Vodafone 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

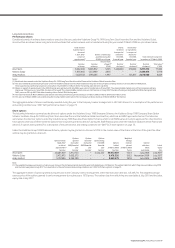

All-employee share incentive schemes

The executive directors are also eligible to participate in the all-employee plans.

Plan Summary of arrangement

Global All-Employee Share Plan The Remuneration Committee approved

a grant of 320 shares to be made on

2 July 2007 to all permanent employees.

The shares awarded vest after two years.

Sharesave The Vodafone Group 1998 Sharesave

Scheme is an HMRC approved scheme

open to all UK eligible employees.

Options under the scheme are granted at

up to a 20% discount to market value.

Executive directors’ participation is included

in the option tables on pages 79 and 80.

Share Incentive Plan The Vodafone Share Incentive Plan is

an HMRC approved plan open to all

eligible UK employees. Participants may

contribute up to £125 per month, which

the trustee of the plan uses to buy shares

on their behalf. An equivalent number of

shares are purchased with contributions

from the employing company. UK based

executive directors are eligible to participate.

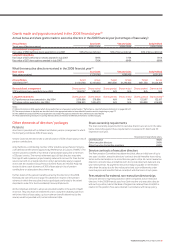

Non-executive directors’ remuneration

The remuneration of non-executive directors is annually reviewed by the Board,

excluding the non-executive directors. The fees payable are as follows:

Fees payable (£’000s)

From From

Position/role 1 April 2007 1 April 2008

Chairman 525 560

Deputy Chairman 145 155

Non-executive director 105 110

Chairmanship of Audit Committee 25 25

Chairmanship of Remuneration Committee 20 20

Chairmanship of Nominations and Governance Committee 15 15

In addition, an allowance of £6,000 is payable each time a non-Europe based non-

executive director is required to travel to attend Board and committee meetings,

to reflect the additional time commitment involved.

Details of each non-executive director’s remuneration for the 2008 financial year

are included in the table on page 77.

Non-executive directors do not participate in any incentive or benefit plans.

The Company does not provide any contribution to their pension arrangements.

The Chairman is entitled to use of a car and a driver whenever and wherever

he is providing his services to or representing the Company.

Chairman and non-executive directors service contracts

The Chairman, Sir John Bond, has a contract, that may be terminated by either

party on one year’s notice.

Non-executive directors, including the Deputy Chairman, are engaged on letters

of appointment that set out their duties and responsibilities. The appointment

of non-executive directors may be terminated without compensation.

The terms and conditions of appointment of non-executive directors are available

for inspection by any person at the Company’s registered office during normal

business hours and at the AGM (for 15 minutes prior to the meeting and during

the meeting).

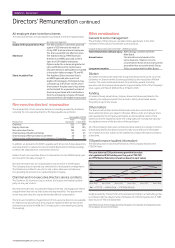

Other considerations

Cascade to senior management

The principles of the policy are cascaded, where appropriate, to the other

members of the Executive Committee as set out below.

Cascade of policy to Executive Committee – 2009 financial year

Total remuneration and base salary Methodology consistent with the

Main Board.

Annual bonus The annual bonus is based on the

same measures. However, in some

circumstances these are across a business

area rather than across the whole Group.

Long term incentive Policy consistent with the Main Board.

Dilution

All awards are made under plans that incorporate dilution limits as set out in the

Guidelines for Share Incentive Schemes published by the Association of British

Insurers. The current estimated dilution from subsisting awards, including

executive and all-employee share awards, is approximately 3.0% of the Company’s

share capital at 31 March 2008 (2.9% at 31 March 2007).

Funding

A mixture of newly issued shares, treasury shares and shares purchased in the

market by the employee benefit trust is used to satisfy share-based awards.

This policy is kept under review.

Other matters

The Share Incentive Plan and the DSB include restrictions on the transfer of

shares while the shares are subject to the plan. Where, under an employee share

plan operated by the Company, participants are the beneficial owners of the

shares, but not the registered owner, the voting rights are normally exercised by

the registered owner at the discretion of the participant.

All of the Company’s share plans contain provisions relating to a change of control.

Outstanding awards and options would normally vest and become exercisable

on a change of control, subject to the satisfaction of any performance conditions

at that time.

