Xerox 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

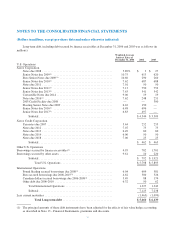

Long-term debt, including debt secured by finance receivables at December 31, 2006 and 2005 was as follows (in

millions):

Weighted Average

Interest Rates at

December 31, 2006 2006 2005

U.S. Operations

Xerox Corporation

Notes due 2008 ................................................ 5.89% $ 3 $ 27

Senior Notes due 2009(1) ........................................ 10.75 613 620

Euro Senior Notes due 2009(1) .................................... 10.60 290 260

Senior Notes due 2010(1) ........................................ 7.62 687 688

Notes due 2011 ................................................ 7.01 50 50

Senior Notes due 2011(1) ........................................ 7.13 750 752

Senior Notes due 2013(1) ........................................ 7.63 541 542

Convertible Notes due 2014 ...................................... 9.00 19 19

Notes due 2016(1) .............................................. 7.62 248 251

2003 Credit Facility due 2008 .................................... — — 300

Floating Senior Notes due 2009 ................................... 6.16 150 —

Senior Notes due 2016(1) ........................................ 6.48 696 —

Senior Notes due 2017(1) ........................................ 6.83 497 —

Subtotal .................................................. $4,544 $ 3,509

Xerox Credit Corporation

Yen notes due 2007 ............................................ 5.44 252 255

Notes due 2012 ................................................ 7.07 75 75

Notes due 2013 ................................................ 6.49 60 60

Notes due 2014 ................................................ 6.06 50 50

Notes due 2018 ................................................ 7.00 25 25

Subtotal .................................................. $ 462 $ 465

Other U.S. Operations

Borrowings secured by finance receivables(2) ............................ 4.95 782 1,701

Borrowings secured by other assets .................................... 9.61 10 220

Subtotal .................................................. $ 792 $1,921

Total U.S. Operations ................................... $5,798 $ 5,895

International Operations

Pound Sterling secured borrowings due 2008(2) ....................... 6.04 609 581

Euro secured borrowings due 2006-2015(2) .......................... 4.62 580 526

Canadian dollars secured borrowings due 2006-2008(2) ................ 5.49 88 174

Other debt due 2006-2010 ....................................... 6.32 50 62

Total International Operations ................................ 1,327 1,343

Subtotal .................................................. 7,125 7,238

Less current maturities .............................................. (1,465) (1,099)

Total Long-term debt .................................. $ 5,660 $ 6,139

(1) The principal amounts of these debt instruments have been adjusted for the effects of fair value hedge accounting,

as described in Note 13 – Financial Instruments, premiums and discounts.

77