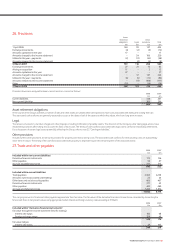

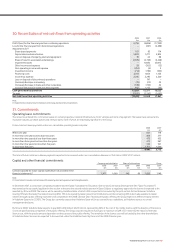

Vodafone 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

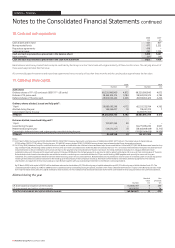

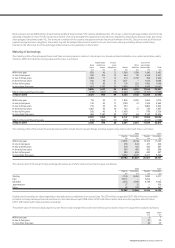

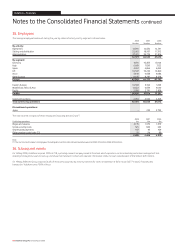

25. Post employment benefits

Background

At 31 March 2008, the Group operated a number of pension plans for the benefit

of its employees throughout the world, which vary depending on the conditions

and practices in the countries concerned. The Group’s pension plans are provided

through both defined benefit and defined contribution arrangements. Defined

benefit schemes provide benefits based on the employees’ length of pensionable

service and their final pensionable salary or other criteria. Defined contribution

schemes offer employees individual funds that are converted into benefits at the

time of retirement.

The principal defined benefit pension scheme of the Group is in the United

Kingdom. This tax approved final salary scheme was closed to new entrants from

1 January 2006. The assets of the scheme are held in an external trustee

administered fund. In addition, the Group operates defined benefit schemes in

Germany, Greece, India, Ireland, Italy, Turkey and the United States. Defined

contribution pension schemes are currently provided in Australia, Egypt, Greece,

Hungary, Ireland, Italy, Kenya, Malta, the Netherlands, New Zealand, Portugal,

South Africa, Spain and the United Kingdom.

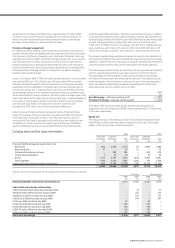

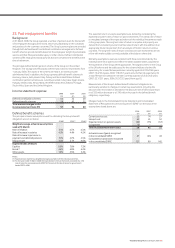

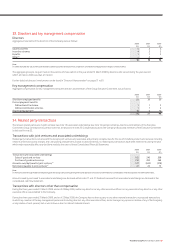

Income statement expense

2008 2007 2006

£m £m £m

Defined contribution schemes 63 32 28

Defined benefit schemes 28 62 52

Total amount charged to the

income statement (note 35) 91 94 80

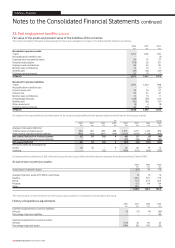

Defined benefit schemes

The principal actuarial assumptions used for estimating the Group’s benefit

obligations are set out below:

2008(1) 2007(1) 2006(1)

Weighted average actuarial assumptions

used at 31 March:

Rate of inflation 3.1% 2.7% 2.5%

Rate of increase in salaries 4.3% 4.4% 4.2%

Rate of increase in pensions in

payment and deferred pensions 3.1% 2.7% 2.5%

Discount rate 6.1% 5.1% 4.8%

Expected rates of return:

Equities 8.0% 7.8% 7.3%

Bonds(2) 4.4% 4.8% 4.2%

Other assets 1.3% 5.3% 3.4%

Notes:

(1) Figures shown represent a weighted average assumption of the individual schemes.

(2) For the year ended 31 March 2008 the expected rate of return for bonds consisted of a 4.7%

rate of return for corporate bonds (2007: 5.1%) and a 3.5% rate of return for government

bonds (2007: 4.0%).

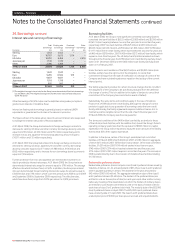

The expected return on assets assumptions are derived by considering the

expected long term rates of return on plan investments. The overall rate of return

is a weighted average of the expected returns of the individual investments made

in the group plans. The long term rates of return on equities and property are

derived from considering current risk free rates of return with the addition of an

appropriate future risk premium from an analysis of historic returns in various

countries. The long term rates of return on bonds and cash investments are set

in line with market yields currently available at the balance sheet date.

Mortality assumptions used are consistent with those recommended by the

individual scheme actuaries and reflect the latest available tables, adjusted for

the experience of the Group where appropriate. The largest scheme in the Group

is the UK scheme and the tables used for this scheme indicate a further life

expectancy for a male/female pensioner currently aged 65 of 22.0/24.8 years

(2007: 19.4/22.4 years, 2006: 17.8/20.7 years) and a further life expectancy for

a male/female non-pensioner member currently aged 40 of 23.2/26.0 years

(2007: 22.1/25.1 years, 2006: 20.3/23.3 years) from age 65.

Measurement of the Group’s defined benefit retirement obligations are

particularly sensitive to changes in certain key assumptions, including the

discount rate. An increase or decrease in the discount rate of 0.5% would result

in a £135 million decrease or a £145 million increase in the defined benefit

obligation, respectively.

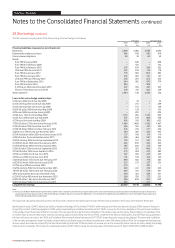

Charges made to the Consolidated Income Statement and Consolidated

Statement of Recognised Income and Expense (“SORIE”) on the basis of the

assumptions stated above are:

2008 2007 2006

£m £m £m

Current service cost 53 74 57

Interest cost 69 61 52

Expected return on pension assets (89) (73) (57)

Curtailment (5) − −

Total included within staff costs 28 62 52

Actuarial losses /(gains) recognised

in the consolidated SORIE 47 (65) 43

Cumulative actuarial losses recognised

in the consolidated SORIE 127 80 145

Vodafone Group Plc Annual Report 2008 121