Xerox 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

Internal Use Software: Capitalized direct costs

associated with developing, purchasing or otherwise

acquiring software for internal use are amortized on a

straight-line basis over the expected useful life of the

software, beginning when the software is implemented.

Useful lives of the software generally vary from 3 to 5

years. Amortization expense, including applicable

impairment charges, was $73, $92, and $107 for the years

ended December 31, 2006, 2005 and 2004, respectively.

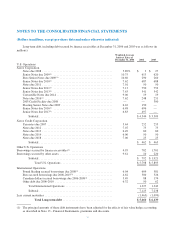

Note 11 – Debt

Short-term borrowings at December 31, 2006 and

2005 were as follows (in millions):

2006 2005

Current maturities of long-term

debt ....................... $1,465 $1,099

Notes payable .................. 20 40

Total ........................ $1,485 $1,139

We classify our debt based on the contractual

maturity dates of the underlying debt instruments or as

of the earliest put date available to the debt holders.

We defer costs associated with debt issuance over the

applicable term or to the first put date, in the case of

convertible debt or debt with a put feature. These costs

are amortized as interest expense in our Consolidated

Statements of Income.

76