Vodafone 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

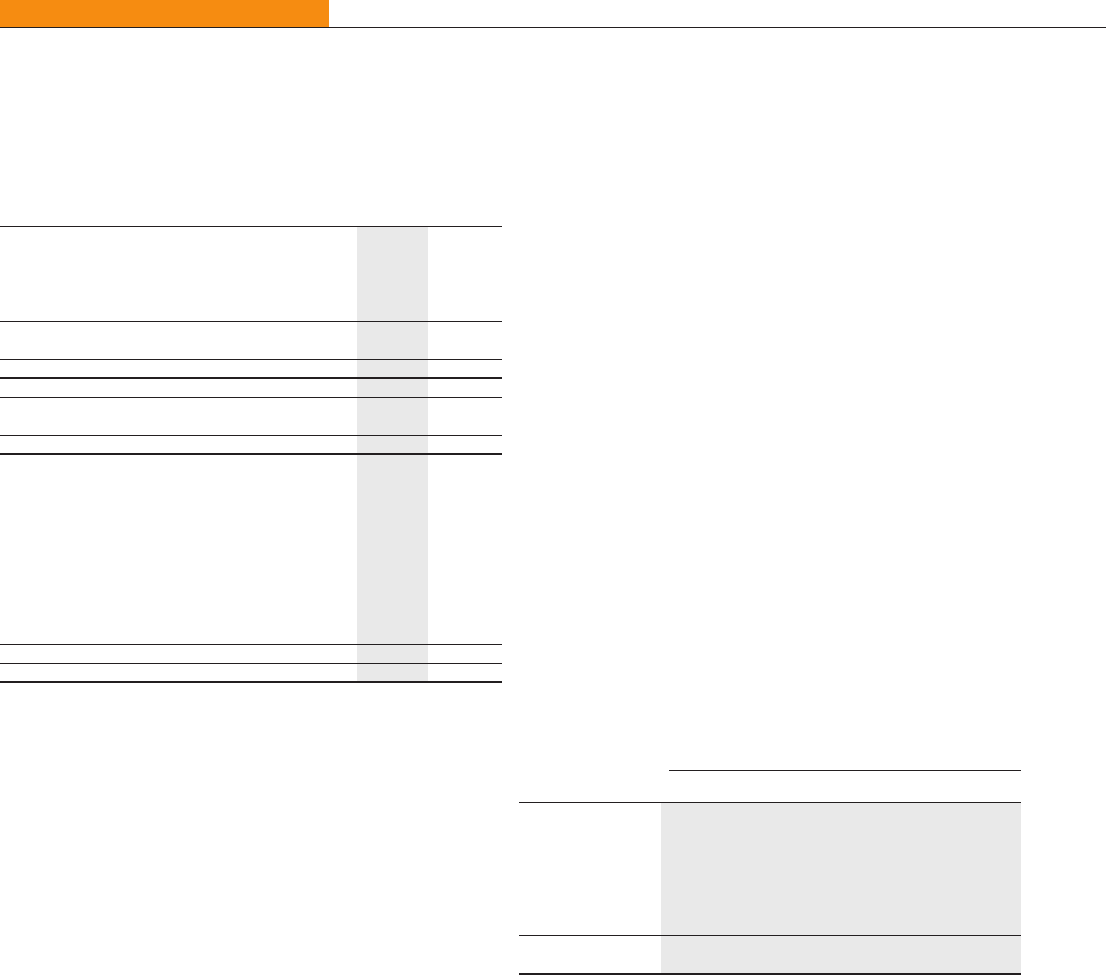

Financial Position and Resources

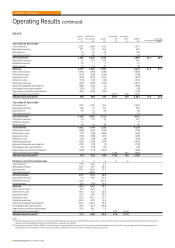

Consolidated Balance Sheet

2008 2007

£m £m

Non-current assets

Intangible assets 70,331 56,272

Property, plant and equipment 16,735 13,444

Investments in associated undertakings 22,545 20,227

Other non-current assets 8,935 6,861

118,546 96,804

Current assets 8,724 12,813

Total assets 127,270 109,617

Total equity shareholders funds 78,043 67,067

Total minority interests (1,572) 226

Total equity 76,471 67,293

Liabilities

Borrowings

Long term 22,662 17,798

Short term 4,532 4,817

Taxation liabilities

Deferred tax liabilities 5,109 4,626

Current taxation liabilities 5,123 5,088

Other non-current liabilities 1,055 954

Other current liabilities(2) 12,318 9,041

50,799 42,324

Total equity and liabilities 127,270 109,617

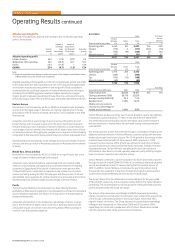

Non-current assets

Intangible assets

At 31 March 2008, the Group’s intangible assets were £70.3 billion, with goodwill

comprising the largest element at £51.3 billion (2007: £40.6 billion). The increase

in intangible assets was primarily as a result of £7.9 billion of favourable exchange

rate movements and £7.6 billion arising on the acquisitions of Vodafone Essar

and Tele2, partially offset by amortisation of £2.5 billion. Refer to note 28

to the Consolidated Financial Statements for further information on the

business acquisitions.