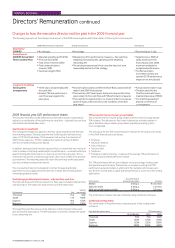

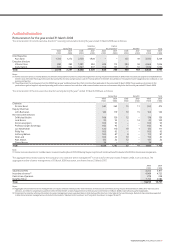

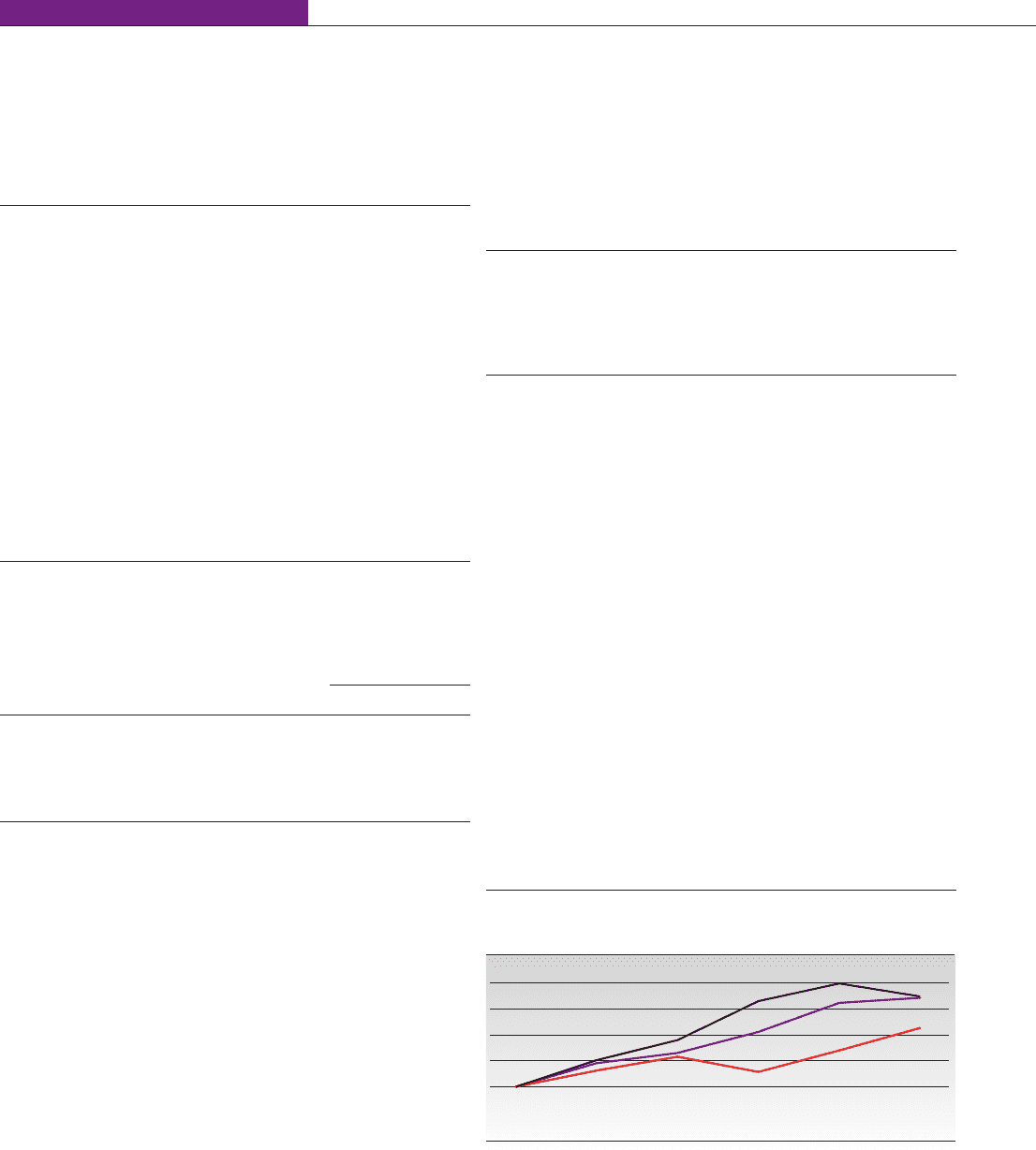

TSR performance (audited information)

The following chart shows the performance of the Company relative to the

FTSE100 index.

Graph provided by Towers Perrin and calculated according to a methodology that

is compliant with the requirements of Schedule 7A of the Companies Act of 1985

Data Sources: FTSE and Datastream.

Note: Performance of the Company shown by the graph is not indicative of vesting levels under

the Company’s various incentive plans.

Key: ― FTSE 100 ― Vodafone Group ― FTSE Global Telecoms

March 2008

March 2003

100

125

March 2004 March 2005 March 2006 March 2007

150

175

200

76 Vodafone Group Plc Annual Report 2008

Vodafone – Governance

Directors’ Remuneration continued

Five year historical TSR performance growth in the value

of a hypothetical £100 holding over five years. FTSE 100

and FTSE Global Telecoms comparison based on spot values