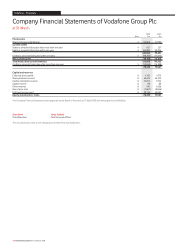

Vodafone 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

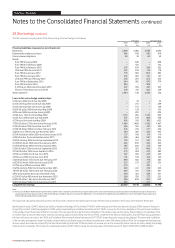

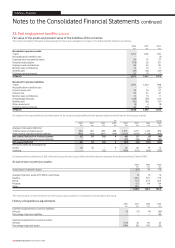

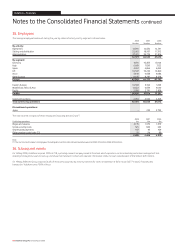

Performance bonds

Performance bonds require the Group to make payments to third parties in the

event that the Group does not perform what is expected of it under the terms

of any related contracts. Group performance bonds include £26 million

(2007: £57 million) in respect of undertakings to roll out 3G networks in Spain.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities,

including those in respect of the Group’s associated undertakings and investments.

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to the Spanish tax

authorities of £197 million (2007: £nil).

The Group also enters into lease arrangements in the normal course of business,

which are principally in respect of land, buildings and equipment. Further details

on the minimum lease payments due under non-cancellable operating lease

arrangements can be found in note 31.

Legal proceedings

The Company and its subsidiaries are currently, and may be from time to time,

involved in a number of legal proceedings, including inquiries from or discussions

with governmental authorities, that are incidental to their operations. However,

save as disclosed below, the Company and its subsidiaries are not involved

currently in any legal or arbitration proceedings (including any governmental

proceedings which are pending or known to be contemplated) which may have,

or have had in the twelve months preceding the date of this report, a significant

effect on the financial position or profitability of the Company and its subsidiaries.

With the exception of the Vodafone 2 enquiry, due to inherent uncertainties,

no accurate quantification of any cost which may arise from any of the legal

proceedings outlined below can be made.

The Company is one of a number of co-defendants in four actions filed in 2001

and 2002 in the Superior Court of the District of Columbia in the United States

alleging personal injury, including brain cancer, from mobile phone use. The

Company is not aware that the health risks alleged in such personal injury claims

have been substantiated and is vigorously defending such claims. In August 2007,

the Court dismissed all four actions against the Company on the basis of the

federal pre-emption doctrine. The plaintiffs have appealed this dismissal.

A subsidiary of the Company, Vodafone 2, is responding to an enquiry (“the

Vodafone 2 enquiry”) by HMRC with regard to the UK tax treatment of its

Luxembourg holding company, Vodafone Investments Luxembourg SARL (“VIL”),

under the Controlled Foreign Companies section of the UK’s Income and

Corporation Taxes Act 1988 (“the CFC Regime”) relating to the tax treatment of

profits earned by the holding company for the accounting period ended 31 March

2001. Vodafone 2’s position is that it is not liable for corporation tax in the UK

under the CFC Regime in respect of VIL. Vodafone 2 asserts, inter alia, that the

CFC Regime is contrary to EU law and has made an application to the Special

Commissioners of HMRC for closure of the Vodafone 2 enquiry. In May 2005,

the Special Commissioners referred certain questions relating to the compatibility

of the CFC Regime with EU law to the European Court of Justice (the “ECJ”) for

determination (“the Vodafone 2 reference”). HMRC subsequently appealed

against the decision of the Special Commissioners to make the Vodafone 2

reference but its appeal was rejected by both the High Court and Court of Appeal.

The Vodafone 2 reference has still to be heard by the ECJ. Vodafone 2’s

application for closure was stayed pending delivery of the ECJ’s judgment.

In September 2006, the ECJ determined in the Cadbury Schweppes case

(C-196/04) (the “Cadbury Schweppes Judgment”) that the CFC Regime is

incompatible with EU law unless it applies only to wholly artificial arrangements

intended to escape national tax normally payable (“wholly artificial arrangements”).

