Xerox 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

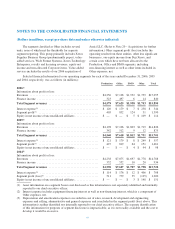

The following table summarizes the maturities and fair market values of our Short-term investments as of

December 31, 2006 and 2005, respectively (in millions):

2006

Due In

1 Year or Less

Due After

1 Year Through

5 Years

Due After

5 Years Through

10 Years

Due After

10 Years Total

Description of Securities

Corporate bonds ............................. $ 65 $— $— $— $ 65

Auction rate municipal bonds .................. — — — 31 31

US government agency securities ............... 23 — — — 23

Certificates of deposit ........................ 8 — — — 8

Total Debt Securities ......................... $ 96 $— $— $ 31 $127

Auction rate preferred securities ................ 10

Total Short-term investments ................. $137

2005

Due In

1 Year or Less

Due After

1 Year Through

5 Years

Due After

5 Years Through

10 Years

Due After

10 Years Total

Description of Securities

Corporate bonds ............................. $ 93 $ 51 $— $— $144

Auction rate municipal bonds .................. — — — 45 45

US government agency securities ............... 13 19 — — 32

Total Debt Securities ......................... $106 $ 70 $— $ 45 $221

Auction rate preferred securities ................ 23

Total Short-term investments ................. $244

Actual maturities may differ from contractual

maturities because borrowers may have the right to

prepay and creditors may have the right to call

obligations. These securities are classified within current

assets because they are highly liquid, traded in active

markets and are available for use, if needed, for current

operations.

Note 4 – Receivables, Net

Finance Receivables: Finance receivables result from installment arrangements and sales-type leases arising from

the marketing of our equipment. These receivables are typically collateralized by a security interest in the underlying

assets. Finance receivables, net at December 31, 2006 and 2005 were as follows (in millions):

2006 2005

Gross receivables ................................................................. $9,389 $ 9,449

Unearned income ................................................................. (1,437) (1,458)

Unguaranteed residual values ....................................................... 90 87

Allowance for doubtful accounts .................................................... (198) (229)

Finance receivables, net ........................................................... 7,844 7,849

Less: Billed portion of finance receivables, net ......................................... (273) (296)

Current portion of finance receivables not billed, net ..................................... (2,649) (2,604)

Amounts due after one year, net ..................................................... $4,922 $ 4,949

66