Target 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

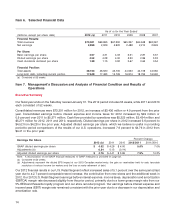

In the U.S. Credit Card Segment, we experienced a decrease in segment profit due to annualizing over a significant

reserve reduction in the prior year and lower finance charge revenue resulting from a smaller portfolio. These

changes were partially offset by lower interest expense due to repayment of $2,769 million in collateralized debt in

the fourth quarter of 2011, as well as the additional week in 2012.

The 2012 and 2011 loss in our Canadian Segment totaling $369 million and $122 million, respectively, is comprised

of start-up costs and depreciation related to our 2013 entry into the Canadian retail market.

Credit Card Receivables Transaction

On October 22, 2012, we reached an agreement to sell our entire consumer credit card portfolio to TD Bank Group

(TD). Historically, our credit card receivables were recorded at par value less an allowance for doubtful accounts.

With this agreement, our receivables are classified as held for sale at February 2, 2013, and are recorded at the

lower of cost (par) or fair value. We recorded a gain of $161 million outside of our segments in 2012, representing

the net adjustment to eliminate our allowance for doubtful accounts and record our receivables at lower of cost

(par) or fair value.

On March 13, 2013, we completed the sale to TD for cash consideration of $5.7 billion, equal to the gross (par) value

of the outstanding receivables at the time of closing. Concurrent with the sale of the portfolio for $5.7 billion, we

repaid the nonrecourse debt collateralized by credit card receivables (2006/2007 Series Variable Funding

Certificate) at par of $1.5 billion, resulting in net cash proceeds of $4.2 billion. As of March 20, 2013, we also have

open tender offers to use up to an aggregate of $1.2 billion of cash proceeds from the sale to repurchase

outstanding debt. Over time, we expect to apply the remaining proceeds from the sale in a manner that will preserve

our strong investment-grade credit ratings by further reducing our debt position and continuing our current share

repurchase program.

Following this sale, TD will underwrite, fund and own Target Credit Card and Target Visa receivables in the U.S. TD

will control risk management policies and oversee regulatory compliance, and we will perform account servicing

and primary marketing functions. We will earn a substantial portion of the profits generated by the Target Credit

Card and Target Visa portfolios. This transaction will be accounted for as a sale, and the receivables will no longer

be reported on our Consolidated Statements of Financial Position.

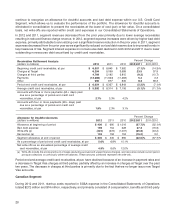

In the first quarter of 2013, we will recognize a gain on sale of $391 million related to consideration received in

excess of the recorded amount of the receivables. Consideration received includes cash of $5.7 billion and a

beneficial interest asset of $225 million. The beneficial interest effectively represents a receivable for the present

value of future profit-sharing we expect to receive on the receivables sold. Based on historical payment patterns, we

estimate that the beneficial interest asset will be reduced over a four year period, with larger reductions in the early

years. As a result, a portion of the profit-sharing payments we receive from TD in the first four years of the

arrangement will not be recorded as income on our Consolidated Statements of Operations.

Following the sale of our credit card portfolio in 2013, income from the profit-sharing arrangement, net of account

servicing expenses, will be recognized within SG&A expenses. Including the profit-sharing arrangement in the U.S.

Segment will reduce the SG&A rate below the historical U.S. Retail Segment SG&A rate, and raise EBITDA and EBIT

margin rates above historical U.S. Retail Segment rates.

For comparison purposes, historical U.S. Retail Segment and U.S. Credit Card Segment results will be restated to

form a new U.S. Segment. The combination of these two historical segments into a single U.S. Segment will result in

a higher SG&A rate in 2013 compared with 2012, 2011 and 2010, reflecting credit card profit that will be retained by

TD beginning in 2013.

Although we expect lower EBITDA and EBIT margin rates in the U.S. Segment compared with prior periods, we

expect that the impact of the receivables sale transaction will become neutral and ultimately accretive to EPS over

time.

15

PART II