Vodafone 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

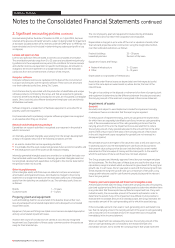

Capital market and bank borrowings

Interest bearing loans and overdrafts are initially measured at fair value (which

is equal to cost at inception), and are subsequently measured at amortised cost,

using the effective interest rate method, except where they are identified as a

hedged item in a fair value hedge. Any difference between the proceeds net of

transaction costs and the settlement or redemption of borrowings is recognised

over the term of the borrowing.

Equity instruments

Equity instruments issued by the Group are recorded at the proceeds received,

net of direct issue costs.

Derivative financial instruments and hedge accounting

The Group’s activities expose it to the financial risks of changes in foreign

exchange rates and interest rates.

The use of financial derivatives is governed by the Group’s policies approved by

the Board of directors, which provide written principles on the use of financial

derivatives consistent with the Group’s risk management strategy. Changes in

values of all derivatives of a financing nature are included within investment

income and financing costs in the income statement. The Group does not use

derivative financial instruments for speculative purposes.

Derivative financial instruments are initially measured at fair value on the contract

date and are subsequently re-measured to fair value at each reporting date.

The Group designates certain derivatives as either:

hedges of the change of fair value of recognised assets and liabilities

(“fair value hedges”); or

hedges of net investments in foreign operations.

Hedge accounting is discontinued when the hedging instrument expires or is sold,

terminated, or exercised, or no longer qualifies for hedge accounting.

Fair value hedges

The Group’s policy is to use derivative instruments (primarily interest rate swaps)

to convert a proportion of its fixed rate debt to floating rates in order to hedge the

interest rate risk arising, principally, from capital market borrowings. The Group

designates these as fair value hedges of interest rate risk with changes in fair value

of the hedging instrument recognised in the income statement for the period

together with the changes in the fair value of the hedged item due to the hedged

risk, to the extent the hedge is effective. The ineffective portion is recognised

immediately in the income statement.

Net investment hedges

Exchange differences arising from the translation of the net investment in foreign

operations are recognised directly in equity. Gains and losses on those hedging

instruments (which include bonds, commercial paper and foreign exchange

contracts) designated as hedges of the net investments in foreign operations

are recognised in equity to the extent that the hedging relationship is effective.

These amounts are included in exchange differences on translation of foreign

operations as stated in the statement of recognised income and expense.

Gains and losses relating to hedge ineffectiveness are recognised immediately

in the income statement for the period. Gains and losses accumulated in the

translation reserve are included in the income statement when the foreign

operation is disposed of. During the year ended 31 March 2006, the Group adopted

the Amendments to IAS 21, “The Effect of Changes in Foreign Exchange Rates”,

with effect from 1 April 2004, being the date of transition to IFRS for the Group.

Put option arrangements

The potential cash payments related to put options issued by the Group over the

equity of subsidiary companies are accounted for as financial liabilities when such

options may only be settled other than by exchange of a fixed amount of cash

or another financial asset for a fixed number of shares in the subsidiary.

•

•

The amount that may become payable under the option on exercise is initially

recognised at fair value within borrowings with a corresponding charge directly to

equity. The charge to equity is recognised separately as written put options over

minority interests, adjacent to minority interests in the net assets of consolidated

subsidiaries. The Group recognises the cost of writing such put options, determined

as the excess of the fair value of the option over any consideration received,

as a financing cost.

Such options are subsequently measured at amortised cost, using the effective

interest rate method, in order to accrete the liability up to the amount payable

under the option at the date at which it first becomes exercisable. The charge

arising is recorded as a financing cost. In the event that the option expires

unexercised, the liability is derecognised with a corresponding adjustment

to equity.

Provisions

Provisions are recognised when the Group has a present obligation as a result

of a past event and it is probable that the Group will be required to settle

that obligation. Provisions are measured at the directors’ best estimate of the

expenditure required to settle the obligation at the balance sheet date and

are discounted to present value where the effect is material.

Share-based payments

The Group issues equity-settled share-based payments to certain employees.

Equity-settled share-based payments are measured at fair value (excluding the

effect of non market-based vesting conditions) at the date of grant. The fair

value determined at the grant date of the equity-settled share-based payments

is expensed on a straight-line basis over the vesting period, based on the Group’s

estimate of the shares that will eventually vest and adjusted for the effect of non

market-based vesting conditions.

Fair value is measured using a binomial pricing model, being a lattice-based

option valuation model, which is calibrated using a Black-Scholes framework.

The expected life used in the model has been adjusted, based on management’s

best estimate, for the effects of non-transferability, exercise restrictions and

behavioural considerations.

The Group uses historical data to estimate option exercise and employee

termination within the valuation model; separate groups of employees that

have similar historical exercise behaviour are considered separately for valuation

purposes. The expected life of options granted is derived from the output of

the option valuation model and represents the period of time that options are

expected to be outstanding. Expected volatilities are based on implied volatilities

as determined by a simple average of no less than three international banks,

excluding the highest and lowest numbers. The risk-free rates for periods within

the contractual life of the option are based on the UK gilt yield curve in effect

at the time of grant.

Some share awards have an attached market condition, based on Total

Shareholder Return (“TSR”), which is taken into account when calculating the

fair value of the share awards. The valuation for the TSR is based on Vodafone’s

ranking within the same group of companies, where possible, over the past five

years. The volatility of the ranking over a three year period is used to determine

the probable weighted percentage number of shares that could be expected

to vest and hence affect fair value.

The fair value of awards of non-vested shares to the Board of directors and

Executive Committee is equal to the closing price of the Vodafone’s shares on

the date of grant, as these awards are entitled to dividend equivalents during the

vesting period. Awards of non-vested shares to other employees are not entitled

to dividends during the vesting period and the fair value reflects a discount to the

closing share price of Vodafone’s shares on the date of grant equal to the present

value of expected dividends to be received over the vesting period.

Vodafone Group Plc Annual Report 2008 95