Xerox 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

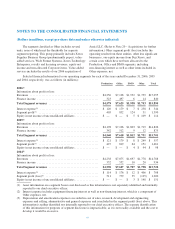

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

The following table summarizes certain significant charges that require management estimates:

Year ended December 31,

(in millions) 2006 2005 2004

Restructuring provisions and asset impairments ................................ $385 $366 $ 86

Amortization of intangible assets ............................................ 45 42 38

Provisions for receivables ................................................. 76 51 86

Provisions for obsolete and excess inventory ................................... 69 56 73

Provisions for litigation and regulatory matters ................................. 89 115 9

Depreciation and obsolescence of equipment on operating leases ................... 230 205 210

Depreciation of buildings and equipment ..................................... 277 280 305

Amortization of capitalized software ......................................... 84 114 134

Pension benefits – net periodic benefit cost .................................... 355 343 350

Other post-retirement benefits – net periodic benefit cost ......................... 117 117 111

Deferred tax asset valuation allowance provisions .............................. 12 (38) 12

Changes in Estimates: In the ordinary course of

accounting for items discussed above, we make changes

in estimates as appropriate, and as we become aware of

circumstances surrounding those estimates. Such changes

and refinements in estimation methodologies are reflected

in reported results of operations in the period in which the

changes are made and, if material, their effects are

disclosed in the Notes to the Consolidated Financial

Statements.

New Accounting Standards and Accounting Changes:

In September 2006, the FASB issued SFAS No. 158,

“Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment of FASB

Statements No. 87, 88, 106 and 132(R)” (“FAS 158”).

FAS 158 requires the recognition of an asset or liability

for the funded status of defined pension and other

postretirement benefit plans in the statement of financial

position of the sponsoring entity. The funded status of a

benefit plan is measured as the difference between plan

assets at fair value and the benefit obligation. For a

defined benefit pension plan, the benefit obligation is the

projected benefit obligation or PBO; for any other defined

benefit postretirement benefit plan, such as a retiree

health care plan, the benefit obligation is the accumulated

postretirement benefit obligation. The initial incremental

recognition of the funded status under FAS 158 of our

defined pension and other post retirement benefit plans,

as well as subsequent changes in our funded status that

are not included in net periodic benefit cost will be

reflected in shareholders’ equity and other comprehensive

loss, respectively. As of December 31, 2006, the net

unfunded status of our benefit plans was $2,842 and

recognition of this status upon the adoption of FAS 158

resulted in an after-tax charge to equity of $1,024. Prior to

the adoption of FAS 158, we recorded an after-tax credit

to our minimum pension liability of $(131), for a total

equity charge in 2006 related to the funded status of our

benefit plans of $893. Amounts recognized in

Accumulated other comprehensive loss are adjusted as

they are subsequently recognized as a component of net

periodic benefit cost. The method of calculating net

periodic benefit cost will not change from existing

guidance. FAS 158 also prescribes enhanced disclosures,

including current and long-term components of plan

assets and liabilities, as well as amounts recognized in

Accumulated other comprehensive loss that will

subsequently be recognized as a component of net

periodic benefit cost in the following year. Refer to Note

14 – Employee Benefit Plans for additional information.

The funded status recognition and certain disclosure

provisions of FAS 158 are effective as of our fiscal year

ending December 31, 2006. Retrospective application of

FAS 158 is not permitted. FAS 158 also requires the

consistent measurement of plan assets and benefit

obligations as of the date of our fiscal year-end statement

of financial position effective for the year ending

55