Vodafone 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

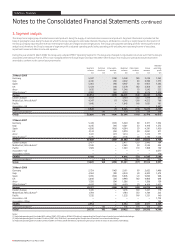

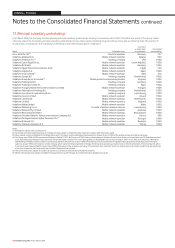

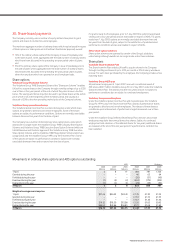

10. Impairment

Impairment losses

The impairment losses recognised in the Consolidated Income Statement, as a separate line item within operating profit, in respect of goodwill are as follows:

2008 2007 2006

Reportable segment £m £m £m

Germany Germany – 6,700 19,400

Italy Italy – 4,900 3,600

Sweden Other Europe – – 515

– 11,600 23,515

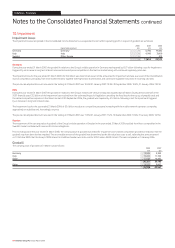

Germany

During the year ended 31 March 2007, the goodwill in relation to the Group’s mobile operation in Germany was impaired by £6.7 billion following a test for impairment

triggered by an increase in long term interest rates and increased price competition in the German market along with continued regulatory pressures.

The impairment loss for the year ended 31 March 2006 of £19.4 billion was determined as part of the annual test for impairment and was as a result of the intensification

in price competition, principally from new market entrants, together with high levels of penetration and continued regulated reductions in incoming call rates.

The pre-tax risk adjusted discount rate used in the testing at 31 March 2007 was 10.6% (31 January 2007: 10.5%, 30 September 2006: 10.4%, 31 January 2006: 10.1%).

Italy

During the year ended 31 March 2007, the goodwill in relation to the Group’s mobile joint venture in Italy was impaired by £4.9 billion. During the second half of the

2007 financial year, £3.5 billion of the impairment loss resulted from the estimated impact of legislation cancelling the fixed fees for the top up of prepaid cards and

the related competitive response in the Italian market. At 30 September 2006, the goodwill was impaired by £1.4 billion, following a test for impairment triggered

by an increase in long term interest rates.

The impairment loss for the year ended 31 March 2006 of £3.6 billion was due to competitive pressures increasing with the mobile network operators competing

aggressively on subsidies and, increasingly, on price.

The pre-tax risk adjusted discount rate used in the testing at 31 March 2007 was 11.5% (31 January 2007: 11.2%, 30 September 2006: 10.9%, 31 January 2006: 10.1%).

Sweden

The impairment of the carrying value of goodwill of the Group’s mobile operation in Sweden in the year ended 31 March 2006 resulted from fierce competition in the

Swedish market combined with onerous 3G licence obligations.

Prior to its disposal in the year ended 31 March 2006, the carrying value of goodwill was tested for impairment as increased competition provided an indicator that the

goodwill may have been further impaired. The recoverable amount of the goodwill was determined as the fair value less costs to sell, reflecting the announcement

on 31 October 2005 that the Group’s 100% interest in Vodafone Sweden was to be sold for €953 million (£653 million). The sale completed on 5 January 2006.

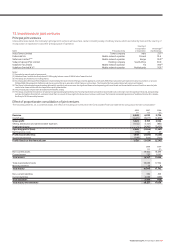

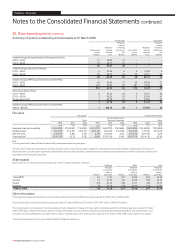

Goodwill

The carrying value of goodwill at 31 March was as follows:

2008 2007

£m £m

Germany 10,984 9,355

Italy 13,205 11,125

Spain 12,168 10,285

36,357 30,765

Other 14,979 9,802

51,336 40,567

104 Vodafone Group Plc Annual Report 2008

Notes to the Consolidated Financial Statements continued

Vodafone – Financials