Vodafone 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Position and Resources continued

Included in the dividends received from associated undertakings and investments

is an amount of £414 million (2007: £328 million) received from Verizon Wireless.

Until April 2005, Verizon Wireless’ distributions were determined by the terms of the

partnership agreement distribution policy and comprised income distributions

and tax distributions. Since April 2005, tax distributions have continued. Current

projections forecast that tax distributions will not be sufficient to cover the US

tax liabilities arising from the Group’s partnership interest in Verizon Wireless

until 2015 and, in the absence of additional distributions above the level of tax

distributions during this period, will result in a net cash outflow for the Group.

Under the terms of the partnership agreement, the Board has no obligation to

provide for additional distributions above the level of the tax distributions. It is the

current expectation that Verizon Wireless will continue to re-invest free cash flow

in the business and reduce indebtedness.

During the year ended 31 March 2008, cash dividends totalling £450 million

(2007: £450 million) were received from SFR in accordance with the shareholders’

agreement. It is currently expected that future dividends from SFR will reduce,

but by no more than 50%, between 2009 and 2011 inclusive, should SFR increase

debt levels following completion of the purchase of an additional stake in

Neuf Cegetel.

Verizon Communications Inc. (“Verizon”) has an indirect 23.1% shareholding in

Vodafone Italy and, under the shareholders’ agreement, the shareholders have

agreed to take steps to cause Vodafone Italy to pay dividends at least annually,

provided that such dividends will not impair the financial condition or prospects

of Vodafone Italy including, without limitation, its credit rating. During the 2008

financial year, Vodafone Italy declared and paid a gross dividend of €8.9 billion,

of which €2.1 billion was received by Verizon net of withholding tax.

The Vodafone Essar shareholders’ agreement provides for the payment of dividends

to minority partners under certain circumstances but not before May 2011.

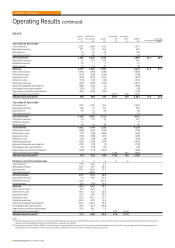

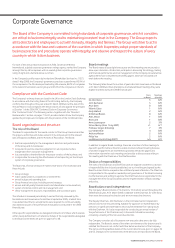

Acquisitions and disposals

The Group paid a net £5,268 million cash and cash equivalents from acquisition

and disposal activities, including investments, in the year to 31 March 2008. An

analysis of the main transactions in the 2008 financial year, including the changes

in the Group’s effective shareholding, are shown in the table below. Further details

of the acquisitions are provided in note 28 to the Consolidated Financial Statements.

£m

Acquisitions(1):

Acquisition of 100% of CGP Investments (Holdings) Limited

(“CGP”), a company with indirect interests in Vodafone Essar

Limited (formerly Hutchison Essar Limited) (5,429)

Tele2 Spain and Italy (from nil to 100%) (451)

Disposals:

Partial disposal of Bharti Airtel (from 9.99% to 5.00%)(1) 654

Other net acquisitions and disposals, including investments (1) (42)

Total (5,268)

Note:

(1) Amounts are shown net of cash and cash equivalents acquired or disposed.

On 8 May 2007, the Group completed the acquisition of 100% of CGP Investments

(Holdings) Limited (“CGP”), a company with indirect interests in Vodafone Essar,

from Hutchison Telecommunications International Limited for cash consideration

of £5,438 million, net of £51 million cash and cash equivalents acquired, of which

£5,429 million was paid during the 2008 financial year. Following this transaction,

the Group has a controlling financial interest in Vodafone Essar. As part of this

transaction, the Group also assumed gross debt of £1,483 million, including £217

million related to written put options over minority interests, and issued a written

put to the Essar group for which the present value of the redemption price at the

date of grant was £2,154 million. See page 58 for further details on these options.

The Group also entered into a shareholders’ agreement with the Essar Group in

relation to Vodafone Essar.

On 9 May 2007, in conjunction with the acquisition of Vodafone Essar, the Group

entered into a share sale and purchase agreement in which a Bharti group

company irrevocably agreed to purchase the Group’s 5.60% direct shareholding

in Bharti Airtel. During the year ended 31 March 2008, the Group received

£654 million in cash consideration for 4.99% of such shareholding. The Group’s

remaining 0.61% direct shareholding was transferred in April 2008 for cash

consideration of £87 million. The Group retains a 4.36% indirect stake in

Bharti Airtel.

On 3 December 2007, the Group completed the acquisition of Tele2 Italia SpA

(“Tele2 Italy”) and Tele2 Telecommunication Services SLU (“Tele2 Spain”) from

Tele2 AB Group for a cash consideration of £452 million, of which £451 million

was paid during the 2008 financial year.

Other returns

The Board will periodically review the free cash flow, anticipated cash

requirements, dividends, credit profile and gearing of the Group and consider

additional shareholder returns.

Treasury shares

The Companies Act 1985 permits companies to purchase their own shares out of

distributable reserves and to hold shares with a nominal value not to exceed 10%

of the nominal value of their issued share capital in treasury. If shares in excess of

this limit are purchased they must be cancelled. While held in treasury, no voting

rights or pre-emption rights accrue and no dividends are paid in respect of

treasury shares. Treasury shares may be sold for cash, transferred (in certain

circumstances) for the purposes of an employee share scheme, or cancelled.

If treasury shares are sold, such sales are deemed to be a new issue of shares

and will accordingly count towards the 5% of share capital which the Company

is permitted to issue on a non pre-emptive basis in any one year as approved by

its shareholders at the AGM. The proceeds of any sale of treasury shares up to the

amount of the original purchase price, calculated on a weighted average price

method, is attributed to distributable profits which would not occur in the case

of the sale of non-treasury shares. Any excess above the original purchase price

must be transferred to the share premium account. The Company did not

repurchase any of its own shares between 1 April 2007 and 31 March 2008.

Shares purchased are held in treasury in accordance with section 162 of the

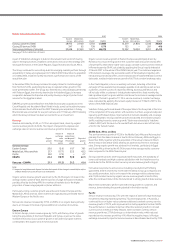

Companies Act 1985. The movement in treasury shares during the financial year

is shown below:

Number

Million £m

1 April 2007 5,251 8,047

Re-issue of shares (118) (191)

31 March 2008 5,133 7,856

56 Vodafone Group Plc Annual Report 2008

Vodafone – Performance