Vodafone 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

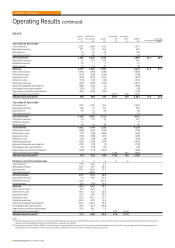

Vodacom’s service revenue increased by 8.6%, or 16.5% at constant exchange

rates, which was achieved largely through average customer growth of 23.1%.

The customer base was impacted by a change in the prepaid disconnection

policy, which resulted in 1.45 million disconnections in September 2007

and a higher ongoing disconnection rate. Vodacom’s data revenue growth

remained very strong, driven by a rapid rise in mobile PC connectivity devices.

Pacific

In the Pacific, service revenue increased by 16.9%, or 8.6% at constant exchange

rates. Australia was a key driver of the increase, with service revenue growth of

15.1%, or 7.5% at constant exchange rates, which was achieved despite the sharp

regulatory driven decline in termination rates during the year. Revenue growth in

Australia reflected an 8.0% increase in the average customer base and the mix of

higher value contract customers. New Zealand also saw strong growth in service

revenue, which increased by 20.0%, or by 10.1% at constant exchange rates,

driven primarily by a 16.7% increase in the average contract customer base and

strong growth in data and fixed line revenue.

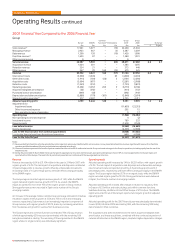

Adjusted operating profit

Adjusted operating profit increased by 15.0% for the year ended 31 March 2008,

or 20.9% on an organic basis, due to strong performances in Romania, Vodacom,

Egypt and Verizon Wireless.

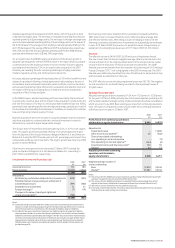

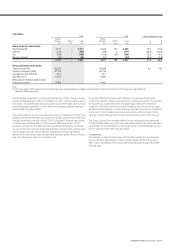

The table below sets out the reconciliation between reported and organic growth,

showing the effect of acquisitions, disposals and exchange rate movements on

adjusted operating profit:

Impact of Impact of

exchange acquisitions

Organic rates and disposals(1) Reported

growth Percentage Percentage growth

% points points %

Adjusted operating profit

Eastern Europe 21.2 (12.9) 72.1 80.4

Middle East, Africa and Asia 13.3 (4.5) 2.0 10.8

Pacific 4.6 9.2 – 13.8

EMAPA 20.9 (5.4) (0.5) 15.0

Note:

(1) Impact of acquisitions and disposals includes the impact of the change in consolidation

status of Bharti Airtel from a joint venture to an investment in February 2007.

The acquisitions in Turkey and India led to a rise in acquired intangible asset

amortisation, which reduced the reported growth in adjusted operating profit,

while the continued investment in network infrastructure in the region resulted in

higher depreciation charges. Reported growth in adjusted operating profit was

also impacted by the disposals of Belgacom Mobile S.A. and Swisscom Mobile A.G.

in the 2007 financial year.

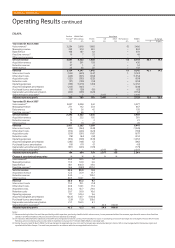

Eastern Europe

Adjusted operating profit increased by 80.4%, or by 21.2% on an organic basis,

with the main contributors being Turkey and Romania. The organic increase in

adjusted operating profit was driven by growth in service revenue, offsetting the

impact of the higher cost base, particularly an organic increase in interconnect

costs and operating expenses of 7.5% and 5.7%, respectively. Depreciation and

amortisation increased by 16.0% on an organic basis, primarily due to continued

investment in network infrastructure, as well as network expansion into rural

areas and increased 3G capacity to support data offerings in Romania.

Turkey generated strong growth in adjusted operating profit, assuming the Group

owned the business for the whole of both periods, driven by the increase in

revenue. The closing customer base grew by 21.8% following additional investment

in customer acquisition activities, with the new connections in the year driving

the higher acquisition costs. Other direct costs were up, mainly due to ongoing

regulatory fees which equate to 15% of revenue. Operating expenses remained

constant as a percentage of service revenue but increased following continued

investment in the brand and network in line with the acquisition plan. There was

also a decrease in acquired intangible asset amortisation, following full amortisation

of the acquired brand by March 2007 as a result of the rebranding to Vodafone.