At a hearing in March 2007, the Special Commissioners heard submissions from

Vodafone 2 and HMRC, in light of the Cadbury Schweppes Judgment, as to

whether the CFC Regime can be interpreted as applying only to wholly artificial

arrangements and whether the Vodafone 2 reference should be maintained

or withdrawn by the Special Commissioners. On 26 July 2007, the Special

Commissioners handed down their judgment on these questions. The tribunal

decided (on the basis of the casting vote of the Presiding Special Commissioner)

that the CFC regime can be interpreted as applying only to wholly artificial

arrangements and that the Vodafone 2 reference should be withdrawn. Vodafone

2 is appealing these decisions to the High Court and this appeal was heard on

20 to 22 May 2008. The High Court’s ruling is expected in the coming months.

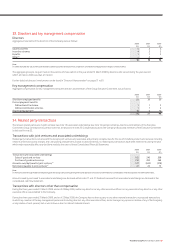

The Company has taken provisions, which at 31 March 2008 amounted to

approximately £2.2 billion, for the potential UK corporation tax liability and related

interest expense that may arise in connection with the Vodafone 2 enquiry. The

provisions relate to the accounting period which is the subject of the proceedings

described above as well as to accounting periods after 31 March 2001 to date.

The provisions at 31 March 2008 reflect the developments during the year.

The Company has been served with a Complaint filed in the Supreme Court of the

State of New York by Cem Uzan and others against the Company, Vodafone

Telekomunikasyon A.S. (“VTAS”), Vodafone Holding A.S. and others. The plaintiffs

make certain allegations in connection with the sale of the assets of the Turkish

company Telsim Mobil Telekomunikasyon Hizmetleri A.S. (“Telsim”) to the Group’s

Turkish subsidiary, which acquired the assets from the SDIF, a public agency of the

Turkish state, in a public auction in Turkey pursuant to Turkish law in which a number

of mobile telecommunications companies participated. The plaintiffs seek an Order

requiring the return of the assets of Telsim to them or damages. The Company

believes these claims have no merit and will vigorously defend the claims.

On 12 November 2007, the Company became aware of the filing of a purported

class action Complaint in the United States District Court for the Southern District

of New York by The City of Edinburgh Council on behalf of the Lothian Pension

Fund against the Company and certain of the Company’s current and former

officers and directors for alleged violations of US federal securities laws.

The Complaint alleged that the Company’s financial statements and certain

disclosures between 10 June 2004 and 27 February 2006 were materially false

and misleading, among other things, as a result of the Company’s alleged failure

to report on a timely basis a write-down for the impaired value of Vodafone’s

German, Italian and Japanese subsidiaries. The Complaint seeks compensatory

damages of an unspecified amount and other relief on behalf of a putative class

comprised of all persons who purchased publicly traded securities, including

ordinary shares and American Depositary Receipts, of the Company between

10 June 2004 and 27 February 2006. The plaintiff subsequently served the

Complaint and, on or about 27 March 2008, the plaintiff filed an Amended

Complaint, asserting substantially the same claims against the same defendants

on behalf of the same putative investor class. The Company believes that the

allegations are without merit and intends to defend the claims vigorously.

Vodafone Essar Limited (“VEL”) and Vodafone International Holdings B.V. (“VIHBV”)

each received notices in August 2007 and September 2007, respectively, from the

Indian tax authorities alleging potential liability in connection with alleged failure

by VIHBV to deduct withholding tax from consideration paid to the Hutchison

Telecommunications International Limited group (“HTIL”) in respect of HTIL’s gain

on its disposal to VIHBV of its interests in a wholly-owned subsidiary that indirectly

holds interests in VEL. Following the receipt of such notices, VEL and VIHBV each

filed writs seeking Orders that their respective notices be quashed and that the

tax authorities take no further steps under the notices, inter alia. Initial hearings

have been held before the Bombay High Court and in the case of VIHBV, the High

Court has admitted the writ for final hearing in June 2008. VEL’s case is stayed

pending the outcome of this hearing. Vodafone believes that neither it nor any

other member of the Group is liable for such withholding tax and intends to

defend this position vigorously.

32. Contingent liabilities

2008 2007

£m £m

Performance bonds 111 109

Credit guarantees – third party indebtedness 29 34

Other guarantees and contingent liabilities 372 90

128 Vodafone Group Plc Annual Report 2008

Notes to the Consolidated Financial Statements continued

Vodafone – Financials