Vodafone 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone offers voice, messaging, data and fixed broadband services through multiple solutions and

supporting technologies to deliver on its total communications strategy. The advancements in 3G

networks and download speeds, handset capabilities and the mobilisation of internet services, have

contributed to an acceleration of data services usage growth.

Products and Services

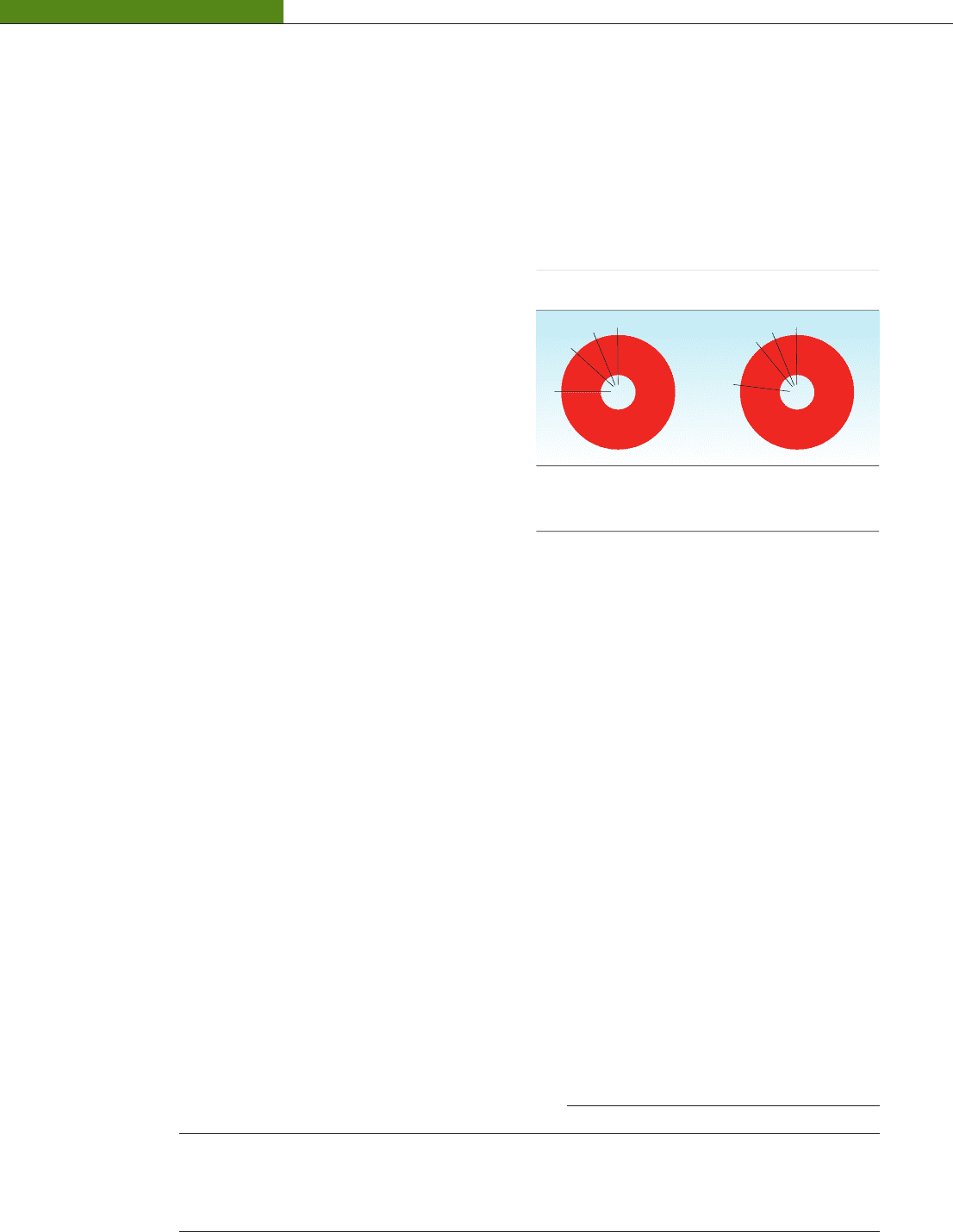

Group service revenue is still predominantly generated by voice

services, though these services as a percentage of revenue are

slowly declining as price competition and regulatory pressures

increase in many markets and the contribution of data grows.