Romania’s adjusted operating profit grew by 31.4%, or 37.7% at constant exchange

rates, with increases in costs being mitigated by service revenue performance.

Interconnect costs grew by 24.7%, or 29.4% at constant exchange rates, reflecting

the 18.3% rise in the average customer base. As a percentage of service revenue,

acquisition and retention costs increased by 0.7% to 13.3% as a result of the

increased competition for customers. Increases in the number of direct sales and

distribution employees, following the market trend towards direct distribution

channels, led to a 6.6% increase in operating expenses, or 11.0% at constant

exchange rates, while depreciation charges rose by 23.0%, or 27.6% at constant

exchange rates, due to network development to support 3G data offerings and

to increase network coverage in the rural areas.

Middle East, Africa and Asia

Adjusted operating profit rose by 10.8%, or 13.3% on an organic basis, with the

acquisition of Vodafone Essar and strong performances in Egypt and Vodacom

being the main factors for the reported increase. The main organic movements

in the cost base were in relation to other direct costs and operating expenses,

which increased by 38.0% and 23.4%, respectively. Depreciation and amortisation

increased by 36.3% on an organic basis, primarily due to enhancements in the

network in Egypt in order to increase capacity and support 3G offerings. In addition,

the expansion of the network in India, where approximately 1,950 base stations have

been constructed per month since acquisition, increased reported depreciation.

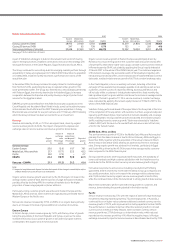

The Indian mobile market continued to grow, with penetration reaching

23% by the end of March 2008. Vodafone Essar, which successfully adopted the

Vodafone brand in September 2007, continued to perform well, with adjusted

operating profit slightly ahead of the expectations held at the time of the completion

of the acquisition. This was partially due to the Group’s rapid network expansion

in this market together with improvements in operating expense efficiency,

particularly in customer care. The outsourcing of the IT function was implemented

during January 2008 and is expected to lead to the faster roll out of more varied

services to customers, while delivering greater cost efficiencies.

In December 2007, the Group announced, alongside Bharti Airtel and Idea Cellular

Limited, the creation of an independent tower company, Indus Towers Limited,

to accelerate the expansion of network infrastructure in India, to reduce overall

costs and generate revenue from third party tenants.

In Egypt, adjusted operating profit increased by 6.3%, or 10.1% at constant

exchange rates. Interconnect costs grew by 41.8%, or 46.2% at constant exchange

rates, in line with the growth in outgoing revenue, with other direct costs rising

by 48.1%, or 52.4% at constant exchange rates, due to prepaid airtime commission

increases and 3G licence costs, both of which were offset by the rise in revenue.

Within operating expenses, staff investment programmes, higher publicity costs

and leased line costs increased during the year, although operating expenses

remained stable as a percentage of service revenue.

Vodacom’s adjusted operating profit rose by 11.8%, or 19.1% at constant

exchange rates. The main cost drivers were operating expenses, which increased

by 10.8%, or 19.2% at constant exchange rates, and other direct costs which grew

by 13.9%, or 22.3% at constant exchange rates, primarily as a result of increased

prepaid airtime commission following the growth of the business. Growth at

constant exchange rates was in excess of reported growth as Vodacom’s reported

performance in the 2008 financial year was impacted by the negative effect of

exchange rates arising on the translation of its results into sterling.

Pacific

Adjusted operating profit in the Pacific rose by 13.8%, or 4.6% at constant

exchange rates. A favourable performance in Australia was a result of the higher

contract customer base, achieved through expansion of retail distribution, with

higher contract revenue offsetting the increase in customer acquisition costs of

36.8%, or 27.6% at constant exchange rates.

40 Vodafone Group Plc Annual Report 2008

Vodafone – Performance

Operating Results continued