Target 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

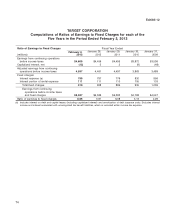

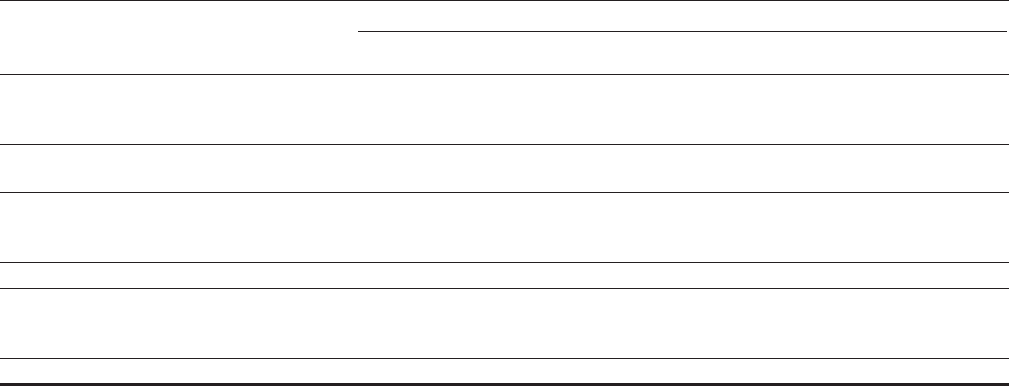

Exhibit 12

TARGET CORPORATION

Computations of Ratios of Earnings to Fixed Charges for each of the

Five Years in the Period Ended February 2, 2013

Ratio of Earnings to Fixed Charges Fiscal Year Ended

January 28, January 29, January 30, January 31,

February 2,

(millions) 2013 2012 2011 2010 2009

Earnings from continuing operations

before income taxes $4,609 $4,456 $4,495 $3,872 $3,536

Capitalized interest, net (12) 5 2 (9) (48)

Adjusted earnings from continuing

operations before income taxes 4,597 4,461 4,497 3,863 3,488

Fixed charges:

Interest expense (a) 799 797 776 830 956

Interest portion of rental expense 111 111 110 105 103

Total fixed charges 910 908 886 935 1,059

Earnings from continuing

operations before income taxes

and fixed charges $5,507 $5,369 $5,383 $4,798 $4,547

Ratio of earnings to fixed charges 6.05 5.91 6.08 5.13 4.29

(a) Includes interest on debt and capital leases (including capitalized interest) and amortization of debt issuance costs. Excludes interest

income and interest associated with unrecognized tax benefit liabilities, which is recorded within income tax expense.

74