At the forefront of the Group’s total communications strategy are

initiatives targeted at providing propositions to customers that

replace traditional fixed line providers, as well as developing

new and innovative ways for customers to enjoy the benefits

of mobility, with the aim to increase the proportion of Group

service revenue that is generated by data and fixed line services.

So that customers can utilise the services that Vodafone offers,

many different tariffs and propositions are available, targeted

at different customer segments and adapted for any localised

customer preferences and needs. These propositions often

bundle together voice, data, messaging and, increasingly,

fixed services so that customers can experience all the different

services that Vodafone has to offer. Typically, customers are

classified either as prepay or contract customers. Prepay

customers pay in advance and are generally not bound to

minimum contractual commitments, while contract customers

usually sign up for a predetermined length of time and are

invoiced for their services, typically on a monthly basis.

As different tariffs and propositions are launched, the Group is

increasingly leveraging the positive experiences in one market to

provide initiatives across the Group. Offers with strong customer

appeal and commercial benefit are being quickly adapted and

rolled out to other markets. An example includes a range of

“Out of Credit” solutions for prepay customers, through which

Vodafone provides temporary credit to a customer which is

then repaid when the customer next tops-up. Reverse charging

capabilities have also been introduced across most markets.

These facilities are very popular with prepay customers and

have been launched in most European markets.

The experience gained in the Group’s more mature markets is

also being used to develop more sophisticated offers across the

emerging markets, many of which have a very high percentage

of prepay customers, and Vodafone is leveraging established

bonus and reward prepay pricing mechanisms, which incentivise

higher usage and spend at an individual customer level.

The Group is also growing usage and account penetration in the

business segment. Vodafone Global Enterprise (“VGE”) provides

over 140 of Vodafone’s largest multinational customers with

consistent levels of service, support and commercial terms

worldwide, by taking specific responsibility for managing these

multinational customers.

Over the last year, VGE launched a number of new products

and services, including, in July 2007, the launch of Vodafone

Applications Service, a service hosted by Vodafone and available

in ten countries, enabling companies to mobilise applications

such as SAP®, Siebel and Salesforce.com to a choice of mobile

devices. VGE has also developed a globally consistent pricing

structure for global business customers and has launched a

new voice roaming tariff that can be used for both domestic and

international voice usage that is available across five European

markets. A data roaming package has also been developed

that is simple, predictable, capped and available across ten

European markets.

Having traditionally been a key player in the provision of

corporate and small and medium enterprises (“SME”) voice

solutions in many markets, Vodafone is increasingly offering

tailored and innovative solutions for small business and

professional business customers. Many of these offers use the

capabilities already developed for larger companies and provide

benefits such as virtual private network services and Vodafone

Wireless Office solutions to much smaller entities.

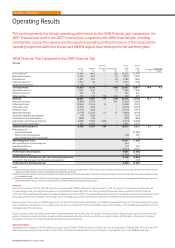

Summary of Group products and services at 31 March 2008

Number of markets available

Partner Number of

Europe EMAPA markets customers(1)

Vodafone at Home 8 3 – 4.4 million

Vodafone Wireless Office 9 5 – 3.0 million

Vodafone Passport 11 3 3 17.5 million

Vodafone live! – Internet on your mobile 9 – – 2.0 million

Vodafone Mobile Connect data card or

Vodafone Mobile Connect USB modem 11 8 25 2.7 million

Note:

(1) Customers are presented on a controlled (fully consolidated) and jointly controlled (proportionately consolidated) basis in accordance with the Group’s

current segments.

24 Vodafone Group Plc Annual Report 2008

Vodafone – Business

Vodafone – Business

Analysis of Group service revenue

(%)

20072008

1

2

34

1

2

34

1 Voice – 77%

2 Messaging – 12%

3 Data – 5%

4 Fixed line – 6%

1 Voice – 75%

2 Messaging – 12%

3 Data – 7%

4 Fixed line – 6%