Xerox 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also extended our black-and-white MFD series, broadening our already extensive product line.

– WorkCentre 4118: Introduced in June, the 4118 is designed for small workgroups and has the strongest set of

features that we offer on a low-end, black-and-white desktop MFD.

– WorkCentre 4150: With the introduction in September of this 50 ppm A4 monochrome MFD, we entered a new,

rapidly growing market segment, offering an economical alternative to large enterprises interested in replacing

their printer fleet.

– WorkCentre 4590: Introduced in January, the 4590, which runs at 90 ppm, rounds out the high-end of our office

monochrome fleet.

– Extensible Interface Platform: In October, we introduced our Extensible Interface Platform (“EIP”) with a

configurable user interface. With EIP, customers can access document-related software applications on a Xerox

MFD user interface, improving workflow and productivity.

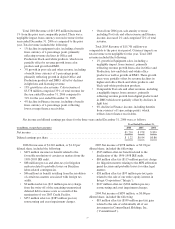

DMO

DMO includes the marketing, sales and servicing of

Xerox products, supplies, and services in Latin America,

Brazil, the Middle East, India, Eurasia and Central-

Eastern Europe and Africa. In countries with developing

economies, DMO manages the Xerox business through

operating companies, subsidiaries, joint ventures, product

distributors, affiliates, concessionaires, value-added

resellers and dealers. Our two-tiered distribution model

has proven very successful in the high-growth

geographies of Russia and Central-Eastern Europe, and in

2006 we completed implementing this business model

throughout the remainder of DMO. We manage our DMO

operations separately as a segment because of the political

and economic volatility, and the unique nature of its

markets. Our 2006 DMO goals included revenue growth,

a continued focus on improving the entire cost base and

providing a foundation for profitable growth.

Other

Our Other segment primarily includes revenue from

paper sales, value-added services and wide-format

systems.

We sell cut-sheet paper to our customers for use in

their document processing products. The market for

cut-sheet paper is highly competitive and revenues are

significantly affected by pricing. Our strategy is to charge

a premium over mill wholesale prices, which is adequate

to cover our costs and the value we add as a distributor, as

well as to provide unique products that enhance the “New

Business of Printing” and color output.

An increasingly important part of our offering is

value-added services, which uses our document industry

knowledge and experience. Our value-added services

deliver solutions that optimize our customers’ document

output and infrastructure costs while streamlining,

simplifying, and digitizing their document-intensive

business processes. In July, we acquired Amici, officially

launching the Xerox Litigation Services line of electronic

discovery (“e-discovery”) and records management

services. E-discovery is the identification, filtering,

production and storage of relevant data from paper or

electronic documents, like e-mail, text files, memos,

databases, presentations and spreadsheets. Often our

value-added services solutions lead to larger managed

services contracts, including our equipment, supplies,

service, and labor. We report the revenue from managed

services contracts in the Production, Office, or DMO

segments. In 2006, the combined value-added services

and managed services revenue, including equipment,

totaled $3.5 billion.

We offer document processing products and devices

in our wide-format systems business designed to

reproduce large engineering and architectural drawings up

to three feet by four feet in size.

20