Vodafone 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As well as driving growth in our existing emerging market

assets, we will continue to explore further opportunities to

expand our emerging market footprint through selective

investments, with a particular focus on Africa and Asia.

Uniquely positioned to deliver growth

We believe that Vodafone is uniquely positioned to capitalise on

the evolving communications environment. Our portfolio of assets

provides the advantages of scale and exposure to attractive growth,

and leverages our strong customer franchise in both consumer

and business segments supported by a leading global brand.

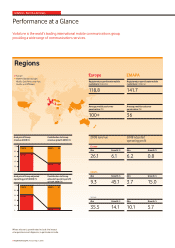

We have a market leading position in mature, high cash flow

generating markets in Europe combined with an increasing

exposure to higher growth emerging markets in Eastern Europe,

Middle East, Africa and Asia, in particular in India. We also have

a material position in the attractive US market through our stake

in Verizon Wireless.

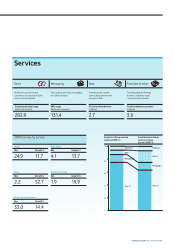

By expanding beyond our historic core mobile offerings to

deliver data and fixed broadband services through our total

communications strategy, this enables us to continue to be a

leader in the increasingly integrated communications industry

and therefore supports continued strong cash generation and

returns to shareholders.

Prospects for the year ahead

Operating conditions are expected to continue to be challenging

in Europe given the current economic environment and ongoing

pricing and regulatory pressures but with continued positive

trends in messaging and data revenue and voice usage growth.

We expect increasing market penetration to continue to result in

overall strong growth for the EMAPA region. Our geographically

diverse portfolio should provide some resilience in the current

economic environment. We also anticipate significant benefit

from recent changes in foreign exchange rates compared to

2008, particularly in respect of the euro, which we have assumed

to be on average at 1.30 to sterling for the year.

Our revenue expectations for the year ahead reflect our drive

for growth, particularly in respect of our total communications

strategy for data and fixed broadband services and in emerging

markets. Adjusted operating profit is therefore anticipated to

reflect a greater proportion of lower margin fixed broadband

services together with continued strong performance from

Verizon Wireless in the US.

Capital expenditure on fixed assets includes an increase in

investment in India to drive further strong growth. Capital

intensity is expected to be maintained at around 10% of

revenue for the total of our Europe region and common

functions, with continued investment in growth. Free cash flow

excludes spectrum and licence payments and is after taking

into account £0.3 billion from payments for capital expenditure

deferred from 2008.

Personal reflections

I have decided to retire as the Chief Executive of the Company

following the AGM on 29 July. It has been a privilege to lead

Vodafone over the last five years. We have made significant

progress, changing our strategy from mobile to total

communications, including broadband and the internet.

We have secured some important assets in markets including

Turkey and India, and we have integrated these acquired

businesses to build a global company. Our Board and

employees are aligned behind the strategic direction of

the business and the Company is well positioned to succeed

in the future. We have issued a strong set of 2008 annual

results in line with, or ahead of, guidance and the Company

has built strong momentum in executing its strategy. I have

accomplished what I set out to achieve on taking the role

as Chief Executive and therefore felt the time was right to

hand over responsibilities to a successor. I am delighted that

Vittorio Colao will be taking over as Chief Executive. He has

the knowledge and vision to drive the business towards

future success.

I believe Vodafone is well positioned to continue delivering

value to both customers and shareholders. I would like to

thank the Board for its support, insight and counsel in recent

years. I would also like to thank our 72,000 employees for

their ongoing customer focus and wish them every success

in the future.

