Vodafone 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

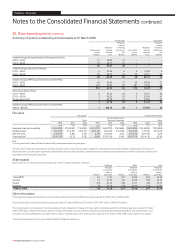

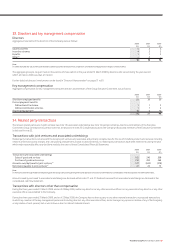

28. Acquisitions

The aggregate cash consideration in respect of acquisitions during the year ended 31 March 2008 was £6,058 million. After deducting aggregate cash and cash

equivalents acquired of £59 million, the net cash outflow related to acquisitions completed in the year ended 31 March 2008 was £5,999 million, of which £5,957

million was paid during the year. The aggregate cash consideration included £5,489 million for Vodafone Essar, £457 million for Tele2 and £112 million for other

acquisitions. Total goodwill acquired was £4,316 million and included £3,950 million in relation to Vodafone Essar, £256 million in relation to Tele2 and £110 million

in relation to other acquisitions.

Vodafone Essar Limited (formerly Hutchison Essar Limited)

On 8 May 2007, the Group completed the acquisition of 100% of CGP Investments (Holdings) Limited (“CGP”), a company with indirect interests in Vodafone Essar

Limited (“Vodafone Essar”), from Hutchison Telecommunications International Limited for cash consideration of US$10.9 billion (£5.5 billion). Following this transaction,

the Group has a controlling financial interest in Vodafone Essar.

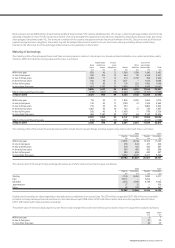

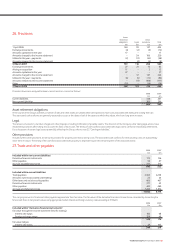

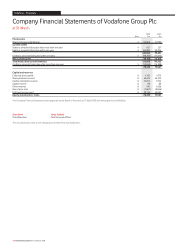

Fair value

Book value adjustments Fair value

£m £m £m

Net assets acquired:

Identifiable intangible assets 121 3,068 3,189

(1)

Property, plant and equipment 1,215 (155) 1,060

Other investments 199 − 199

Inventory 5 (2) 3

Taxation recoverable 5 − 5

Trade and other receivables 277 13 290

Cash and cash equivalents 51 − 51

Deferred tax asset/(liability) 36 (512) (476)

Short and long term borrowings(2) (1,467) (16) (1,483)

Provisions (11) − (11)

Trade and other payables (534) (35) (569)

(103) 2,361 2,258

Minority interests (936)

Written put options over minority interests(2) 217

Goodwill 3,950

Total consideration (including £34 million of directly attributable costs)(3) 5,489

Notes:

(1) Identifiable intangible assets of £3,189 million consist of licences and spectrum fees of £3,045 million and other intangible assets of £144 million. The weighted average lives of licences and

spectrum fees, other intangible assets and total intangibles assets are 11 years, two years and 11 years, respectively.

(2) Included within short term and long term borrowings are liabilities of £217 million related to written put options over minority interests.

(3) After deducting cash and cash equivalents acquired of £51 million, the net cash outflow related to the acquisition was £5,438 million, of which £5,429 million was paid during the 2008

financial year.

The goodwill is attributable to the expected profitability of the acquired business and the synergies expected to arise after the Group’s acquisition of CGP. The results

of the acquired entity have been consolidated in the income statement from the date of acquisition. From the date of acquisition, the acquired entity contributed a

£219 million loss to the profit attributable to equity shareholders of the Group. As a result of the acquisition of Vodafone Essar, the Group disposed of its 5.60% direct

shareholding in Bharti Airtel Limited (see note 29).

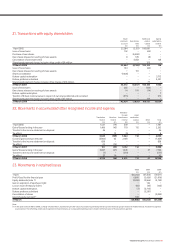

Tele2

On 3 December 2007, the Group completed the acquisition of 100%(1) of the issued share capital of Tele2 Italia SpA and Tele2 Telecommunications Services SLU

(together referred to as “Tele2”) from Tele2 AB Group for cash consideration of €635 million (£452 million).(1)

The initial purchase price allocation has been determined to be provisional pending the completion of the final valuation of the fair value of assets acquired.

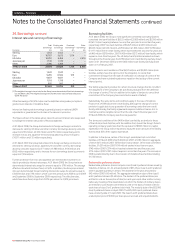

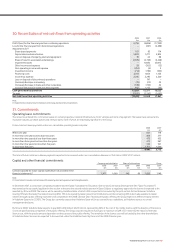

Fair value

Book value adjustments Fair value

£m £m £m

Net assets acquired:

Identifiable intangible assets 5 106 111

Property, plant and equipment 115 (11) 104

Trade and other receivables 149 − 149

Cash and cash equivalents 5 − 5

Deferred tax asset/(liability) 36 (39) (3)

Short and long term borrowings (6) − (6)

Provisions (1) (1) (2)

Trade and other payables (159) 2 (157)

144 57 201

Goodwill 256

Total consideration (including £6 million of directly attributable costs)(1)(2) 457

Notes:

(1) The Group acquired Tele2 for cash consideration of €747 million. 100% of the issued share capital of Tele2 Italia SpA was acquired through Vodafone Omnitel N.V., a joint venture proportionately

consolidated by the Group, resulting in an effective Group voting interest of 76.9% and disclosed total cash consideration of €635 million (£451 million).

(2) After deducting cash and cash equivalents acquired of £5 million, the net cash outflow related to the acquisition was £452 million, of which £451 million was paid during the 2008 financial year.

The goodwill is attributable to the expected profitability of the acquired businesses and the synergies expected to arise after the acquisition. The results of the

acquired entities have been consolidated in the income statement from the date of acquisition. The weighted average life of total intangible assets was two years.

From the date of acquisition, the acquired entity contributed a £67 million loss to the profit attributable to equity shareholders of the Group.

124 Vodafone Group Plc Annual Report 2008

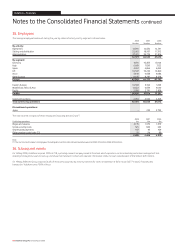

Notes to the Consolidated Financial Statements continued

Vodafone – Financials