Vodafone 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

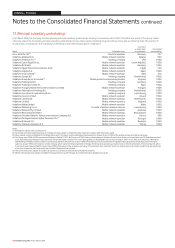

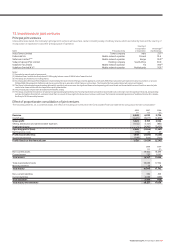

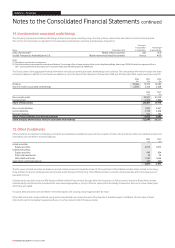

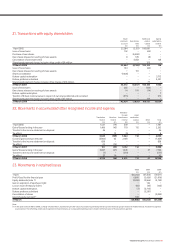

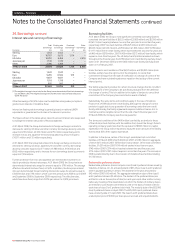

14. Investments in associated undertakings

The Company’s principal associated undertakings all have share capital consisting solely of ordinary shares, unless otherwise stated, and are all indirectly held.

The country of incorporation or registration of all associated undertakings is also their principal place of operation.

Country of

incorporation Percentage(1)

Name Principal activity or registration shareholdings

Cellco Partnership(2) Mobile network operator USA 45.0

Société Française du Radiotéléphone S.A. Mobile network and fixed line operator France 44.0

Notes:

(1) Rounded to nearest tenth of one percent.

(2) Cellco Partnership trades under the name Verizon Wireless. The principal office of the partnership is One Verizon Way, Basking Ridge, New Jersey, 07920 USA while the registered office is

CSC – the Corporation Service Company, 2711 Centreville Road, Suite 400, Wilmington, DE 19808, USA.

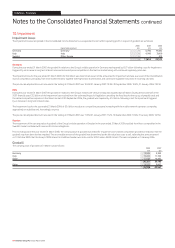

The Group’s share of the aggregated financial information of equity accounted associated undertakings is set out below. The comparative information includes the share

of results in Belgacom Mobile S.A. and Swisscom Mobile A.G. up to the date of their disposal on 3 November 2006 and 20 December 2006, respectively (see note 29).

2008 2007 2006

£m £m £m

Revenue 13,630 12,919 12,480

Share of result in associated undertakings 2,876 2,728 2,428

2008 2007

£m £m

Non-current assets 25,951 25,120

Current assets 2,546 1,998

Share of total assets 28,497 27,118

Non-current liabilities 1,830 2,067

Current liabilities 3,736 4,438

Minority interests 386 386

Share of total liabilities and minority interests 5,952 6,891

Share of equity shareholders’ funds in associated undertakings 22,545 20,227

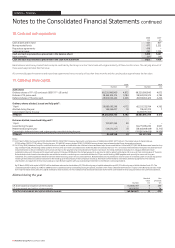

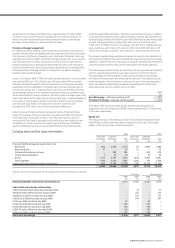

15. Other investments

Other investments comprise the following, all of which are classified as available-for-sale, with the exception of other debt and bonds, which are classified as loans and

receivables, and cash held in restricted deposits:

2008 2007

£m £m

Listed securities:

Equity securities 4,813 3,915

Unlisted securities:

Equity securities 949 634

Public debt and bonds 24 20

Other debt and bonds 1,352 1,046

Cash held in restricted deposits 229 260

7,367 5,875

The fair values of listed securities are based on quoted market prices and include the Group’s 3.2% investment in China Mobile Limited, which is listed on the Hong

Kong and New York stock exchanges and incorporated under the laws of Hong Kong. China Mobile Limited is a mobile network operator and its principal place of

operation is China.

Unlisted equity securities include a 26% interest in Bharti Infotel Private Limited, through which the Group has a 4.36% economic interest in Bharti Airtel Limited.

Unlisted equity investments are recorded at fair value where appropriate, or at cost if their fair value cannot be reliably measured as there is no active market upon

which they are traded.

For public debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.

Other debt and bonds include preferred equity and a subordinated loan received as part of the disposal of Vodafone Japan to SoftBank. The fair value of these

instruments cannot be reliably measured as there is no active market in which these are traded.

110 Vodafone Group Plc Annual Report 2008

Notes to the Consolidated Financial Statements continued

Vodafone – Financials