized websites. XMPie helps graphic designers,

marketing companies and print providers develop

creative, customized marketing programs. XMPie

provides software for variable data publishing ranging

from the desktop to servers, from print to multi-channel

campaigns, from personalized images to personalized

booklets, and from out-of-the-box solutions to a platform

for creating custom solutions that fit unique business,

integration and workflow requirements.

Segment Information

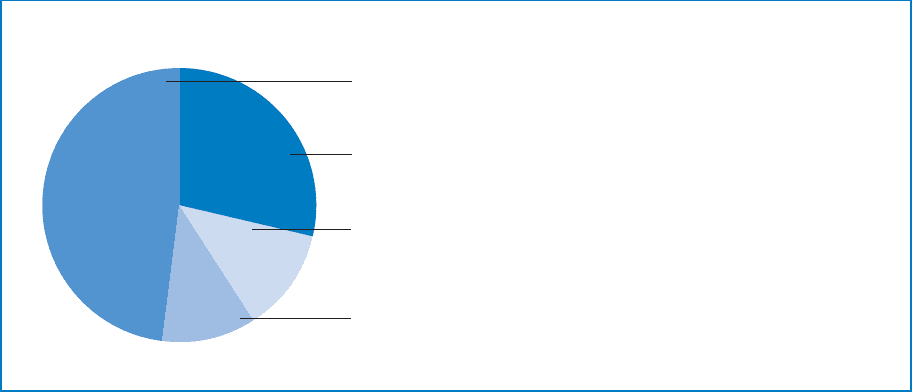

Our reportable segments are Production, Office,

Developing Markets Operations (“DMO”), and Other. We

present operating segment financial information in

Note 2 – Segment Reporting to the Consolidated

Financial Statements, which we incorporate by reference

here. We have a very broad and diverse base of

customers, both geographically and demographically,

ranging from small and medium businesses to graphic

communications companies, governmental entities,

educational institutions and large (Fortune 1000)

corporate accounts. None of our business segments

depends upon a single customer, or a few customers, the

loss of which would have a material adverse effect on our

business.

Office $7,625 million

Our Office segment serves global, national and small to medium-size commercial

customers as well as government, education, and other public sector customers.

Production $4,579 million

We provide high-end digital monochrome and color systems designed for customers

in the graphic communications industry and for large enterprises.

Other $1,753 million

The Other segment primarily includes revenue from paper sales, wide-format systems,

and value-added services.

DMO $1,938 million

DMO includes the marketing, sales, and servicing of Xerox products, supplies, and

services in Latin America, Brazil, the Middle East, India, Eurasia and Central-Eastern

Europe, and Africa.

Reviews by Business Segment

47.97%

12.19%

28.81%

11.03%

17