Target 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

paid dividends every quarter since our 1967 initial public offering, and it is our intent to continue to do so in the

future.

Short-term and Long-term Financing

Our financing strategy is to ensure liquidity and access to capital markets, to manage our net exposure to floating

interest rate volatility, and to maintain a balanced spectrum of debt maturities. Within these parameters, we seek to

minimize our borrowing costs. Our ability to access the long-term debt, commercial paper and securitized debt

markets has provided us with ample sources of liquidity. Our continued access to these markets depends on

multiple factors, including the condition of debt capital markets, our operating performance and maintaining strong

debt ratings. As of February 2, 2013, our credit ratings were as follows:

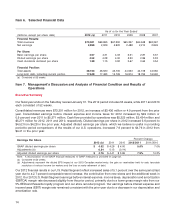

Standard andCredit Ratings

Moody’s Poor’s Fitch

Long-term debt A2 A+ Aǁ

Commercial paper P-1 A-1 F2

If our credit ratings were lowered, our ability to access the debt markets, our cost of funds and other terms for new

debt issuances could be adversely impacted. Each of the credit rating agencies reviews its rating periodically and

there is no guarantee our current credit rating will remain the same as described above.

As a measure of our financial condition, we monitor our interest coverage ratio, representing the ratio of pretax

earnings before fixed charges to fixed charges. Fixed charges include interest expense and the interest portion of

rent expense. Our interest coverage ratio was 6.1x in 2012, 5.9x in 2011 and 6.1x in 2010.

In 2012, we funded our peak sales season working capital needs through internally generated funds. In 2011, we

funded our peak sales season working capital needs through our commercial paper program and used the cash

generated from that sales season to repay the commercial paper issued.

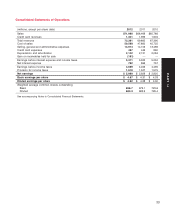

Commercial Paper

(dollars in millions) 2012 2011 2010

Maximum daily amount outstanding during the year $ 970 $1,211 $—

Average amount outstanding during the year 120 244 —

Amount outstanding at year-end 970 ——

Weighted average interest rate 0.16% 0.11% —%

We have additional liquidity through a committed $2.25 billion revolving credit facility obtained in October 2011 and

expiring in October 2017. No balances were outstanding at any time during 2012 or 2011 under this facility.

Most of our long-term debt obligations contain covenants related to secured debt levels. Our credit facility also

contains a debt leverage covenant. We are, and expect to remain, in compliance with these covenants, and these

covenants have no practical effect on our ability to pay dividends. Additionally, at February 2, 2013, no notes or

debentures contained provisions requiring acceleration of payment upon a debt rating downgrade, except that

certain outstanding notes allow the note holders to put the notes to us if within a matter of months of each other we

experience both (i) a change in control; and (ii) our long-term debt ratings are either reduced and the resulting

rating is non-investment grade, or our long-term debt ratings are placed on watch for possible reduction and those

ratings are subsequently reduced and the resulting rating is non-investment grade.

We believe our sources of liquidity will continue to be adequate to maintain operations, finance anticipated

expansion and strategic initiatives, pay dividends and continue purchases under our share repurchase program for

the foreseeable future. We continue to anticipate ample access to commercial paper and long-term financing.

24