Target 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

1. Summary of Accounting Policies

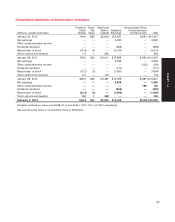

Organization Target Corporation (Target, the Corporation, or the Company) operates three reportable segments:

U.S. Retail, U.S. Credit Card and Canadian. Our U.S. Retail Segment includes all of our U.S. merchandising

operations. Our U.S. Credit Card Segment offers credit to qualified guests through our branded proprietary credit

cards: the Target Credit Card and the Target Visa (Target Credit Cards). Additionally, we offer a branded proprietary

Target Debit Card. Collectively, we refer to these products as REDcardsᓼ, which strengthen the bond with our

guests, drive incremental sales and contribute to our profitability. Our Canadian Segment was initially reported in

the first quarter of 2011 as a result of our purchase of leasehold interests in Canada from Zellers, Inc. (Zellers). This

segment includes costs incurred in the U.S. and Canada related to our 2013 Canadian retail market entry.

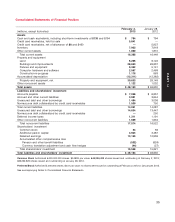

Consolidation The consolidated financial statements include the balances of the Corporation and its subsidiaries

after elimination of intercompany balances and transactions. All material subsidiaries are wholly owned. We

consolidate variable interest entities where it has been determined that the Corporation is the primary beneficiary of

those entities’ operations, including a bankruptcy remote subsidiary through which we sell certain accounts

receivable as a method of providing funding for our accounts receivable.

Use of estimates The preparation of our consolidated financial statements in conformity with U.S. generally

accepted accounting principles (GAAP) requires management to make estimates and assumptions affecting

reported amounts in the consolidated financial statements and accompanying notes. Actual results may differ

significantly from those estimates.

Fiscal year Our fiscal year ends on the Saturday nearest January 31. Unless otherwise stated, references to years

in this report relate to fiscal years, rather than to calendar years. Fiscal 2012 ended February 2, 2013 and consisted

of 53 weeks. Fiscal 2011 ended January 28, 2012, and consisted of 52 weeks. Fiscal 2010 ended January 29, 2011,

and consisted of 52 weeks. Fiscal 2013 will end February 1, 2014, and will consist of 52 weeks.

Accounting policies Our accounting policies are disclosed in the applicable Notes to the Consolidated Financial

Statements.

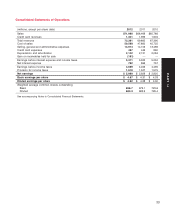

2. Revenues

Our retail stores generally record revenue at the point of sale. Sales from our online and mobile applications include

shipping revenue and are recorded upon delivery to the guest. Total revenues do not include sales tax because we

are a pass-through conduit for collecting and remitting sales taxes. Generally, guests may return merchandise

within 90 days of purchase. Revenues are recognized net of expected returns, which we estimate using historical

return patterns as a percentage of sales. Commissions earned on sales generated by leased departments are

included within sales and were $25 million, $22 million and $20 million in 2012, 2011 and 2010, respectively.

Revenue from gift card sales is recognized upon gift card redemption. Our gift cards do not have expiration dates.

Based on historical redemption rates, a small and relatively stable percentage of gift cards will never be redeemed,

referred to as ‘‘breakage.’’ Estimated breakage revenue is recognized over time in proportion to actual gift card

redemptions and was not material in any period presented.

Credit card revenues are recognized according to the contractual provisions of each credit card agreement. When

accounts are written off, uncollected finance charges and late fees are recorded as a reduction of credit card

revenues. Target retail sales charged on our credit cards totaled $5,807 million, $4,686 million and $3,455 million in

2012, 2011 and 2010, respectively.

38