Xerox 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

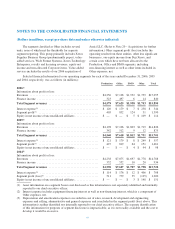

(Dollars in millions, except per-share data and unless otherwise indicated)

In June 2006, the FASB ratified the consensus

reached on EITF Issue No. 06-03, “How Sales Taxes

Collected from Customers and Remitted to Governmental

Authorities Should Be Presented in the Income Statement

(that is, Gross Versus Net Presentation)” (“EITF 06-03”).

The EITF reached a consensus that the presentation of

taxes on either a gross or net basis is an accounting policy

decision that requires disclosure. EITF 06-03 is effective

for our fiscal year beginning January 1, 2007. Sales tax

amounts collected from customers have been recorded on

a net basis. The adoption of EITF 06-03 will not have any

effect on our financial position or results of operations.

In February 2006, the FASB issued SFAS No. 155,

“Accounting for Certain Hybrid Financial Instruments”

(“FAS 155”), which amends SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities”

(“FAS 133”) and SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities” (“FAS 140”). FAS 155

provides guidance to simplify the accounting for certain

hybrid instruments by permitting fair value

remeasurement for any hybrid financial instrument that

contains an embedded derivative, as well as, clarifies that

beneficial interests in securitized financial assets are

subject to FAS 133. In addition, FAS 155 eliminates a

restriction on the passive derivative instruments that a

qualifying special-purpose entity may hold under FAS

140. FAS 155 is effective for all financial instruments

acquired, issued or subject to a new basis occurring after

the start of our fiscal year beginning January 1, 2007. We

believe that the adoption of this statement will not have a

material effect on our financial condition or results of

operations.

In March 2005, the FASB issued Interpretation

No. 47, “Accounting for Conditional Asset Retirement

Obligations – an interpretation of FASB Statement

No. 143” (“FIN 47”). FIN 47 requires an entity to

recognize a liability for the fair value of a conditional

asset retirement obligation if the fair value can be

reasonably estimated. A conditional asset retirement

obligation is a legal obligation to perform an asset

retirement activity in which the timing or method of

settlement are conditional upon a future event that may or

may not be within control of the entity. The adoption of

FIN 47 in 2005 resulted in an after-tax charge of $8 ($12

pre-tax) and was recorded as a cumulative effect of

change in accounting principle. This charge represented

conditional asset retirement obligations associated with

leased facilities where we are required to remove certain

leasehold improvements and restore the facility to its

original condition at lease termination.

Stock-Based Compensation: In December 2004, the

FASB issued SFAS No. 123(R), “Share-Based Payment”

(“FAS 123(R)”), which requires companies to recognize

compensation expense using a fair value based method for

costs related to all share-based payments, including stock

options. On January 1, 2006, we adopted FAS 123(R)

using the modified prospective transition method and

therefore we did not restate the results of prior periods.

Prior to the adoption of FAS 123(R), under previous

accounting guidance, we did not expense stock options, as

there was no intrinsic value associated with the options

granted because the exercise price was set equal to the

market price at the date of grant. The adoption of FAS

123(R) was immaterial to our results of operations

primarily as a result of changes made in our stock-based

compensation programs in 2005 as well as the accelerated

vesting of substantially all outstanding unvested stock

options prior to the adoption of FAS 123(R).

In January 2005, we implemented changes in our

stock-based compensation programs that included

expanded use of restricted stock grants with time- and

performance-based restrictions in lieu of stock options.

Prior to this change, our stock-based compensation

programs primarily consisted of stock option grants.

These new restricted stock awards are reflected as

compensation expense in our results of operations in both

2005 and 2006 and the adoption of FAS 123(R) did not

materially affect the expense recognized for these awards.

In May 2005, we accelerated the vesting of

approximately 3.6 million stock options granted in 2004

that would have been scheduled to vest on January 1,

2007, to December 31, 2005. The accelerated vesting

resulted in substantially all outstanding stock options

being vested at the date of the adoption of FAS 123(R).

The primary purpose of this accelerated vesting was to

reduce our pre-tax compensation expense in 2006 by

approximately $31 or $0.02 per diluted share.

57