Vodafone 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

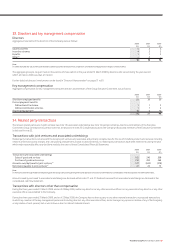

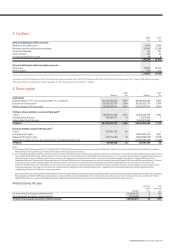

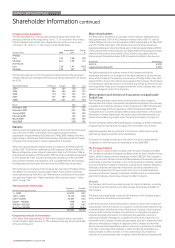

9. Equity dividends

2008 2007

£m £m

Declared during the financial year:

Final dividend for the year ended 31 March 2007: 4.41 pence per share (2006: 3.87 pence per share) 2,331 2,328

Interim dividend for the year ended 31 March 2008: 2.49 pence per share (2007: 2.35 pence per share) 1,322 1,238

3,653 3,566

Proposed after the balance sheet date and not recognised as a liability:

Final dividend for the year ended 31 March 2008: 5.02 pence per share

(2007: 4.41 pence per share) 2,667 2,331

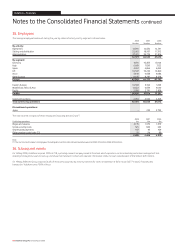

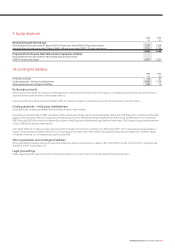

10. Contingent liabilities

2008 2007

£m £m

Performance bonds 30 87

Credit guarantees – third party indebtedness 4,208 1,278

Other guarantees and contingent liabilities 255 10

Performance bonds

Performance bonds require the Company to make payments to third parties in the event that the Company or its subsidiary undertakings do not perform what is

expected of them under the terms of any related contracts.

Company performance bonds include £26 million (2007: £57 million) in respect of undertakings to roll out third generation networks in Spain.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities.

During the year ended 31 March 2008, a subsidiary of the Company granted put options exercisable between 8 May 2010 and 8 May 2011 to members of the Essar

group of companies that, if exercised, would allow the Essar group to sell its 33% shareholding in Vodafone Essar to the Group for US$5 billion or to sell between

US$1 billion and US$5 billion worth of Vodafone Essar shares to the Group at an independently appraised fair market value. The Company has guaranteed payment

of up to US$5 billion related to these options.

At 31 March 2008, the Company had also guaranteed debt of Vodafone Finance K.K. amounting to £1,303 million (2007: £1,117 million) and issued guarantees in

respect of notes issued by Vodafone Americas, Inc. amounting to £163 million (2007: £161 million). The Japanese facility expires by March 2011 and the majority

of Vodafone Americas, Inc. bond guarantees expire by July 2008.

Other guarantees and contingent liabilities

Other guarantees principally comprise of a guarantee relating to a bid for a second licence in Qatar of £57 million (2007: nil) and a commitment to the Spanish tax

authorities of £197 million (2007: nil).

Legal proceedings

Details regarding certain legal actions which involve the Company are set out in note 32 to the Consolidated Financial Statements.

Vodafone Group Plc Annual Report 2008 139