Vodafone 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

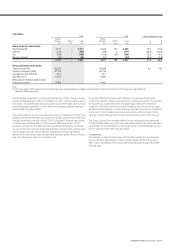

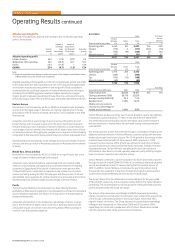

Outlook

2009 financial year

Adjusted Capitalised

operating fixed asset Free

Revenue profit additions cash flow

£bn £bn £bn £bn

2008 performance 35.5 10.1 5.1 5.5(1)

2009 outlook(2)(3) 39.8 to 40.7 11.0 to 11.5 5.3 to 5.8 5.1 to 5.6(4)

Notes:

(1) The amount for the 2008 financial year includes £0.4 billion benefit from deferred payments

for capital expenditure but is stated after £0.7 billion of tax payments, including associated

interest, in respect of a number of long standing tax issues.

(2) Includes assumption of average foreign exchange rates for the 2009 financial year of

approximately £1:€1.30 (2008: 1.42) and £1:US$1.96 (2008: 2.01). A substantial majority

of the Group’s revenue, adjusted operating profit, capitalised fixed asset additions and free

cash flow is denominated in currencies other than sterling, the Group’s reporting currency.

A 1% change in the euro to sterling exchange rate would impact revenue by approximately

£250 million and adjusted operating profit by approximately £70 million.

(3) The outlook does not include the impact of a change in the Group’s effective interest in

Neuf Cegetel.

(4) Excludes spectrum and licence payments, but includes estimated payments in respect of

long standing tax issues.

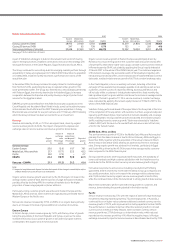

The outlook ranges reflect the Group’s assumptions for average foreign exchange

rates for the 2009 financial year. In respect of the euro to sterling exchange rate,

this represents an approximate 10% change to the 2008 financial year, resulting

in favourable year on year increases in revenue, adjusted operating profit and free

cash flow and adverse changes in capitalised fixed asset additions.

Operating conditions are expected to continue to be challenging in Europe given

the current economic environment and ongoing pricing and regulatory pressures

but with continued positive trends in messaging and data revenue and voice

usage growth. Increasing market penetration is expected to continue to result

in overall strong growth for the EMAPA region. The Group considers that its

geographically diverse portfolio should provide some resilience in the current

economic environment.

Revenue is expected to be in the range of £39.8 billion to £40.7 billion. The Group

continues to drive revenue growth, particularly in respect of its total communications

strategy for data and fixed broadband services and in emerging markets. Revenue

includes the first full year post acquisition of Vodafone Essar in India and the Tele2

businesses in Italy and Spain.

Adjusted operating profit is expected to be in the range of £11.0 billion to

£11.5 billion. The Group margin is expected to decline by a similar amount as

in the 2008 financial year but with a greater impact from lower margin fixed

broadband services. Verizon Wireless, the Group’s US associate, is expected to

continue to perform strongly.

Total depreciation and amortisation charges are anticipated to be around

£6.5 billion to £6.6 billion, higher than the 2008 financial year, primarily as a

result of the ongoing investment in capital expenditure in India and the impact

of changes in foreign exchange rates.

The Group expects capitalised fixed asset additions to be in the range of

£5.3 billion to £5.8 billion, including an increase in investment in India. Capitalised

fixed asset additions are anticipated to be around 10% of revenue for the total of

the Europe region and common functions, with continued investment in growth.

Free cash flow is expected to be in the range of £5.1 billion to £5.6 billion, excluding

spectrum and licence payments. This is after taking into account £0.3 billion from

payments for capital expenditure deferred from the 2008 financial year.

The Group will invest £0.2 billion in Qatar in respect of the second mobile licence

won in December 2007. During the 2009 financial year, Vodafone Qatar is expected

to pay £1.0 billion for the licence with the balance of the funding being provided

by the other shareholders in Vodafone Qatar.

The Group continues to make significant cash payments for tax and associated

interest in respect of long standing tax issues. The Group does not expect

resolution of the application of the UK Controlled Foreign Company legislation

to the Group in the near term.

The adjusted effective tax rate percentage is expected to be in the high 20s for

the 2009 financial year, with the Group targeting the high 20s in the medium term.

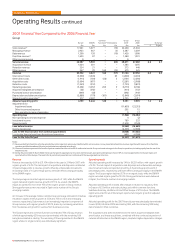

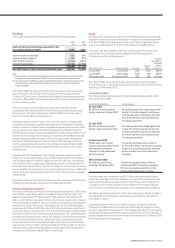

2008 financial year

Capitalised

Adjusted fixed

operating asset Free

Revenue profit additions cash flow(1)

£bn £bn £bn £bn

Outlook – May 2007(2) 33.3 to 34.1 9.3 to 9.9 4.7 to 5.1 4.0 to 4.5

Outlook – November 2007(3) 34.5 to 35.1 9.5 to 9.9 4.7 to 5.1 4.4 to 4.9

Foreign exchange(4) 0.7 0.1 0.1 0.1

Adjusted outlook(5) 35.2 to 35.8 9.6 to 10.0 4.8 to 5.2 4.5 to 5.0

2008 performance 35.5 10.1 5.1 5.5

Notes:

(1) The amount for the 2008 financial year includes £0.4 billion benefit from deferred payments

for capital expenditure but is stated after £0.7 billion of tax payments, including associated

interest, in respect of a number of long standing tax issues.

(2) The Group’s outlook from May 2007 reflected expectations for average foreign exchange

rates for the 2008 financial year of approximately £1:€1.47 and £1:US$1.98.

(3) The Group’s outlook, as updated in November 2007, reflected improvements in operational

performance, the impact of the Tele2 acquisition and updated expectations for average

foreign exchange rates for the 2008 financial year of approximately £1:€1.45 and £1:US$2.04.

(4) These amounts represent the difference between the forecast exchange rates used in the

November 2007 update and rates used to translate actual results including £1:€1.42 and

£1:US$2.01.

(5) Outlook from November 2007 adjusted solely for exchange rate differences as discussed in

note 4 above.

Vodafone Group Plc Annual Report 2008 51