Xerox 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

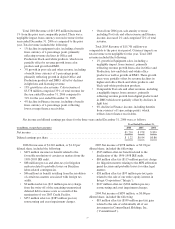

we expect will drive future growth. We include in our

R,D&E expenses our sustaining engineering expenses,

which are the hardware engineering and software

development costs we incur after we launch a product.

Our R&D is strategically coordinated

with that of Fuji Xerox, which

invested $660 million in R&D in

2006, $720 million in 2005 and

$704 million in 2004.

Patents, Trademarks and Licenses

We are a technology company. With our Xerox Palo

Alto Research Center (“PARC”) subsidiary, we were

awarded nearly 560 U.S. utility patents in 2006. We were

ranked 39th on the list of companies that were awarded

the most U.S. patents during the year and would have

been ranked 36th with the inclusion of PARC patents.

With our research partner, Fuji Xerox, we were awarded

over 800 U.S. utility patents in 2006. Our patent portfolio

evolves as new patents are awarded to us and as older

patents expire. As of December 31, 2006, we held

approximately 8,300 design and utility U.S. patents.

These patents expire at various dates up to 20 years or

more from their original filing dates. While we believe

that our portfolio of patents and applications has value, in

general no single patent is essential to our business or

any individual segment. In addition, any of our

proprietary rights could be challenged, invalidated, or

circumvented or may not provide significant competitive

advantages.

In the U.S., we are party to numerous patent-

licensing agreements, and in a majority of them, we

license or assign our patents to others, in return for

revenue and/or access to their patents. Most of the patent

licenses expire concurrently with the expiration of the

last patent identified in the license. In 2006, with our

PARC subsidiary, we added approximately 25

agreements to our portfolio of patent licensing

agreements, and either we or our PARC subsidiary was a

licensor in 22 of the agreements. We also have a number

of cross-licensing agreements with companies with

substantial patent portfolios, including Canon, Microsoft,

IBM, Hewlett Packard and Océ. Those agreements vary

in subject matter, scope, compensation, significance and

time.

In the U.S., we own approximately 560 trademarks,

either registered or applied for. These trademarks have a

perpetual life, subject to renewal every ten years. We

vigorously enforce and protect our trademarks. We hold a

perpetual trademark license for “DocuColor.”

Competition

Although we encounter aggressive competition in all

areas of our business, we are the leader or among the

leaders in each of our principal business segments. Our

competitors range from large international companies to

relatively small firms. We compete primarily on the basis

of technology, performance, price, quality, reliability,

brand, distribution, and customer service and support. To

remain competitive, we invest in and develop new

products and services and continually improve our

existing offerings. Our key competitors include Canon,

Ricoh, IKON, Hewlett-Packard, and, in certain areas of

the business, Pitney Bowes, Kodak, Océ, Konica-Minolta

and Lexmark. We believe that our brand recognition,

reputation for document knowledge and expertise,

innovative technology, breadth of product offerings,

global distribution channels, our customer relationships

and large customer base are important competitive

advantages. We and our competitors continue to develop

and market new and innovative products at competitive

prices, and, at any given time, we may set new market

standards for quality, speed and function.

22