Arun Sarin

Chief Executive

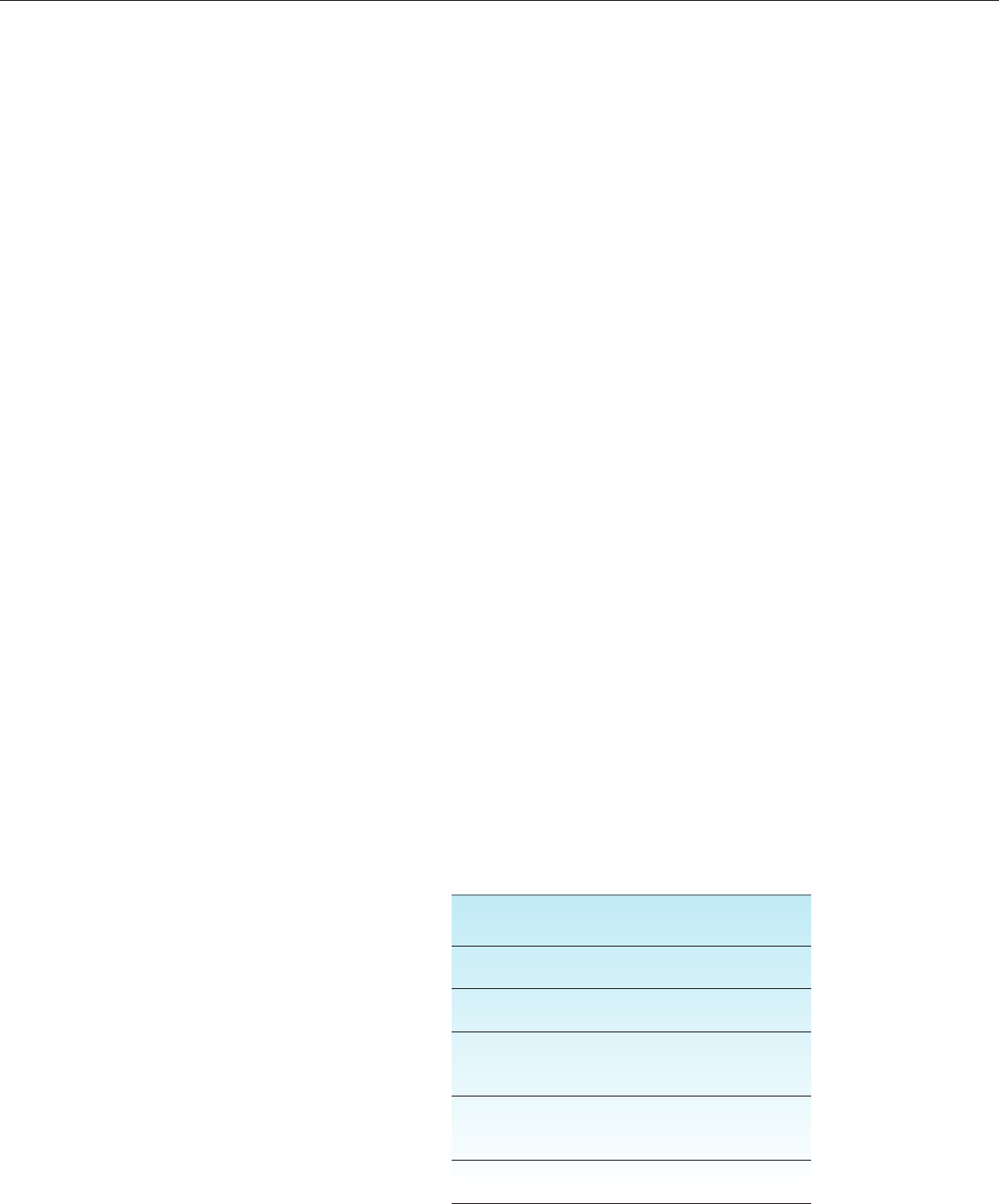

Outlook for 2009

(£bn) 2009 outlook 2008 actual

Revenue 39.8 to 40.7 35.5

Adjusted

operating profit 11.0 to 11.5 10.1

Capitalised fixed

asset additions 5.3 to 5.8 5.1

Free cash flow 5.1 to 5.6 5.5

Vodafone Group Plc Annual Report 2008 7