Xerox 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

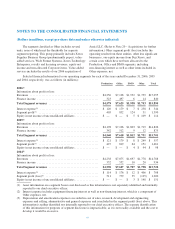

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

The segment classified as Other includes several

units, none of which met the thresholds for separate

segment reporting. This group primarily includes Xerox

Supplies Business Group (predominantly paper), value-

added services, Wide Format Systems, Xerox Technology

Enterprises, royalty and licensing revenues, equity net

income and non-allocated Corporate items. Value-added

services includes the results of our 2006 acquisition of

Amici LLC. (Refer to Note 20 – Acquisitions for further

information.) Other segment profit (loss) includes the

operating results from these entities, other less significant

businesses, our equity income from Fuji Xerox, and

certain costs which have not been allocated to the

Production, Office and DMO segments, including

non-financing interest as well as other items included in

Other expenses, net.

Selected financial information for our operating segments for each of the years ended December 31, 2006, 2005

and 2004, respectively, was as follows (in millions):

Production Office DMO Other Total

2006(1)

Information about profit or loss:

Revenues ............................................... $4,256 $7,128 $1,932 $1,739 $15,055

Finance income .......................................... 323 497 6 14 840

Total Segment revenues .................................. $4,579 $7,625 $1,938 $1,753 $15,895

Interest expense(2) ........................................ $ 120 $ 179 $ 7 $ 238 $ 544

Segment profit(3) ......................................... 403 832 124 31 1,390

Equity in net income of unconsolidated affiliates ................ $ — $ — $ 5 $ 109 $ 114

2005(1)

Information about profit or loss:

Revenues ............................................... $4,198 $7,106 $1,803 $1,719 $14,826

Finance income .......................................... 342 512 9 12 875

Total Segment revenues .................................. $4,540 $7,618 $1,812 $1,731 $15,701

Interest expense(2) ........................................ $ 121 $ 179 $ 8 $ 249 $ 557

Segment profit(3) ......................................... 427 819 64 151 1,461

Equity in net income of unconsolidated affiliates ................ $ — $ — $ 4 $ 94 $ 98

2004(1)

Information about profit or loss:

Revenues ............................................... $4,238 $7,075 $1,697 $1,778 $14,788

Finance income .......................................... 352 552 10 20 934

Total Segment revenues .................................. $4,590 $7,627 $1,707 $1,798 $15,722

Interest expense(2) ........................................ $ 114 $ 176 $ 12 $ 406 $ 708

Segment profit (loss)(3) .................................... 511 779 35 (125) 1,200

Equity in net income of unconsolidated affiliates ................ $ — $ — $ 3 $ 148 $ 151

(1) Asset information on a segment basis is not disclosed as this information is not separately identified and internally

reported to our chief executive officer.

(2) Interest expense includes equipment financing interest as well as non-financing interest, which is a component of

Other expenses, net.

(3) Depreciation and amortization expense is recorded in cost of sales, research, development and engineering

expenses and selling, administrative and general expenses and is included in the segment profit (loss) above. This

information is neither identified nor internally reported to our chief executive officer. The separate identification

of this information for purposes of segment disclosure is impracticable, as it is not readily available and the cost to

develop it would be excessive.

64