Target 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

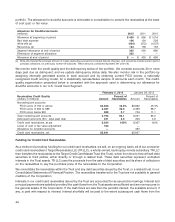

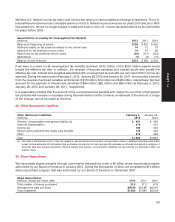

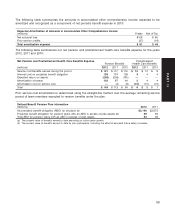

Of the shares reacquired, a portion was delivered upon settlement of prepaid forward contracts as follows:

Settlement of Prepaid Forward Contracts (a)

(millions) 2012 2011 2010

Total number of shares purchased 0.5 1.0 1.1

Total cash investment $25 $52 $56

Aggregate market value (b) $29 $52 $61

(a) These contracts are among the investment vehicles used to reduce our economic exposure related to our nonqualified deferred

compensation plans. The details of our positions in prepaid forward contracts have been provided in Note 27.

(b) At their respective settlement dates.

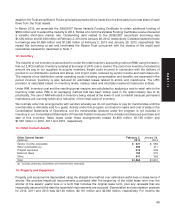

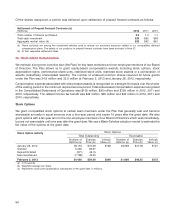

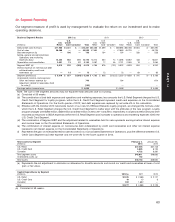

26. Share-Based Compensation

We maintain a long-term incentive plan (the Plan) for key team members and non-employee members of our Board

of Directors. The Plan allows us to grant equity-based compensation awards, including stock options, stock

appreciation rights, performance share units, restricted stock units, restricted stock awards or a combination of

awards (collectively, share-based awards). The number of unissued common shares reserved for future grants

under the Plan was 24.9 million and 32.5 million at February 2, 2013 and January 28, 2012, respectively.

Compensation expense associated with share-based awards is recognized on a straight-line basis over the shorter

of the vesting period or the minimum required service period. Total share-based compensation expense recognized

in the Consolidated Statements of Operations was $105 million, $90 million and $109 million in 2012, 2011 and

2010, respectively. The related income tax benefit was $42 million, $35 million and $43 million in 2012, 2011 and

2010, respectively.

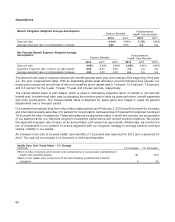

Stock Options

We grant nonqualified stock options to certain team members under the Plan that generally vest and become

exercisable annually in equal amounts over a four-year period and expire 10 years after the grant date. We also

grant options with a ten-year term to the non-employee members of our Board of Directors which vest immediately,

but are not exercisable until one year after the grant date. We use a Black-Scholes valuation model to estimate the

fair value of the options at the grant date.

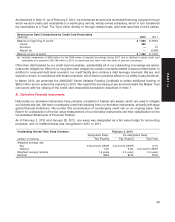

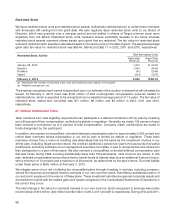

Stock Options

Stock Option Activity

Total Outstanding Exercisable

Number of Exercise Intrinsic Number of Exercise Intrinsic

Options (a) Price (b) Value (c) Options (a) Price (b) Value (c)

January 28, 2012 38,154 $47.59 $166 23,283 $47.06 $121

Granted 5,063 60.57

Expired/forfeited (971) 49.15

Exercised/issued (7,788) 42.55

February 2, 2013 34,458 $50.60 $366 21,060 $48.25 $273

(a) In thousands.

(b) Weighted average per share.

(c) Represents stock price appreciation subsequent to the grant date, in millions.

54