Vodafone 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

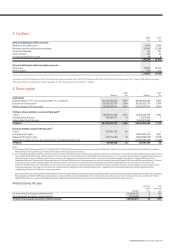

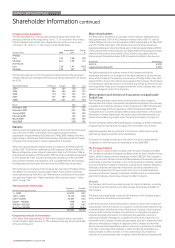

Additional tax considerations

UK inheritance tax

An individual who is domiciled in the United States (for the purposes of the Estate

Tax Convention) and is not a UK national will not be subject to UK inheritance tax in

respect of the Company’s shares or ADSs on the individual’s death or on a transfer

of the shares or ADSs during the individual’s lifetime, provided that any applicable US

federal gift or estate tax is paid, unless the shares or ADSs are part of the business

property of a UK permanent establishment or pertain to a UK fixed base used for

the performance of independent personal services. Where the shares or ADSs have

been placed in trust by a settlor, they may be subject to UK inheritance tax unless,

when the trust was created, the settlor was domiciled in the United States and was

not a UK national. Where the shares or ADSs are subject to both UK inheritance

tax and to US federal gift or estate tax, the Estate Tax Convention generally

provides a credit against US federal tax liabilities for UK inheritance tax paid.

UK stamp duty and stamp duty reserve tax

Stamp duty will, subject to certain exceptions, be payable on any instrument

transferring shares in the Company to the Custodian of the Depositary at the rate

of 1.5% on the amount or value of the consideration if on sale or on the value of

such shares if not on sale. Stamp duty reserve tax (“SDRT”), at the rate of 1.5% of

the price or value of the shares, could also be payable in these circumstances and on

issue to such a person, but no SDRT will be payable if stamp duty equal to such SDRT

liability is paid. In accordance with the terms of the Deposit Agreement, any tax or duty

payable on deposits of shares by the Depositary or the Custodian of the Depositary

will be charged to the party to whom ADSs are delivered against such deposits.

No stamp duty will be payable on any transfer of ADSs of the Company, provided

that the ADSs and any separate instrument of transfer are executed and retained

at all times outside the United Kingdom. A transfer of shares in the Company in

registered form will attract ad valorem stamp duty generally at the rate of 0.5% of the

purchase price of the shares. There is no charge to ad valorem stamp duty on gifts.

SDRT is generally payable on an unconditional agreement to transfer shares in the

Company in registered form at 0.5% of the amount or value of the consideration for

the transfer, but is repayable if, within six years of the date of the agreement, an

instrument transferring the shares is executed or, if the SDRT has not been paid, the

liability to pay the tax (but not necessarily interest and penalties) would be cancelled.

However, an agreement to transfer the ADSs of the Company will not give rise to SDRT.

PFIC Rules

The Company does not believe that the shares or ADSs will be treated as stock

of a passive foreign investment company, or PFIC, for US federal income tax

purposes. This conclusion is a factual determination that is made annually and

thus is subject to change. If the Company is treated as a PFIC, any gain realised on

the sale or other disposition of the shares or ADSs would in general not be treated

as capital gain, unless a US holder elects to be taxed annually on a mark to market

basis with respect to the shares or ADSs. Otherwise a US holder would be treated

as if he or she has realised such gain and certain “excess distributions” rateably

over the holding period for the shares or ADSs and would be taxed at the highest

tax rate in effect for each such year to which the gain was allocated. An interest

charge in respect of the tax attributable to each such year would also apply.

Dividends received from Vodafone would not be eligible for the preferential tax

rate applicable to qualified dividend income for certain non-corporate holders.

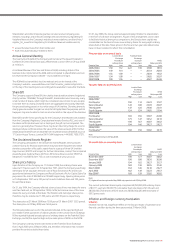

The Company was incorporated under English law in 1984 as Racal Strategic

Radio Limited (registered number 1833679). After various name changes,

20% of Racal Telecom Plc capital was offered to the public in October 1988.

