Vodafone 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

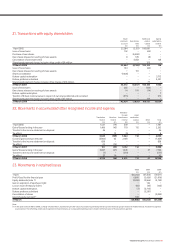

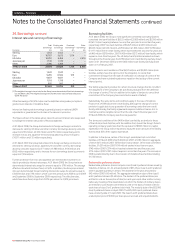

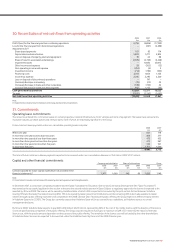

Pro forma full year information

The following unaudited pro forma summary presents the Group as if CGP and Tele2 had been acquired on 1 April 2007. The impact of other acquisitions on the

pro forma amounts disclosed below is not significant. The pro forma amounts include the results of CGP and Tele2, amortisation of the acquired intangible assets

recognised on acquisition and the interest expenses on debt issued as a result of the acquisitions. The pro forma amounts do not include any possible synergies from

these acquisitions. The pro forma information is provided for comparative purposes only and does not necessarily reflect the actual results that would have occurred,

nor is it necessarily indicative of future results of operations of the combined companies.

2008

£m

Revenue 35,931

Profit for the financial year 6,665

Profit attributable to equity shareholders 6,575

Pence per share

Basic earnings per share 12.40

Diluted earnings per share 12.34

Other

The Group completed a number of smaller acquisitions for aggregate cash consideration of £112 million, gross of £3 million cash and cash equivalents acquired in the

2008 financial year. £77 million of the net cash consideration was paid during the year. The aggregate fair values of goodwill, identifiable assets, and liabilities of the

acquired operations were £110 million, £29 million and £27 million, respectively.

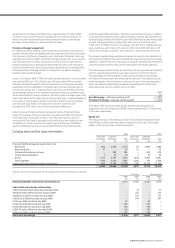

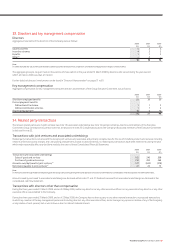

29. Disposals and discontinued operations

India – Bharti Airtel Limited

On 9 May 2007 and in conjunction with the acquisition of Vodafone Essar, the Group entered into a share sale and purchase agreement in which a Bharti group

company irrevocably agreed to purchase the Group’s 5.60% direct shareholding in Bharti Airtel Limited. During the year ended 31 March 2008, the Group received

£654 million in cash consideration for 4.99% of such shareholding and recognised a net gain on disposal of £250 million, reported in non-operating income and

expense. The Group’s remaining 0.61% direct shareholding was transferred in April 2008 for cash consideration of £87 million.

Japan – Vodafone K.K.

On 17 March 2006, the Group announced an agreement to sell its 97.7% holding in Vodafone K.K. to SoftBank. The transaction completed on 27 April 2006, with the

Group receiving cash of approximately ¥1.42 trillion (£6.9 billion), including the repayment of intercompany debt of ¥0.16 trillion (£0.8 billion). In addition, the Group

received non-cash consideration with a fair value of approximately ¥0.23 trillion (£1.1 billion), comprised of preferred equity and a subordinated loan. SoftBank also

assumed debt of approximately ¥0.13 trillion (£0.6 billion). Vodafone K.K. represented a separate geographical area of operation and, on this basis, Vodafone K.K.

was treated as a discontinued operation in Vodafone Group Plc’s annual report for the year ended 31 March 2006.

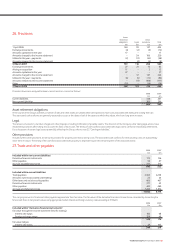

Income statement and segment analysis of discontinued operations

2007 2006

£m £m

Segment revenue 520 7,268

Inter-segment revenue – (2)

Net revenue 520 7,266

Operating expenses (402) (5,667)

Depreciation and amortisation(1) – (1,144)

Impairment loss – (4,900)

Operating profit/(loss) 118 (4,445)

Net financing costs 8 (3)

Profit/(loss) before taxation 126 (4,448)

Taxation relating to performance of discontinued operations (15) 7

Loss on disposal(2) (747) –

Taxation relating to the classification of the discontinued operations 145 (147)

Loss for the financial year from discontinued operations(3) (491) (4,588)

Notes:

(1) Including gains and losses on disposal of fixed assets.

(2) Includes £794 million of foreign exchange differences transferred to the income statement on disposal.

(3) Amount attributable to equity shareholders for the year to 31 March 2008 was nil (2007: £(494) million; 2006: £(4,598) million).

Loss per share from discontinued operations

2007 2006

Pence Pence

per share per share

Basic loss per share (0.90) (7.35)

Diluted loss per share (0.90) (7.35)

Vodafone Group Plc Annual Report 2008 125