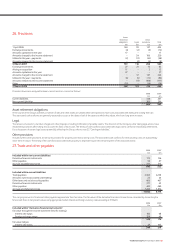

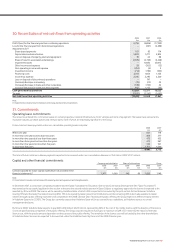

Vodafone 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

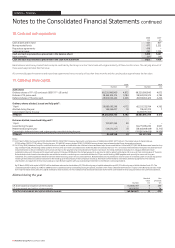

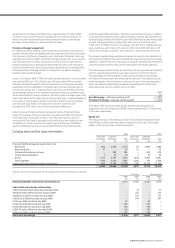

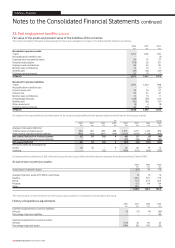

25. Post employment benefits continued

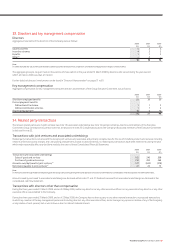

Fair value of the assets and present value of the liabilities of the schemes

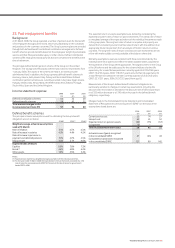

The amount included in the balance sheet arising from the Group’s obligations in respect of its defined benefit schemes is as follows:

2008 2007 2006

£m £m £m

Movement in pension assets:

1 April 1,251 1,123 874

Reclassification as held for sale − − (3)

Expected return on pension assets 89 73 57

Actuarial (losses)/gains (176) 26 121

Employer cash contributions 86 55 85

Member cash contributions 13 13 11

Benefits paid (42) (32) (27)

Exchange rate movements 50 (7) 5

31 March 1,271 1,251 1,123

Movement in pension liabilities:

1 April 1,292 1,224 998

Reclassification as held for sale − − (31)

Current service cost 53 74 57

Interest cost 69 61 52

Member cash contributions 13 13 11

Actuarial (gains)/losses (129) (39) 164

Benefits paid (42) (32) (27)

Other movements (6) 4 (8)

Exchange rate movements 60 (13) 8

31 March 1,310 1,292 1,224

An analysis of net assets/(deficits) is provided below for the Group’s principal defined benefit pension scheme in the UK and for the Group as a whole.

UK Group

2008 2007 2006 2005 2008 2007 2006 2005

£m £m £m £m £m £m £m £m

Analysis of net assets/(deficits):

Total fair value of scheme assets 934 954 835 628 1,271 1,251 1,123 874

Present value of funded scheme liabilities (902) (901) (847) (619) (1,217) (1,194) (1,128) (918)

Net assets/(deficits) for funded schemes 32 53 (12) 9 54 57 (5) (44)

Present value of unfunded scheme liabilities − − − − (93) (98) (96) (80)

Net assets/(deficits) 32 53 (12) 9 (39) (41) (101) (124)

Net assets/(deficits) are analysed as:

Assets 32 53 − 9 65 82 19 12

Liabilities − − (12) − (104) (123) (120) (136)

It is expected that contributions of £82 million will be paid into the Group’s defined benefit retirement schemes during the year ending 31 March 2009.

Actual return on pension assets

2008 2007 2006

£m £m £m

Actual return on pension assets (87) 99 178

Analysis of pension assets at 31 March is as follows: % % %

Equities 68.5 72.1 71.9

Bonds 17.7 27.5 26.5

Property 0.3 0.4 0.4

Other 13.5 − 1.2

100.0 100.0 100.0

The schemes have no direct investments in the Group’s equity securities or in property currently used by the Group.

History of experience adjustments

2008 2007 2006 2005

£m £m £m £m

Experience adjustments on pension liabilities:

Amount (5) (2) (4) (60)

Percentage of pension liabilities − − − 6%

Experience adjustments on pension assets:

Amount (176) 26 121 24

Percentage of pension assets (14%) 2% 11% 3%

122 Vodafone Group Plc Annual Report 2008

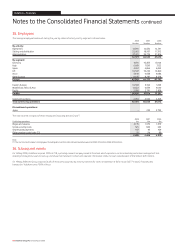

Notes to the Consolidated Financial Statements continued

Vodafone – Financials