Target 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

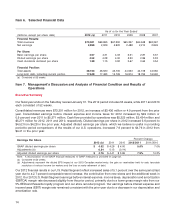

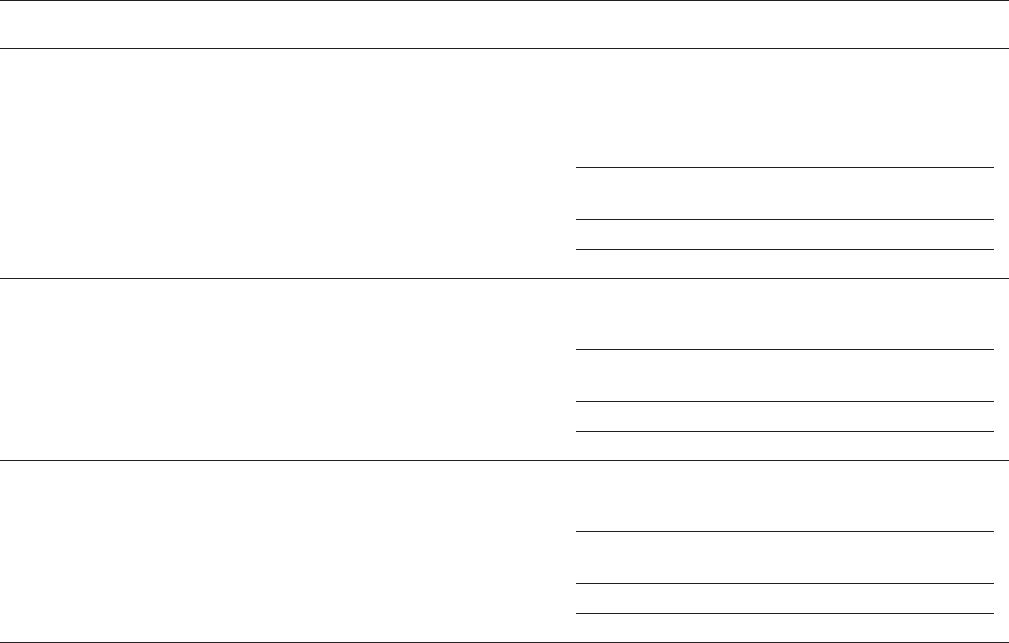

Reconciliation of Non-GAAP Financial Measures to GAAP Measures

Our segment measure of profit is used by management to evaluate the return on our investment and to make

operating decisions. To provide additional transparency, we have disclosed non-GAAP adjusted diluted earnings

per share, which excludes the impact of our 2013 Canadian market entry, the gain on receivables held for sale,

favorable resolution of various income tax matters and the loss on early retirement of debt. We believe this

information is useful in providing period-to-period comparisons of the results of our U.S. operations. This measure

is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The

most comparable GAAP measure is diluted earnings per share. Non-GAAP adjusted EPS should not be considered

in isolation or as a substitution for analysis of our results as reported under GAAP. Other companies may calculate

non-GAAP adjusted EPS differently than we do, limiting the usefulness of the measure for comparisons with other

companies.

U.S. Consolidated

(millions, except per share data) U.S. Retail Credit Card Total U.S. Canada Other GAAP Total

2012 (a)

Segment profit $5,019 $557 $5,576 $ (369) $ — $5,206

Other net interest expense (b) 672 78 — 749

Adjustment related to receivables

held for sale (c) — — (152) (152)

Earnings before income taxes 4,904 (447) 152 4,609

Provision for income taxes (d) 1,744 (132) (3) (f) 1,610

Net earnings $3,160 $ (315) $ 155 $2,999

Diluted earnings per share (e) $ 4.76 $(0.48) $0.23 $ 4.52

2011

Segment profit $4,765 $606 $5,371 $ (122) $ — $5,250

Other net interest expense (b) 663 44 87 (g) 794

Earnings before income taxes 4,708 (166) (87) 4,456

Provision for income taxes (d) 1,690 (47) (117) (f) 1,527

Net earnings $3,018 $ (119) $ 30 $2,929

Diluted earnings per share (e) $ 4.41 $(0.17) $ 0.04 $ 4.28

2010

Segment profit $4,629 $541 $5,169 $ — $ — $5,169

Other net interest expense (b) 674 — — 674

Earnings before income taxes 4,495 — — 4,495

Provision for income taxes (d) 1,677 — (102) (f) 1,575

Net earnings $2,818 $ — $ 102 $2,920

Diluted earnings per share (e) $ 3.86 $ — $ 0.14 $ 4.00

Note: A non-GAAP financial measures summary is provided on page 14. The sum of the non-GAAP adjustments may not equal the total

adjustment amounts due to rounding.

(a) Consisted of 53 weeks.

(b) Represents interest expense, net of interest income, not included in U.S. Credit Card Segment profit. For 2012, 2011 and 2010, U.S. Credit

Card Segment profit included $13 million, $72 million and $83 million of interest expense on nonrecourse debt collateralized by credit card

receivables, respectively. These amounts, along with other net interest expense, equal consolidated GAAP net interest expense.

(c) Represents the gain on receivables held for sale recorded in our Consolidated Statements of Operations, plus the difference between U.S.

Credit Card Segment bad debt expense and net write-offs for the fourth quarter of 2012.

(d) Taxes are allocated to our business segments based on income tax rates applicable to the operations of the segment for the period.

(e) For 2012, 2011 and 2010, average diluted shares outstanding were 663.3 million, 683.9 million and 729.4 million, respectively.

(f) Represents the effect of resolution of income tax matters. The 2012 results also include a $55 million tax expense for the adjustment

related to receivables held for sale, while the 2011 results include a $32 million tax benefit related to the loss on early retirement of debt.

(g) Represents the loss on early retirement of debt.

22