Xerox 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our 2006 balance sheet strategy focused on

optimizing operating cash flows, maintaining debt levels

primarily to support our customer financing operations,

replacing secured debt collaterized by our finance

receivables with new unsecured debt, and returning

value to shareholders through acquisitions and our

announced share repurchase programs. The successful

implementation of this strategy in 2006 enabled us to

significantly improve our financial position, return to

investment grade and finish the year with a cash, cash

equivalents and short-term investments

balance of $1.5 billion. Our prospective balance

sheet strategy includes: optimizing operating cash flows;

maintaining our investment grade credit ratings;

achieving an optimal cost of capital; rebalancing secured

and unsecured debt; and effectively deploying cash to

deliver and maximize long-term shareholder value. Our

strategy also includes maintaining an appropriate

leverage of our financing assets (finance receivables and

equipment on operating leases) and an appropriate level

of non-financing debt.

Currency Impacts

To understand the trends in the business, we believe

that it is helpful to analyze the impact of changes in the

translation of foreign currencies into U.S. dollars on

revenues and expenses. We refer to this analysis as

“currency impact” or “the impact from currency”.

Revenues and expenses from our Developing Markets

Operations (“DMO”) are analyzed at actual exchange

rates for all periods presented, since these countries

generally have volatile currency and inflationary

environments, and our operations in these countries have

historically implemented pricing actions to recover the

impact of inflation and devaluation. We do not hedge the

translation effect of revenues or expenses denominated in

currencies where the local currency is the functional

currency.

Approximately half of our consolidated revenues are

derived from operations outside of the United States

where the U.S. dollar is not the functional currency.

When compared with the average of the major European

currencies on a revenue-weighted basis, the U.S. dollar

was unchanged in both 2006 and 2005 and 10% weaker in

2004. As a result, the foreign currency translation impact

on revenue was negligible in 2006 and 2005.

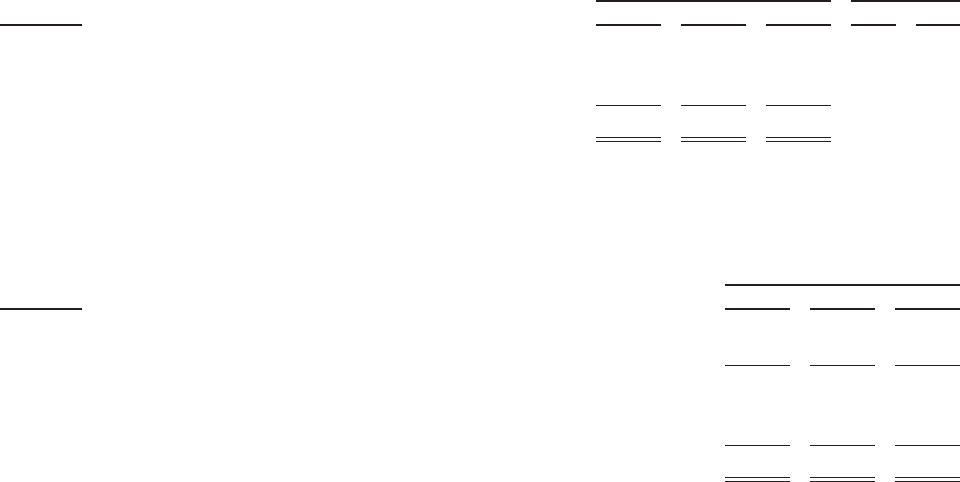

Summary Results:

Revenues for the three years ended December 31, 2006 were as follows:

(in millions)

Year Ended December 31, Percent Change

2006 2005 2004 2006 2005

Equipment sales ............................................ $ 4,457 $ 4,519 $ 4,480 (1)% 1%

Post sale and other revenue ................................... 10,598 10,307 10,308 3% —

Finance income ............................................ 840 875 934 (4)% (6)%

Total Revenue ............................................. $15,895 $15,701 $15,722 1% —

Total Color revenue included in total revenue ..................... $ 5,578 $ 4,928 $ 4,188 13% 18%

The following presentation reconciles the above information to the revenue classifications included in our

Consolidated Statements of Income:

(in millions)

Year Ended December 31,

2006 2005 2004

Sales .................................................................. $ 7,464 $ 7,400 $ 7,259

Less: Supplies, paper and other sales ......................................... (3,007) (2,881) (2,779)

Equipment sales ......................................................... $ 4,457 $ 4,519 $ 4,480

Service, outsourcing and rentals ............................................ $ 7,591 $ 7,426 $ 7,529

Add: Supplies, paper and other sales ......................................... 3,007 2,881 2,779

Post sale and other revenue ................................................ $10,598 $10,307 $10,308

27