Vodafone 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

would reduce or increase profit before tax by approximately £3 million (2007:

increase or reduce by £24 million), including mark-to-market revaluations of

interest rate and other derivatives and the potential interest on outstanding

tax issues. There would be no material impact on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange, its share price is

quoted in sterling. Since the sterling share price represents the value of its future

multi-currency cash flows, principally in euro, sterling and US dollars, the Group

maintains the currency of debt and interest charges in proportion to its expected

future principal multi-currency cash flows and has a policy to hedge external

foreign exchange risks on transactions denominated in other currencies above

certain de minimis levels. As the Group’s future cash flows are increasingly likely

to be derived from emerging markets, it is likely that more debt in emerging

market currencies will be drawn.

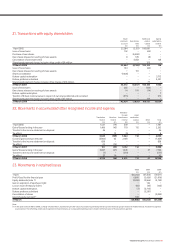

As such, at 31 March 2008, 119% of net debt was denominated in currencies other

than sterling (80% euro, 27% US dollar and 12% other), while 19% of net debt

had been purchased forward in sterling in anticipation of sterling denominated

shareholder returns via dividends. This allows euro, US dollar and other debt to

be serviced in proportion to expected future cash flows and, therefore, provides

a partial hedge against income statement translation exposure, as interest costs

will be denominated in foreign currencies. Yen debt is used as a hedge against the

value of yen assets as the Group has minimal yen cash flows. A relative weakening

in the value of sterling against certain currencies in which the Group maintains

cash and cash equivalents has resulted in an increase in cash and cash

equivalents of £129 million from currency translation differences.

Under the Group’s foreign exchange management policy, foreign exchange

transaction exposure in Group companies is generally maintained at the lower

of €5 million per currency per month or €15 million per currency over a six

month period. The Group is exposed to profit and loss account volatility on the

retranslation of certain investments received upon the disposal of Vodafone

Japan to SoftBank which are yen denominated financial instruments but are

owned by legal entities with either a sterling or euro functional currency. In addition,

a US dollar denominated financial liability arising from the put rights granted over

the Essar Group’s interests in Vodafone Essar in the 2008 financial year and discussed

on page 118, were granted by a legal entity with a euro functional currency.

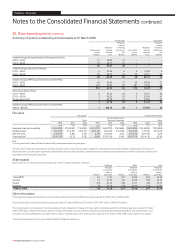

A 10%, 2% or 1% (2007: 2%, 5% or nil) change in the ¥/£, ¥/€ or US$/€ exchange

rates would have a £47 million, £17 million or £23 million (2007: £8 million, £33

million and nil) impact on profit or loss in relation to these financial instruments.

The Group recognises foreign exchange movements in equity for the translation of

net investment hedging instruments and balances treated as investments in foreign

operations. However, there is no net impact on equity for exchange rate movements

as there would be an offset in the currency translation of the foreign operation.

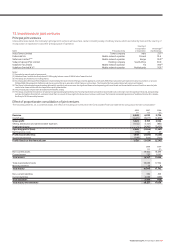

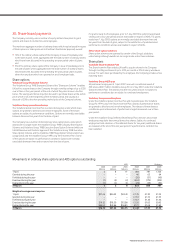

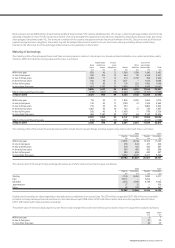

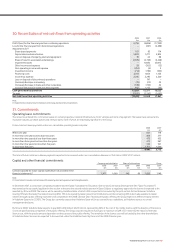

The following table details the Group’s sensitivity of the Group’s adjusted operating

profit to a strengthening of the Group’s major currencies in which it transacts.

The percentage movement applied to each currency is based on the average

movements in the previous three annual reporting periods. The analysis has been

performed based on the movement occurring at the start of the reporting period

and is calculated by retranslating the adjusted operating profit of each entity

whose functional currency is either euro or US dollar.

2008

£m

Euro 6% change – Adjusted operating profit 357

US dollar 7% change – Adjusted operating profit 177

At 31 March 2007, sensitivity of the Group’s adjusted operating profit was

analysed for euro 3% change and US$ 8% change, representing £175 million and

£176 million respectively.

Equity risk

The Group has equity investments, primarily in China Mobile Limited and Bharti

Infotel Private Limited, which are subject to equity risk. See note 15 for further

details on the carrying value of these investments.

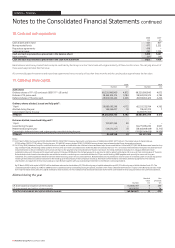

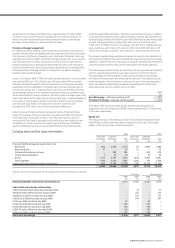

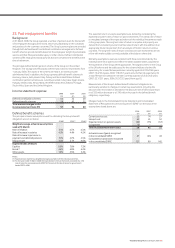

Carrying value and fair value information

2008 2007

Short term Long term Short term Long term

borrowings borrowings Total borrowings borrowings Total

£m £m £m £m £m £m

Financial liabilities measured at amortised cost:

Bank loans 806 2,669 3,475 94 2,086 2,180

Bank overdrafts 47 – 47 23 – 23

Redeemable preference shares – 985 985 – 818 818

Finance lease obligations 9 60 69 7 59 66

Bonds 1,125 4,439 5,564 1,648 3,953 5,601

Other liabilities 1,740 2,945 4,685 2,202 156 2,358

Loans and bonds in fair value hedge relationships 805 11,564 12,369 843 10,726 11,569

4,532 22,662 27,194 4,817 17,798 22,615

The fair value and carrying value of the Group’s short term borrowings is as follows:

Fair value Carrying value

2008 2007 2008 2007

£m £m £m £m

Financial liabilities measured at amortised cost 3,715 3,972 3,727 3,974

Loans in fair value hedge relationships:

4.161% US dollar 150m bond due November 2007 – 76 – 77

3.95% US dollar 500m bond due January 2008 – 252 – 254

4.625% euro 250m bond due January 2008 – 170 – 171

4.625% euro 500m bond due January 2008 – 341 – 341

5.5% euro 400m bond due July 2008 37 – 39 –

6.25% sterling 250m bond due July 2008 250 – 249 –

6.25% sterling 150m bond due July 2008 150 – 148 –

6.65% US dollar 500m bond due May 2008 126 – 130 –

4.0% euro 300m bond due January 2009 237 – 239 –

Short term borrowings 4,515 4,811 4,532 4,817

Vodafone Group Plc Annual Report 2008 117