Xerox 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revenue

Approximately 28% of our

revenue comes from equipment

sales, from either lease

arrangements that qualify as

sales for accounting purposes,

or outright cash sales.

Revenue Stream

The remaining 72% of our

revenue, “Post sale and

financing,” includes annuity-

based revenue from maintenance,

services, supplies, and financing,

as well as revenue from rentals

or operating lease arrangements.

28% 72%

We sell most of our products and services under

bundled lease arrangements, in which our customers pay a

monthly amount for the equipment, maintenance,

services, supplies and financing over the course of the

lease agreement. These arrangements are beneficial to our

customers and us since, in addition to customers receiving

a bundled offering, these arrangements allow us to

maintain the customer relationship for future sales of

equipment and services.

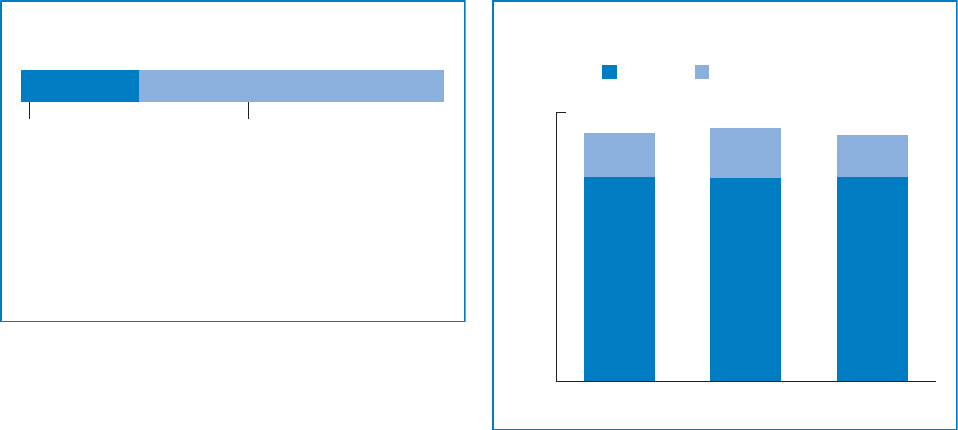

Research and Development

R&D Sustaining Engineering

R, D&E Expenses

(in millions)

1000

800

600

400

200

0

$922

$161

$761

2006

$943

$188

$755

2005

$914

$154

$760

2004

Investment in R&D is critical for competitiveness in

Xerox’s fast paced markets where more than two-thirds of

our equipment sales are from products launched during

the past two years.

We are required, for accounting purposes, to analyze

these arrangements to determine whether the equipment

component meets certain accounting requirements so that

the equipment should be recorded as a sale at lease

inception, that is, a sales-type lease. Under a sales-type

lease we are required to allocate a portion of the monthly

minimum payments attributable to the fair value of the

equipment to equipment sales. We allocate the remaining

portion of the monthly minimum payments to the various

remaining elements based on fair value – service,

maintenance, supplies and financing – that we generally

recognize over the term of the lease agreement, and that

we report as “post sale and other revenue” and “finance

income” revenue. In those arrangements that do not

qualify as sales-type leases, which have increased as a

result of our services-led strategy, we recognize the entire

monthly payment over the term of the lease agreement,

whether rental or operating lease, and report it in “post

sale and other revenue.” Our accounting policies for

revenue recognition for leases and bundled arrangements

are included in Note 1 – Summary of Significant

Accounting Policies to the Consolidated Financial

Statements in our 2006 Annual Report.

Xerox’s R&D drives innovation and customer value

by:

–Creating new differentiated products and services.

–Enabling cost competitiveness through disruptive

products and services.

–Enabling new ways to serve customers.

–Creating new business opportunities to drive future

growth by reaching out to new customers.

To ensure our success, we have aligned our R&D

investment portfolio with our strategic planks: leading the

color transition, enabling the “New Business of Printing”,

and enhancing customer value through services. 2006

R&D spending focused primarily on the development of

high-end business applications to drive the “New

Business of Printing”, on extending our color capabilities,

and on lower-cost platforms and customer productivity

enablers that drive the digitization of the office. The

Xerox iGen3, an advanced next-generation digital

printing press that produces photographic-quality prints

indistinguishable from offset, and Xerox’s proprietary

Solid Ink technology for the office are examples of the

type of breakthrough technology we developed and that

21