Vodafone 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

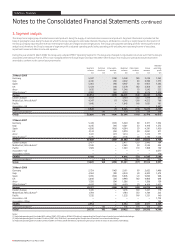

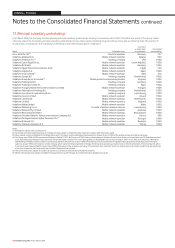

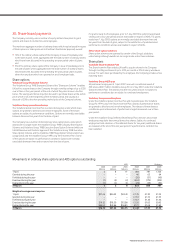

10. Impairment continued

Sensitivity to changes in assumptions

Other than as disclosed below, management believes that no reasonably possible change in any of the above key assumptions would cause the carrying value of any

cash generating unit to exceed its recoverable amount.

31 March 2008

As of 31 January 2008, the date of the Group’s annual impairment test, the estimated recoverable amount of the Group’s operations in Germany and Italy exceeded

their carrying value by £2,700 million and £3,400 million respectively. The table below shows the key assumptions used in the value in use calculation and the amount

by which each key assumption must change in isolation in order for the estimated recoverable amount to be equal to its carrying value in both cases.

Assumptions used in value in Change required for carrying value

use calculation to equal the recoverable amount

Germany Italy Germany Italy

% % Percentage points Percentage points

Pre-tax adjusted discount rate 10.2 11.5 1.6 2.7

Long term growth rate 1.2 0.1 (1.7) (3.0)

Budgeted EBITDA(1)

(2.2) 1.4 (2.0) (4.2)

Budgeted capital expenditure(2) 7.5 to 8.7 5.8 to 9.5 4.2 6.6

Notes:

(1) Budgeted EBITDA is expressed as the compound annual growth rates in the initial five years of the Group’s approved management plans.

(2) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial five years of the Group’s approved management plans.

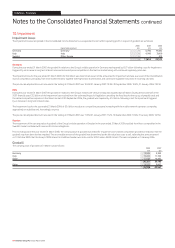

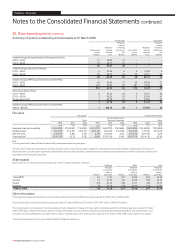

31 March 2007

Germany

The estimated recoverable amount of the Group’s operations in Germany equalled its carrying value and, consequently, any adverse change in a key assumption could

have caused a further impairment loss to be recognised.

The last value in use calculation during the year ended 31 March 2007 was based on the following assumptions:

Pre-tax risk adjusted discount rate of 10.6%;

Long term growth rate of 1.2%;

Budgeted EBITDA, expressed as the compound annual growth rates in the initial five years of the Group’s approved management plans, of (4.2)%; and

Budgeted capital expenditure, expressed as the range of capital expenditure as a percentage of revenue in the initial five years of the Group’s approved management

plans, of 7.5-7.0%.

Italy

The estimated recoverable amount of the Group’s operations in Italy equalled its carrying value and, consequently, any adverse change in a key assumption could have

caused a further impairment loss to be recognised.

The last value in use calculation during the year ended 31 March 2007 was based on the following assumptions:

Pre-tax risk adjusted discount rate of 11.5%;

Long term growth rate of 1.0%;

Budgeted EBITDA, expressed as the compound annual growth rates in the initial five years of the Group’s approved management plans, of (3.8)%; and

Budgeted capital expenditure, expressed as the range of capital expenditure as a percentage of revenue in the initial five years of the Group’s approved management

plans, of 11.4-8.7%.

•

•

•

•

•

•

•

•

106 Vodafone Group Plc Annual Report 2008

Notes to the Consolidated Financial Statements continued

Vodafone – Financials