The Company was fully demerged from Racal Electronics Plc and became an

independent company in September 1991, at which time it changed its name

to Vodafone Group Plc.

Since then, the Group entered into various transactions, which consolidated the

Group’s position in the United Kingdom and enhanced its international presence.

The most significant of these transactions were as follows:

The merger with AirTouch Communications, Inc., which completed on 30 June

1999. The Company changed its name to Vodafone AirTouch Plc in June 1999,

but then reverted to its former name, Vodafone Group Plc, on 28 July 2000.

The acquisition of Mannesmann AG, which completed on 12 April 2000.

Through this transaction the Group acquired subsidiaries in Germany and Italy,

and increased the Group’s indirect holding in SFR.

Through a series of business transactions between 1999 and 2004, the Group

acquired a 97.7% stake in Vodafone Japan. This was then disposed of on 27

April 2006.

On 8 May 2007, the Group acquired companies with interests in Vodafone

Essar for $10.9 billion (£5.5 billion), following which the Group controls

Vodafone Essar (see note 28 to the Consolidated Financial Statements).

Other transactions that have occurred since 31 March 2005 are as follows:

11 May 2005 – France: Following a transaction completed by the Group’s

associated undertaking, SFR, the Group’s effective shareholding in Neuf Cegetel

became 12.4%.

31 May 2005 – Czech Republic and Romania: 79.0% of the share capital of

MobiFon S.A. (“MobiFon”) in Romania and 99.9% of the share capital of Oskar

Mobil a.s. (“Oskar”) in the Czech Republic were acquired for $3.5 billion (£1.9

billion). In addition, the Group assumed approximately $1.0 billion (£0.6 billion)

of net debt.

18 November 2005 – India: Acquired a 5.60% interest in Bharti Airtel and on

22 December 2005 acquired a further 4.39% interest in Bharti Airtel. Total

consideration for the combined 10.0% stake was Rs. 67 billion (£858 million).

•

•

•

•

5 January 2006 – Sweden: Sold Vodafone Sweden for €970 million (£660 million).

20 April 2006 – South Africa: Increased stake in Vodacom Group (Pty) Limited

(“Vodacom”) by 15.0% to 50.0% for a consideration of ZAR15.8 billion (£1.5 billion).

24 May 2006 – Turkey: The assets of Telsim Mobil Telekomunikasyon (“Telsim”)

were acquired for $4.67 billion (£2.6 billion).

29 June 2006 – Greece: The Group’s interest in Vodafone Greece reached 99.9%

following a public offer for all outstanding shares.

3 November 2006 – Belgium: Disposed of 25% interest in Belgacom Mobile SA

for €2.0 billion (£1.3 billion).

25 November 2006 – The Netherlands: Group’s shareholdings increased to

100.0% following a compulsory acquisition of outstanding shares.

3 December 2006 – Egypt: Acquired an additional 4.8% stake in Vodafone Egypt

bringing the Group’s interest to 54.9%.

20 December 2006 – Switzerland: Disposed of 25% interest in Swisscom Mobile

AG for CHF4.25 billion (£1.8 billion).

9 May 2007 – India: A Bharti group company irrevocably agreed to purchase

the Group’s 5.60% direct shareholding in Bharti Airtel (see note 29 to the

Consolidated Financial Statements).

3 December 2007 – Italy and Spain: Acquired Tele2 Italia SpA and Tele2

Telecommunications Services SLU from Tele2 AB Group for €775 million

(£537 million).

11 December 2007 – Qatar: A consortium comprising Vodafone and The Qatar

Foundation was named as the successful applicant in the auction to become the

second mobile operator in Qatar.

19 May 2008 – Arcor: The Group increased its stake in Arcor for €474 million

(£377 million) and now owns 100% of Arcor.

146 Vodafone Group Plc Annual Report 2008

Vodafone – Additional Information

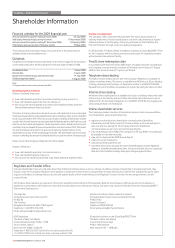

Shareholder Information continued

History and Development