Vodafone 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

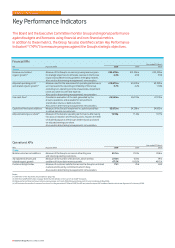

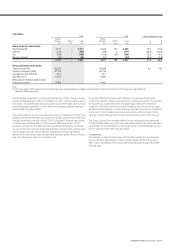

Mobile telecommunications KPIs

2008 2007

Eastern Middle East, Eastern Middle East,

Europe Africa & Asia Pacific EMAPA Europe Africa & Asia Pacific EMAPA

Closing customers (’000) 33,547 79,289 6,279 119,115 28,975 27,160 5,750 61,885

Closing 3G devices (’000) 686 885 1,297 2,868 347 367 778 1,492

Voice usage (millions of minutes) 48,431 189,747 12,845 251,023 39,658 37,449 11,371 88,478

See page 155 for definition of terms

Vodafone has continued to execute on its strategy to deliver strong growth in

emerging markets during the 2008 financial year, with the acquisition of Vodafone

Essar (formerly Hutchison Essar) in India and with strong performances in Turkey,

acquired in May 2006, Romania and Egypt. The Group is beginning to differentiate

itself in its emerging markets, with initiatives such as the introduction of Vodafone

branded handsets and the Vodafone M-PESA/Vodafone Money Transfer service.

On 8 May 2007, the Group continued to successfully increase its portfolio in

emerging markets by acquiring companies with interests in Vodafone Essar,

a leading operator in the fast growing Indian mobile market, following which

the Group controls Vodafone Essar. The business was rebranded to Vodafone

in September 2007.

In conjunction with the Vodafone Essar acquisition, the Group signed a

memorandum of understanding with Bharti Airtel, the Group’s former joint

venture in India, on infrastructure sharing and granted an option to a Bharti

group company to buy its 5.60% direct interest in Bharti Airtel, which was

exercised on 9 May 2007.

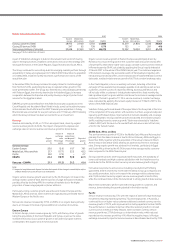

An initial public offering of 25% of Safaricom shares held by the Government of

Kenya closed to applicants on 23 April 2008. Share allocations are expected

to be announced on, or around, 30 May 2008, following which Safaricom will be

accounted for as an associate, rather than as a joint venture. The Group’s effective

equity interest will remain unchanged.

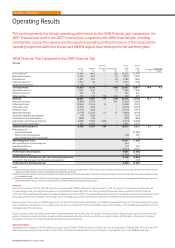

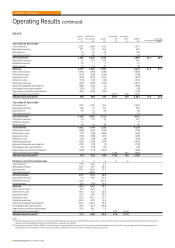

Revenue

Revenue growth for the year ended 31 March 2008 was 45.1% for the region,

or 14.5% on an organic basis, with the key driver for organic growth being the

increase in service revenue of 46.1%, or 14.4% on an organic basis. The impact of

acquisitions, disposal and foreign exchange movements on service revenue and

revenue growth are shown below:

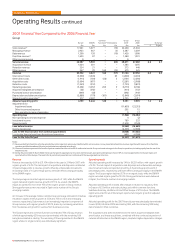

Impact of Impact of

exchange acquisitions

Organic rates and disposal(1) Reported

growth Percentage Percentage growth

% points points %

Service revenue

Eastern Europe 9.7 6.9 10.5 27.1

Middle East, Africa and Asia 22.3 (7.6) 66.3 81.0

Pacific 8.6 8.3 – 16.9

EMAPA 14.4 3.4 28.3 46.1

Revenue – EMAPA 14.5 3.1 27.5 45.1

Note:

(1) Impact of acquisitions and disposal includes the impact of the change in consolidation status

of Bharti Airtel from a joint venture to an investment in February 2007.

On an organic basis, voice revenue grew by 12.8% and messaging revenue and

data revenue rose by 6.5% and 87.9%, respectively, as a result of the 26.2%

organic increase in the average customer base, driven primarily by increasing

penetration in emerging markets. Strong performances in Turkey, Egypt, Romania

and India contributed to the growth in service revenue.

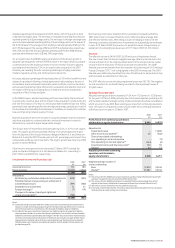

Eastern Europe

In Eastern Europe, service revenue increased by 27.1%, or 9.7% on an organic

basis, driven by the acquisition of Turkey in the 2007 financial year and a good

performance in Romania.

At constant exchange rates, Turkey delivered revenue growth of 24%, assuming

the Group owned the business for the whole of both periods, with 25.2% growth

in the average customer base compared to the 2007 financial year. While growth

rates remained high, they slowed in the last quarter of the year, but remained

consistent with the overall growth rate for the market. In order to maintain

momentum in an increasingly competitive environment, the business is

concentrating on targeted promotional offers and focusing on developing

distribution, as well as continued investment in the brand and completing the

planned improvements to network coverage. The revenue performance year on

year was principally as a result of the increase in voice revenue driven by the rise

in average customers, but also benefited from the growth in messaging revenue,

resulting from higher volumes.

In Romania, service revenue increased by 15.0%, or 19.6% at constant exchange

rates, driven by an 18.3% rise in the average customer base following the impact

of initiatives focusing on business and contract customers, as well as growth

in roaming revenue and a strong performance in data revenue, which grew by

92.6%, or 97.7% at constant exchange rates, to £41 million following successful

promotions and a growing base of mobile data customers. However, service

revenue growth slowed in the last quarter, when compared to the same quarter

in the 2007 financial year, in line with lower average customer growth, which is

in turn driven by increased competition in the market, with five mobile operators

now competing for market share.

Middle East, Africa and Asia

Service revenue growth in Middle East, Africa and Asia increased by 81.0%, or

22.3% on an organic basis, with the acquisition of Vodafone Essar being the main

reason for the difference between reported and organic growth. The growth

in organic service revenue was as a result of strong performances in Egypt,

Vodacom and Safaricom, the Group’s joint venture in Kenya.

At constant exchange rates, Vodafone Essar has performed well since acquisition,

with growth in revenue of 55% assuming the Group owned the business for the

whole of both periods. Since acquisition, there have been 16.4 million net customer

additions, bringing the total customer base to 44.1 million at 31 March 2008.

Penetration in mobile telephony increased following falling prices of both handsets

and tariffs and network coverage increases. The market remains competitive with

prepaid offerings moving to lifetime validity products, which allow the customer

to stay connected to the network without requiring any top ups, following price

reductions in the market. Revenue continues to grow as the customer base

increases, particularly in outgoing voice as service offerings drive greater usage.

In Egypt, service revenue growth was 27.1%, or 31.2% at constant exchange rates,

benefiting from a 52.7% increase in the average customer base and an increase in

voice revenue, with the fall in the effective rate per minute being offset by a 60.1%

increase in usage. The success of recent prepaid customer offerings, such as the

Vodafone Family tariff, contributed to the 45.8% growth in closing customers

compared to the 2007 financial year.

Vodafone Group Plc Annual Report 2008 39