Vodafone 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

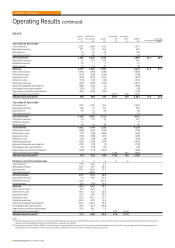

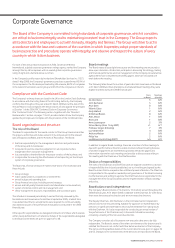

Equity dividends

The table below sets out the amounts of interim, final and total cash dividends

paid or, in the case of the final dividend for the 2008 financial year, proposed,

in respect of each financial year, indicated in pence per ordinary share.

Pence per ordinary share

Year ended 31 March Interim Final Total

2004 0.9535 1.0780 2.0315

2005 1.91 2.16 4.07

2006 2.20 3.87 6.07

2007 2.35 4.41 6.76

2008 2.49 5.02(1) 7.51

Note:

(1) The final dividend for the year ended 31 March 2008 was proposed on 27 May 2008 and is

payable on 1 August 2008 to holders of record as of 6 June 2008. For American Depositary

Share (“ADS”) holders, the dividend will be payable in US dollars under the terms of the ADS

depositary agreement.

The Company has historically paid dividends semi-annually, with a regular interim

dividend in respect of the first six months of the financial year payable in February

and a final dividend payable in August. The Board expects that the Company

will continue to pay dividends semi-annually. In November 2007, the directors

announced an interim dividend of 2.49 pence per share, representing a 6.0%

increase over last year’s interim dividend.

In considering the level of dividends, the Board takes account of the outlook

for earnings growth, operating cash flow generation, capital expenditure

requirements, acquisitions and divestments, together with the amount of debt

and share purchases.

The Board remains committed to its existing policy of distributing 60% of adjusted

earnings per share by way of dividend. The Group targets a low single A rating in

line with the policy established by the Board in 2006. The Group has no current

plans for share purchases or one-time returns.

Accordingly, the directors announced a proposed final dividend of 5.02 pence per

share, representing a 13.8% increase on last year’s final dividend.

Cash dividends, if any, will be paid by the Company in respect of ordinary shares

in pounds sterling or, to holders of ordinary shares with a registered address in

a country which has adopted the euro as its national currency, in euro, unless

shareholders wish to elect to continue to receive dividends in sterling, are

participating in the Company’s Dividend Reinvestment Plan, or have mandated

their dividend payment to be paid directly into a bank or building society account

in the UK. In accordance with the Company’s Articles of Association, the sterling:

euro exchange rate will be determined by the Company shortly before the

payment date.

The Company will pay the ADS Depositary, The Bank of New York, its dividend

in US dollars. The sterling: US dollar exchange rate for this purpose will be

determined by the Company up to ten New York and London business days prior

to the payment date. Cash dividends to ADS holders will be paid by the ADS

Depositary in US dollars.

Liquidity and capital resources

The major sources of Group liquidity for the 2008 and 2007 financial years

were cash generated from operations, dividends from associated undertakings,

borrowings through short term and long term issuances in the capital markets

and, particularly in the 2007 financial year, investment and business disposals.

The Group does not use off-balance sheet special purpose entities as a source

of liquidity or for other financing purposes.

The Group’s key sources of liquidity for the foreseeable future are likely to be

cash generated from operations and borrowings through long term and short

term issuances in the capital markets, as well as committed bank facilities.

The Group’s liquidity and working capital may be affected by a material decrease

in cash flow due to factors such as reduced operating cash flow resulting from

further possible business disposals, increased competition, litigation, timing of

tax payments and the resolution of outstanding tax issues, regulatory rulings,

delays in the development of new services and networks, licences and spectrum

payments, inability to receive expected revenue from the introduction of new

services, reduced dividends from associates and investments or increased

dividend payments to minority shareholders. Please see the section titled

“Principal Risk Factors and Uncertainties”, on pages 52 and 53. In particular,

the Group continues to anticipate significant cash tax payments and associated

interest payments due to the resolution of long standing tax issues.

The Group is also party to a number of agreements that may result in a cash

outflow in future periods. These agreements are discussed further in “Option

agreements and similar arrangements” at the end of this section.

Wherever possible, surplus funds in the Group (except in Egypt and India) are

transferred to the centralised treasury department through repayment of

borrowings, deposits, investments, share purchases and dividends. These are then

on-lent or contributed as equity to fund Group operations, used to retire external

debt or invested externally.

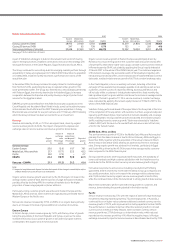

Cash flows

During the 2008 financial year, the Group increased its net cash inflow from

operating activities by 1.4% to £10,474 million. The Group generated £5,540

million of free cash flow from continuing operations, a reduction of 9.6% on the

2007 financial year, primarily as a result of higher payments for taxation and

interest and an increase in capital expenditure.

2008 2007

£m £m

Net cash flows from operating activities 10,474 10,328

Discontinued operations – 135

Continuing operations 10,474 10,193

Taxation 2,815 2,243

Purchase of intangible fixed assets (846) (899)

Purchase of property, plant and equipment (3,852) (3,633)

Disposal of property, plant and equipment 39 34

Operating free cash flow 8,630 8,073

Discontinued operations – (8)

Continuing operations 8,630 8,081

Taxation (2,815) (2,243)

Dividends from associated undertakings 873 791

Dividends paid to minority shareholders

in subsidiary undertakings (113) (34)

Dividends from investments 72 57

Interest received 438 526

Interest paid (1,545) (1,051)

Free cash flow 5,540 6,119

Discontinued operations – (8)

Continuing operations 5,540 6,127

Net cash (outflow)/inflow from acquisitions and disposals (5,957) 7,081

Other cash flows from investing activities 689 (92)

Equity dividends paid (3,658) (3,555)

Other cash flows from financing activities (2,549) (4,712)

Net cash flows in the year (5,935) 4,841

Dividends from associated undertakings and to minority shareholders

Dividends from the Group’s associated undertakings are generally paid at the

discretion of the Board of directors or shareholders of the individual operating and

holding companies and Vodafone has no rights to receive dividends, except where

specified within certain of the companies’ shareholders’ agreements, such as

with SFR, the Group’s associated undertaking in France. Similarly, the Group does

not have existing obligations under shareholders’ agreements to pay dividends

to minority interest partners of Group subsidiaries or joint ventures, except as

specified overleaf.

Vodafone Group Plc Annual Report 2008 55