Vodafone 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

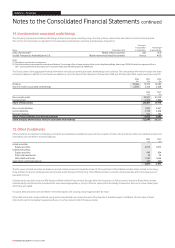

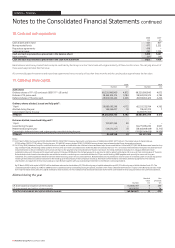

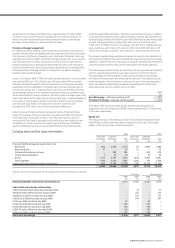

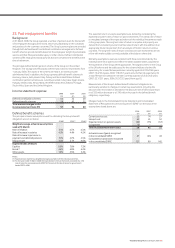

21. Transactions with equity shareholders

Share Additional Capital

premium Own shares paid-in redemption

account held capital reserve

£m £m £m £m

1 April 2005 52,284 (5,121) 100,081 −

Issue of new shares 152 − (44) −

Purchase of own shares − (6,500) − −

Own shares released on vesting of share awards 8 370 (8) −

Cancellation of own shares held − 3,053 − 128

Share-based payment charge, inclusive of tax credit of £9 million − − 123 −

31 March 2006 52,444 (8,198) 100,152 128

Issue of new shares 154 − (44) −

Own shares released on vesting of share awards − 151 − −

Share consolidation (9,026) − − −

B share capital redemption − − − 5,713

B share preference dividend − − − 3,291

Share-based payment charge, inclusive of tax charge of £16 million – − 77 −

31 March 2007 43,572 (8,047) 100,185 9,132

Issue of new shares 263 − (134) −

Own shares released on vesting of share awards 14 191 (14) −

B share capital redemption − − − 7

Transfer of B share nominal value in respect of own shares deferred and cancelled (915) − − 915

Share-based payment charge, inclusive of tax credit of £7 million − − 114 −

31 March 2008 42,934 (7,856) 100,151 10,054

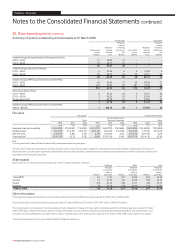

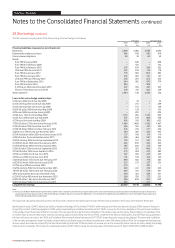

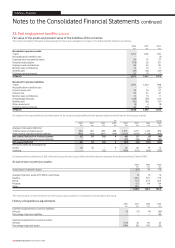

22. Movements in accumulated other recognised income and expense

Available-

for-sale Asset

Translation Pensions investments revaluation

reserve reserve reserve surplus Other Total

£m £m £m £m £m £m

1 April 2005 1,521 (79) 339 − − 1,781

Gains/(losses) arising in the year 1,486 (43) 710 112 − 2,265

Transfer to the income statement on disposal 36 − − − − 36

Tax effect − 13 (5) − − 8

31 March 2006 3,043 (109) 1,044 112 − 4,090

(Losses)/gains arising in the year (3,802) 65 2,108 − − (1,629)

Transfer to the income statement on disposal 838 − − − − 838

Tax effect 22 (15) − − − 7

31 March 2007 101 (59) 3,152 112 − 3,306

Gains/(losses) arising in the year 5,827 (47) 1,949 − 37 7,766

Transfer to the income statement on disposal (7) − (570) − − (577)

Tax effect 53 10 − − − 63

31 March 2008 5,974 (96) 4,531 112 37 10,558

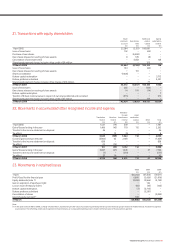

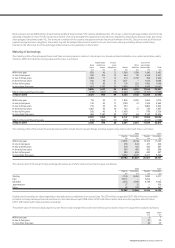

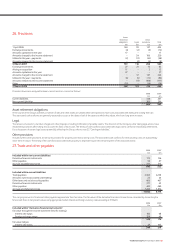

23. Movements in retained losses

2008 2007 2006

£m £m £m

1 April (85,253) (67,356) (39,511)

Profit/(loss) for the financial year 6,660 (5,426) (21,916)

Equity dividends (note 7) (3,653) (3,566) (2,753)

Gain on expiration of equity put right − 142 −

Loss on issue of treasury shares (60) (43) (123)

B share capital redemption (7) (5,713) −

B share preference dividend − (3,291) −

Cancellation of shares − – (3,053)

Grant of equity put right(1) 333 – −

31 March (81,980) (85,253) (67,356)

Note:

(1) In the year ended 31 March 2008, a charge of £333 million, representing the fair value of put options granted by the Group over the Essar group’s interest in Vodafone Essar, has been recognised

as an expense. The offsetting credit was recognised in retained losses, as no equivalent liability arose in respect of the fair value of the put options granted.

Vodafone Group Plc Annual Report 2008 115