Property, plant and equipment

Property, plant and equipment increased from £13.4 billion at 31 March 2007 to

£16.7 billion at 31 March 2008, predominantly as a result of £4.1 billion of additions,

a £1.2 billion increase due to acquisitions during the year and £1.6 billion of

favourable foreign exchange movements, which more than offset the £3.4 billion

of depreciation charges and £0.1 billion reduction due to disposals.

Investments in associated undertakings

The Group’s investments in associated undertakings increased from £20.2 billion

at 31 March 2007 to £22.5 billion at 31 March 2008, as a result of a £2.9 billion

increase from the Group’s share of the results of its associates, after the

deductions of interest, tax and minority interest, mainly arising from the Group’s

investment in Verizon Wireless and favourable foreign exchange movements of

£0.3 billion, partially offset by £0.9 billion of dividends received.

Other non-current assets

Other non-current assets mainly relates to other investments held by the Group,

which totalled £7.4 billion at 31 March 2008 compared to £5.9 billion at 31 March

2007. The movement primarily represents an increase of £1.8 billion in the

investment in China Mobile as a result of the increase in the listed share price,

partially offset by the disposal of the Group’s 5.60% stake in Bharti Airtel.

Current assets

Current assets decreased to £8.7 billion at 31 March 2008 from £12.8 billion

at 31 March 2007, mainly as a result of decreased cash holdings following the

completion of the Vodafone Essar acquisition.

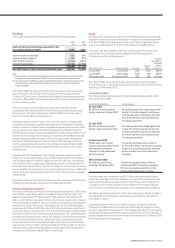

Total equity shareholders’ funds

Total equity shareholders’ funds increased from £67.1 billion at 31 March 2007 to

£78.0 billion at 31 March 2008. The increase comprises primarily of the profit for

the year of £6.8 billion less equity dividends of £3.7 billion, a £5.8 billion benefit

from the impact of favourable exchange rate movements and the unrealised

holding gains on other investments discussed above.

Borrowings

Long term borrowings and short term borrowings increased to £27.2 billion at

31 March 2008 from £22.6 billion at 31 March 2007, mainly as a result of foreign

exchange movements and written put option liabilities assumed on the

completion of the Vodafone Essar acquisition.

Taxation liabilities

The deferred tax liability increased from £4.6 billion at 31 March 2007 to

£5.1 billion at 31 March 2008, which arose mainly from £0.5 billion in relation to

the acquisition of Vodafone Essar.

Other current liabilities

The increase in other current liabilities from £9.0 billion to £12.3 billion is primarily

to due foreign exchange differences arising on translation and other current

liabilities in the newly acquired Vodafone Essar.

Contractual obligations

A summary of the Group’s principal contractual financial obligations is shown below.

Further details on the items included can be found in the notes to the Consolidated

Financial Statements.

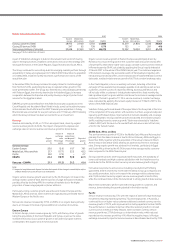

Payments due by period £m

1-3 3-5

Contractual obligations(1) Total <1year years years >5 years

Borrowings(2) 34,537 5,492 10,150 4,728 14,167

Operating lease

commitments(3) 4,441 837 1,081 771 1,752

Capital

commitments(3)(4) 1,620 1,262 213 84 61

Purchase

commitments 2,347 1,548 439 283 77

Total contractual

cash obligations(1) 42,945 9,139 11,883 5,866 16,057

Notes:

(1) The above table of contractual obligations excludes commitments in respect of options over

interests in Group businesses held by minority shareholders (see “Option agreements and

similar arrangements”) and obligations to pay dividends to minority shareholders (see

“Dividends from associated undertakings and to minority shareholders”). The table excludes

current and deferred tax liabilities and obligations under post employment benefit schemes,

details of which are provided in notes 6 and 25 to the Consolidated Financial Statements,

respectively.

(2) See note 24 to the Consolidated Financial Statements.

(3) See note 31 to the Consolidated Financial Statements.

(4) Primarily related to network infrastructure.

Contingencies

Details of the Group’s contingent liabilities are included in note 32 to the

Consolidated Financial Statements.

54 Vodafone Group Plc Annual Report 2008

Vodafone – Performance