Vodafone 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

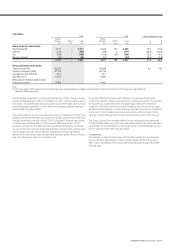

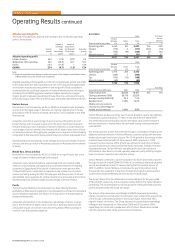

Mobile telecommunications KPIs

2007 2006

Eastern Middle East, Eastern Middle East,

Europe Africa & Asia Pacific EMAPA Europe Africa & Asia Pacific EMAPA

Closing customers (’000) 28,975 27,160 5,750 61,885 12,579 21,884 5,346 39,809

Closing 3G devices (’000) 347 65 758 1,170 135 − 281 416

Voice usage (millions of minutes) 39,658 37,449 11,371 88,478 13,302 18,300 9,811 41,413

See page 155 for definition of terms

A part of Vodafone’s strategy is to build on the Group’s track record of creating

value in emerging markets. Vodafone continued to execute on this strategy, with

strong performances in the Czech Republic, Egypt, Romania and South Africa.

The Group continued to successfully build its emerging markets portfolio through

acquisitions in Turkey and, subsequent to 31 March 2007, India. Since its acquisition

on 24 May 2006, Vodafone Turkey has shown a performance in excess of the

acquisition plan.

In December 2006, the Group increased its equity interest in Vodafone Egypt

from 50.1% to 54.9%, positioning the Group to capture further growth in this

lower penetrated market. The Group also entered into a new strategic partnership

with Telecom Egypt, the minority shareholder in Vodafone Egypt, to increase

cooperation between both parties and jointly develop a range of products and

services for the Egyptian market.

EMAPA’s growth has benefited from the 2006 financial year acquisitions in the

Czech Republic and the stake in Bharti Airtel in India, as well as the stake increases

in Romania and South Africa and the 2007 financial year acquisition in Turkey.

Bharti Airtel was accounted for as a joint venture until 11 February 2007, following

which the Group’s interest has been accounted for as an investment.

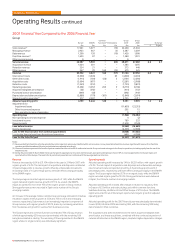

Revenue

Revenue increased by 41.4%, or 21.1% on an organic basis, driven by organic

service revenue growth of 20.4%. The impact of acquisitions, disposal and

exchange rates on service revenue and revenue growth is shown below.

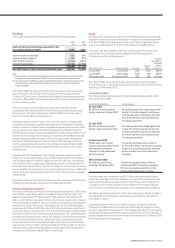

Impact of Impact of

exchange acquisitions

Organic rates and disposal(1) Reported

growth Percentage Percentage growth

% points points %

Service revenue

Eastern Europe 20.0 (5.6) 61.7 76.1

Middle East, Africa and Asia 27.7 (17.7) 33.5 43.5

Pacific 10.0 (7.3) − 2.7

EMAPA 20.4 (10.9) 32.8 42.3

Revenue − EMAPA 21.1 (11.2) 31.5 41.4

Note:

(1) Impact of acquisitions and disposal includes the impact of the change in consolidation status

of Bharti Airtel from a joint venture to an investment.

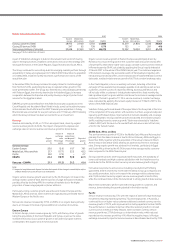

Organic service revenue growth was driven by the 30.2% organic increase in the

average mobile customer base and the success of usage stimulation initiatives,

partially offset by declining ARPU in a number of markets due to the higher

proportion of lower usage prepaid customer additions.

Particularly strong customer growth was achieved in Eastern Europe and the

Middle East, Africa and Asia, where markets are typically less penetrated than in

Western Europe or the Pacific area.

Non-service revenue increased by 31.5%, or 28.9% on an organic basis, primarily

due to an increase in the level of gross additions in a number of countries.

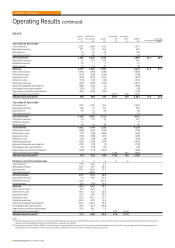

Eastern Europe

In Eastern Europe, service revenue grew by 76.1%, with the key driver of growth

being the acquisitions in the Czech Republic and Turkey, as well as the stake

increase in Romania. Good customer growth in all Eastern European markets

contributed to the organic service revenue growth.

Organic service revenue growth in Eastern Europe was principally driven by

Romania. As a result of the growth in the customer base and a promotional offer

of lower tariffs, which led to higher voice usage, constant currency service revenue

in Romania grew by 29.4%, calculated by applying the Group’s equity interest at

31 March 2007 to the whole of the 2006 financial year. The continued expansion

of 3G network coverage, the successful launch of 3G broadband, together with

introductory promotional offers, and increased sales of Vodafone Mobile Connect

data cards, resulted in data revenue growth of 66.7% at constant exchange rates.

In the Czech Republic, a focus on existing customers, including a Christmas

campaign of free weekend text messages available to all existing as well as new

customers, and the success of a business offering allowing unlimited on and

off net calls within a customers’ virtual private network for a fixed monthly fee,

had a positive impact on gross additions and drove the increase in average mobile

customers. This led to growth of 11.1% in service revenue at constant exchange

rates, calculated by applying the Group’s equity interest at 31 March 2007 to the

whole of the 2006 financial year.

Vodafone Turkey performed ahead of the expectations the Group had at the time

of the completion of the acquisition, with customer numbers, usage and adjusted

operating profit ahead of plan. Improvements in network reliability and coverage

have contributed to strong customer growth and allowed an increase in prepaid

tariffs, resulting in service revenue growth. Telsim was rebranded to Vodafone

in March 2007, with the launch of a new tariff with inclusive on and off net calls,

a first for the Turkish market.

Middle East, Africa and Asia

The service revenue growth of 43.5% in the Middle East, Africa and Asia resulted

primarily from the stake increases in South Africa in February 2006 and Egypt in

December 2006, together with the acquisition of the Group’s interest in Bharti

Airtel in India in December 2005, offset by an adverse movement in exchange

rates. Strong organic growth was achieved in all markets, particularly in Egypt

and South Africa, driven by the 40.2% increase in the average mobile customer

base compared to the 2006 financial year.

Strong customer growth, driven by prepaid tariff reductions, the availability of

lower cost handsets and high customer satisfaction with the Vodafone service,

contributed to the 39.5% constant currency service revenue growth in Egypt.

Innovative new products and services, including a new hybrid tariff offering

guaranteed airtime credit every month with the ability to top up as required, and

successful promotions, led to an increase in the average mobile customer base

and 21.6% constant currency organic service revenue growth in South Africa,

while the continued rollout of the 3G network led to strong growth in data revenue.

Bharti Airtel continued to perform well with strong growth in customers and

revenue, demonstrating the growth potential in the Indian market.

Pacific

Service revenue increased by 2.7%, with the impact of adverse foreign exchange

movements reducing reported growth by 7.3 percentage points. In Australia, a

continued focus on higher value customers delivered constant currency service

revenue growth of 13.7%, with improvements in both prepaid and contract ARPU.

The performance in Australia more than offset the reduced growth in constant

currency service revenue in New Zealand, where constant currency service

revenue growth was 2.7% following a cut in termination rates, which reduced

reported service revenue growth by 4.1%. After the negative impact of foreign

exchange movements, reported service revenue in New Zealand declined by 7.9%.

Vodafone Group Plc Annual Report 2008 49