Target 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

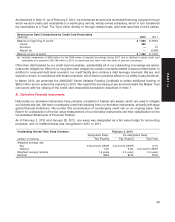

As described in Note 11, as of February 2, 2013, we maintained an accounts receivable financing program through

which we sold credit card receivables to a bankruptcy remote, wholly owned subsidiary, which in turn transferred

the receivables to a Trust. The Trust, either directly or through related trusts, sold debt securities to third parties.

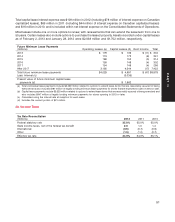

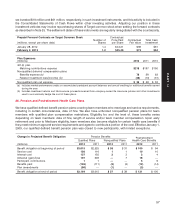

Nonrecourse Debt Collateralized by Credit Card Receivables

(millions) 2012 2011

Balance at beginning of period $ 1,000 $ 3,954

Issued 500 —

Accretion —41

Repaid (a) —(2,995)

Balance at end of period $ 1,500 $ 1,000

(a) Includes repayments of $226 million for the 2008 series of secured borrowings during 2011 due to declines in gross credit card

receivables and payment of $2,769 million in 2011 to repurchase and retire in full this series of secured borrowings.

Other than debt backed by our credit card receivables, substantially all of our outstanding borrowings are senior,

unsecured obligations. Most of our long-term debt obligations contain covenants related to secured debt levels. In

addition to a secured debt level covenant, our credit facility also contains a debt leverage covenant. We are, and

expect to remain, in compliance with these covenants, which have no practical effect on our ability to pay dividends.

In March 2012, we amended the 2006/2007 Series Variable Funding Certificate to obtain additional funding of

$500 million and to extend the maturity to 2013. We repaid this borrowing at par and terminated the Master Trust

concurrent with the closing of the credit card receivables transaction described in Note 7.

21. Derivative Financial Instruments

Historically our derivative instruments have primarily consisted of interest rate swaps, which are used to mitigate

our interest rate risk. We have counterparty credit risk resulting from our derivative instruments, primarily with large

global financial institutions. We monitor this concentration of counterparty credit risk on an ongoing basis. See

Note 9 for a description of the fair value measurement of our derivative instruments and their classification on the

Consolidated Statements of Financial Position.

As of February 2, 2013 and January 28, 2012, one swap was designated as a fair value hedge for accounting

purposes, and no ineffectiveness was recognized in 2012 or 2011.

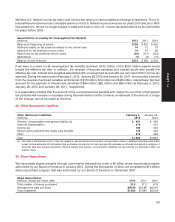

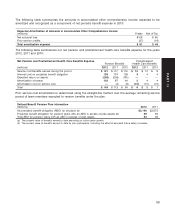

Outstanding Interest Rate Swap Summary February 2, 2013

Designated Swap De-designated Swap

(dollars in millions) Pay Floating Pay Floating Pay Fixed

Weighted average rate:

Pay three-month LIBOR one-month LIBOR 3.1%

Receive 1.0% 5.3% one-month LIBOR

Weighted average maturity 1.5 years 2.4 years 2.4 years

Notional $350 $750 $750

49

PART II